Amid Apple (NASDAQ: AAPL) revealing several of its latest products, including the iPhone 16, AirPods 4, and the Apple Watch 10, towards a new major sales cycle, Wall Street analysts have retained their generally optimistic sentiment regarding the Apple stock price prediction.

Indeed, Apple believes that the above products could help kickstart a new sales season following several years of mostly lagging iPhone sales due to hardware upgrades nearing their peak and the declining need for further improvements, which have recently led to merely incremental enhancements.

Wall Street’s Apple stock price prediction

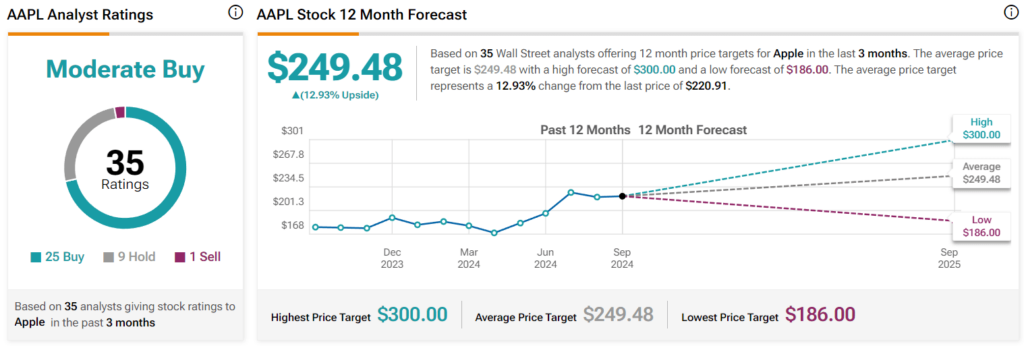

In this context, a group of 35 Wall Street analysts offering their 12-month Apple stock price prediction targets in the past three months has retained their ‘moderate buy’ rating, with 25 of them recommending a ‘buy,’ nine advocating for a ‘hold,’ and with only one ‘sell’ call.

At the same time, the average Apple stock price prediction, based on their respective forecasts, stands at $249.48, which suggests an increase of 12.93% from its price at press time, with the lowest target at $186 (-15.80%) and the highest at $300 (+35.80%), per recent TipRanks data on September 10.

As it happens, among the analysts offering their Apple stock price prediction targets is Wedbush Securities’ Dan Ives, who believes that the iPhone 16 reveal could be a potential watershed moment for the technology giant and could kick off “Cupertino’s biggest upgrade cycle in its history.”

Furthermore, Ives has referred to the integration of artificial intelligence (AI) as a key driver for this predicted supercycle, highlighting in a research note on September 8 that about 20% of consumers worldwide would access and interact with generative AI apps through the Apple ecosystem in the coming years:

“This iPhone 16 release is all about Apple Intelligence and the unleashing of the consumer AI Revolution through Cupertino.”

Moreover, the expert also stressed his supply chain checks, which suggest stronger-than-expected initial shipments for the iPhone 16, amounting to closer to 90 million units, above the earlier Wall Street analysts’ expectations of 80 to 84 million, as well as over 240 million iPhone units sold in fiscal 2025.

Maintaining an ‘outperform’ rating, Ives has set his Apple stock price prediction target at $285 and emphasized the strategic importance of the company’s AI push, implying that Apple will become “the gatekeeper of the consumer AI Revolution.”

Apple stock price analysis

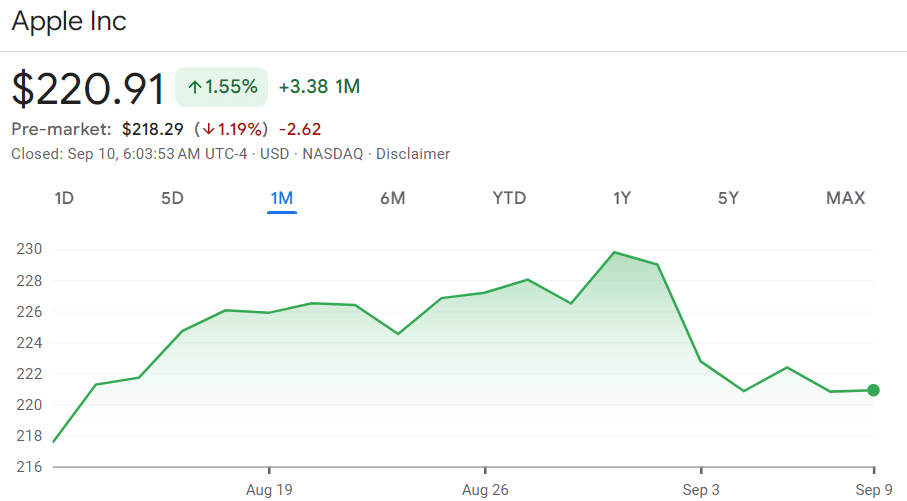

For now, the price of Apple stock amounts to $220.91, recording a modest 0.041% increase on the day, having declined 3.35% over the past week, advancing 1.55% in the last month, and accumulating a 19% gain year-to-date, according to the most recent chart information.

Ultimately, Apple stock might continue to justify analysts’ bullish attitude, particularly following the newest product line reveal, but also after the company announced a software update to give its AirPods Pro 2 the ability to “transform” into a personalized hearing aid by enhancing specific sounds in real-time, like parts of speech in a user’s surroundings.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.