A Wall Street analyst is cautioning that Palantir’s (NASDAQ: PLTR) stock price could crash below $50, warning about the sustainability of the current momentum.

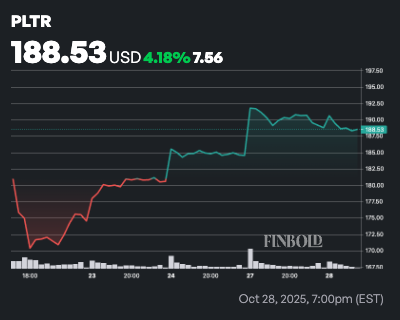

Specifically, RBC Capital analyst Rishi Jaluria on October 28 reiterated an ‘Underperform’ rating on Palantir, setting a price target of $45, a potential downside of roughly 76% from the current trading price of $188.

The warning comes ahead of Palantir’s third-quarter earnings report, scheduled for release on November 3 after the market close.

The analyst described Palantir’s current valuation as “unsustainable,” noting that the stock trades at more than 20 times enterprise value to estimated 2026 revenue (EV/CY26E), one of the highest multiples in RBC’s SaaS coverage universe.

He emphasized that such lofty valuations require an extraordinary beat-and-raise performance to justify current prices.

Despite Palantir’s impressive 80% gross profit margins and 39% revenue growth over the past twelve months, RBC Capital views the stock’s risk/reward profile as unfavorable.

The analyst highlighted that while Palantir shares have rallied 20% in the last three months, outpacing the roughly 4% gain in the iShares Expanded Tech-Software Sector ETF (IGV), expectations heading into Q3 earnings are “exceptionally high.”

RBC believes that the combination of premium valuation and elevated investor optimism could amplify downside risk if Palantir’s upcoming results fail to deliver significant upside surprises.

Analysts optimistic on PLTR stock

In contrast, other Wall Street firms remain more optimistic. For instance, Piper Sandler raised its price target for Palantir to $201, maintaining an ‘Overweight’ rating, citing robust revenue visibility and deepening AI partnerships.

This comes as Palantir continues to expand its footprint in the artificial intelligence space with commercial and government deals. For instance, the company recently announced new collaborations with Lumen Technologies and Snowflake, aimed at integrating Palantir’s AI software with enterprise data systems to accelerate AI deployment across industries.

Notably, ahead of Q3 earnings, analysts expect the company to report stronger results driven by rising demand for its AI Platform (AIP). Consensus estimates project earnings of $0.17 per share, up 70% from last year, and revenues rising nearly 50% year-over-year to $1.09 billion.

Featured image via Shutterstock