Shares of Advanced Micro Devices (NASDAQ: AMD) have surged to an all-time high as the company continues to benefit from its role in the booming artificial intelligence (AI) sector.

Amid this momentum, Wall Street’s updated outlook projects a modest drop over the next 12 months.

At the close of the last market session, AMD was trading at $252.92, up more than 7% for the day, while year-to-date, the stock has gained roughly 110%.

The rally follows several key developments, including a landmark multi-year agreement with OpenAI. Under the deal, AMD will supply six gigawatts of AI compute power using its MI450 GPUs, positioning the company as a key partner in AI infrastructure and challenging Nvidia’s market dominance. The agreement also includes an option for OpenAI to acquire up to 160 million AMD shares.

Investor confidence has been further boosted by a partnership with Oracle Cloud to deploy 50,000 next-generation GPUs and AMD’s involvement in IBM’s recent quantum computing breakthrough using its FPGAs. Strong financial performance, including a projected Q3 revenue of $8.7 billion, has reinforced optimism.

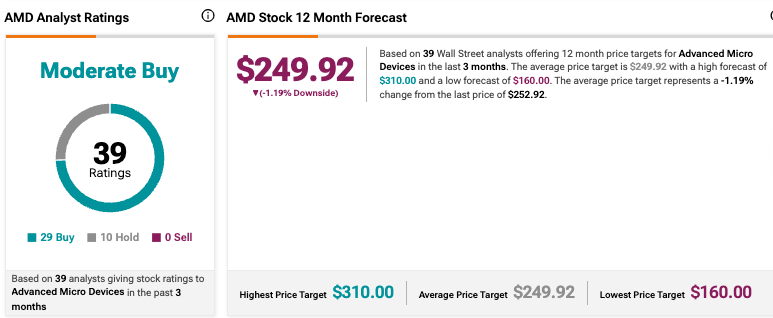

Wall Street predicts AMD stock price

On Wall Street, the American semiconductor giant has been given a ‘Moderate Buy’ rating by 39 analysts tracked by TipRanks. The average 12-month price target stands at $249.92, representing a 1.19% downside from the stock’s last closing price. Notably, the highest forecast sits at $310 and the lowest at $160.

Of the 39 analysts, 29 recommend a ‘Buy,’ 10 suggest a ‘Hold,’ and none have issued a ‘Sell’ rating.

On October 22, Kevin Cassidy of Bernstein reiterated a ‘Market Perform’ rating on AMD with a $200 price target. Cassidy noted that while AMD’s strategic move with OpenAI, giving up 10% equity to secure AI market access, was surprising, it was understandable given AMD’s strong financial health. He highlighted improving PC and server markets, market share gains, and a solid near-term outlook but cautioned that the market might be overly optimistic about AMD’s ramp-up through 2027.

Meanwhile, on October 20, Vivek Arya of BofA Securities raised AMD’s price target to $300 from $250, maintaining a ‘Buy’ rating. Arya’s upgrade followed AMD’s announcements at the 2025 OCP Conference, particularly the launch of the MI450 Series “Helios” racks expected in late 2026, underscoring AMD’s growing presence in AI infrastructure.

Earlier, on October 15, Matt Bryson of Wedbush increased AMD’s price target to $270 from $190, keeping an ‘Outperform’ rating. Bryson cited AMD’s significant AI partnerships, notably with Oracle, which plans to deploy 50,000 MI450 GPUs in its AI supercluster by Q3 2026. He also highlighted AMD’s Helios open rack-scale AI platform, designed to support next-generation AI workloads.

Featured image via Shutterstock