Although its earnings have fallen short of analysts’ forecasts and Twitch is yet to explode in popularity and profit, the price of Amazon (NASDAQ: AMZN) stock responded by dipping over 8% in pre-market trading, finance experts’ AMZN stock price targets for the next 12 months are bullish.

Indeed, Amazon reported profits from its Prime Video ads of $12.77 billion, driving its advertising revenue up 20% for the second quarter of 2024, which was less than the $13 billion in ad revenue that analysts anticipated after the company’s initiative to insert ads into its streaming service.

At the same time, despite expectations of it becoming the next YouTube or Instagram, Amazon’s nearly $1 billion purchase of live-video streaming platform Twitch Interactive 10 years ago has still not panned out, losing money on, by Amazon’s standards, very modest revenue.

Amazon stock price prediction

That said, analysts from multiple Wall Street organizations retain an exceptionally optimistic attitude toward the Amazon stock price for the one-year period, setting its average price at $228.21, which suggests an increase of 34.97% from its current situation.

Not only that, but even the experts’ lowest expected AMZN stock price forecast of $200 would still represent an increase of 18.29% from the price of Amazon shares at the time of publication, while the highest AMZN price target at $250 would lead to a 47.86% gain.

At the same time, all of the 30 analysts offering their price prognosis for AMZN shares in the last three months agree that Amazon stock is a ‘strong buy,’ with not a single recommendation to either ‘sell’ or ‘hold’ in the next 12 months, according to the TipRanks data retrieved on August 2.

Among these experts is Brent Thill from Jefferies, who has retained his positive opinion on the stock with a ‘buy’ rating, albeit decreasing the target price from $235 to $225, whereas Brad Erickson from RBC maintained the price target at $215, as well as the ‘buy’ score for AMZN shares.

At the same time, UBS equities market analyst Stephen Ju has stood by his ‘buy’ recommendation and the price target of $224, while Roth MKM adjusted its price targets towards the upside – increasing from $210 to $215 while also maintaining the ‘buy’ rating for Amazon stock.

Amazon stock price analysis

For the time being, AMZN stock price stands at $169.08, recording an 8.48% dip in pre-market, accumulating a loss of 5.10% across the previous week, and adding up to the 14.43% drop in the past month, while still holding onto the 12.77% gain in 2024, according to the latest chart information.

Meanwhile, pseudonymous financial markets commenter Dividend Dude has observed that Amazon is “now easily the cheapest mega-cap stock down 6.75%” at the time, adding that “earnings were strong and the market is overreacting to this revenue miss,” according to his X post on August 2.

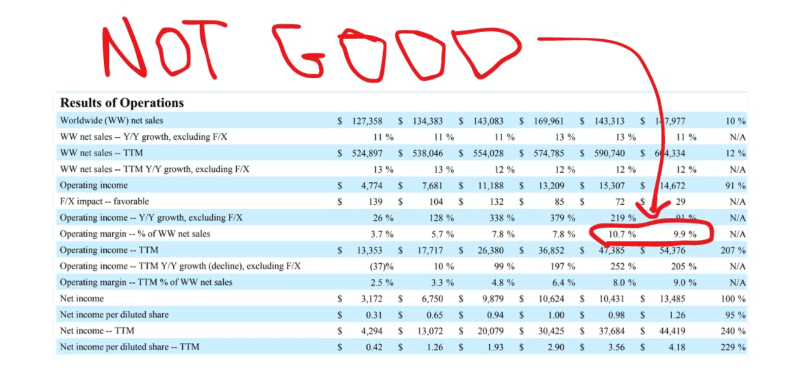

On the other hand, investor and content creator Amit Kukreja opined that the “reason Amazon is down is because they cannot make money on their retail business,” pointing out that the company’s “operating margins went down to 9.9% from 10.7%,” in an X post on August 1.

However, Kukreja said he remains “super bullish long term” on Amazon stock, explaining this was just his view on why the company is “struggling after the bell,” and “maybe the stock recovers on the call but this is simply not acceptable anymore” in terms of poor performance.

All things considered, Amazon, indeed, has strong fundamentals for continuous growth of its stock price, despite a temporary setback caused by developments some may interpret as unfavorable. Still, doing one’s own research is critical when investing, as trends in the stock market can change.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.