One of Nancy Pelosi’s favorite holdings, Palo Alto Network (NASDAQ: PANW), recently unveiled its Q4 earnings report on August 20, posting beat on expectations.

Namely, PANW reported earnings per share (EPS) of $1.51, compared with an estimated $1.41, and revenue of $2.19 billion, above the expected $2.16 billion. This represents a 12% increase in revenue from the same period in the previous year.

Furthermore, Palo Alto Networks raised its EPS guidance to $6.18 to $6.31, compared to an estimated $6.22 for the full year, and revenue guidance to $9.1 billion to $9.15 billion, compared to an estimated $9.1 billion.

Picks for you

This earnings beat and raised guidance for the upcoming year have motivated Wall Street analysts to revise their PANW stock price targets for the upcoming 12 months.

Wall Street is optimistic about PANW stock prospects

As earnings reports fell in line with most analyst estimates while overachieving on others, analysts from large financial institutions rewarded this cybersecurity firm with a fresh round of price target upgrades.

On August 20, Jefferies analysts upgraded the price target for PANW stock from $365 to $400 while maintaining its “buy” rating. An updated Remaining Performance Obligations (RPO) guidance highlights robust growth in the upcoming 2025, setting the target at 20%, which represents robust growth despite an increasingly competitive industry.

On the same date, BTIG increased its price target for Palo Alto Network shares from $366 to $395, keeping its “buy” rating. This decision was mainly motivated by the strong Q4 earnings report, which revealed increasing revenue from the previous quarter and compared to the same period last year.

Rosenblatt Securities analysts upgraded their price target for PANW shares on August 19, raising it from $300 to $345 while maintaining a “neutral” rating on the stock. This is the same rating maintained by Guggenheim analysts on August 20, without a price target update.

Analysts see some more growth for PANW stock

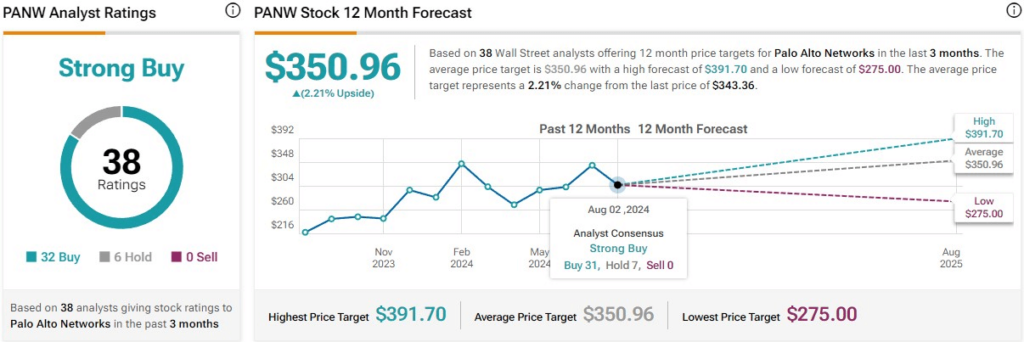

Opinions of analysts from Wall Street compiled by TipRanks reveal a “strong buy” rating for PANW stock based on 38 examinations. Of these, 32 recommended a “buy,” while six advised a “hold,” with none opting for a “sell.”

The average price target for PANW stock shows little room for growth. It stands at $350.96, just 2.21% more than the latest closing price on August 19.

However, it is important to notice that the most recent analyst rating showed a significant price target increase, which could be followed by upgrades from other financial institutions, thus raising the 12-month average price target even more.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.