The stock value of computer software company Adobe (NASDAQ: ADBE) is experiencing short-term price gains as it aims to enhance its product offerings by incorporating elements such as high-soaring artificial intelligence (AI) technology.

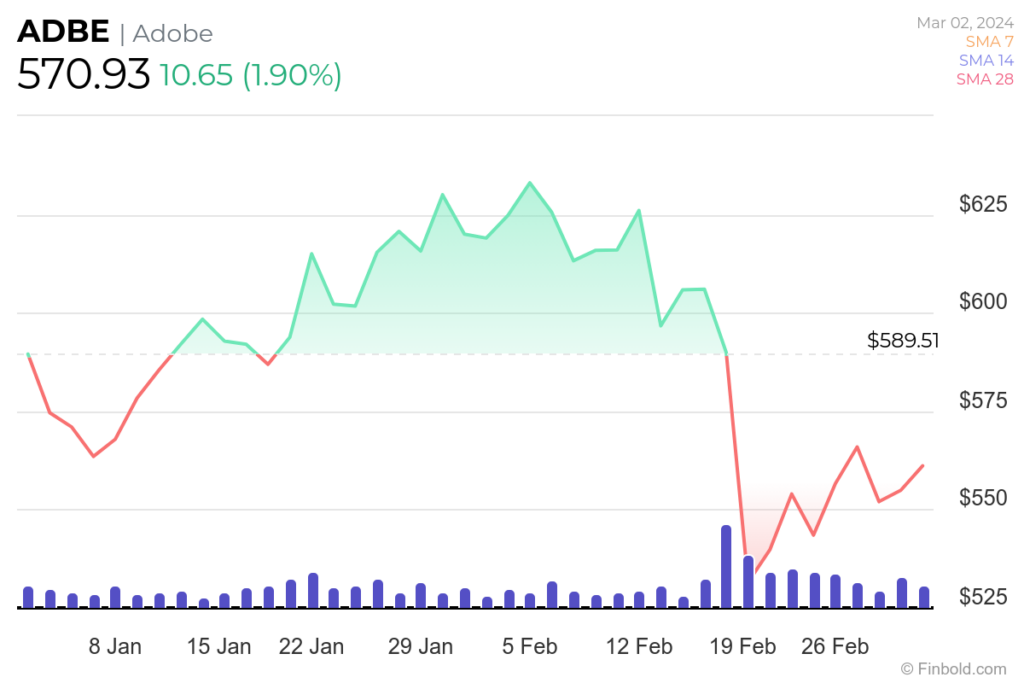

In this line, Adobe’s stock has experienced a remarkable 70% surge over the past year, reaching $570.93 by press time. Despite this impressive performance, the current valuation reflects year-to-date losses of nearly 2%.

Nevertheless, the stock has demonstrated resilience, posting gains of 1.9% and 2.58% on the one-day and five-day charts, respectively.

Wall Street sets Adobe price

With Adobe seemingly striving to regain its previous year’s highs, investor interest is focused on how the stock will perform in the coming months. In this context, Finbold consulted TradingView, where Wall Street analysts shared their outlook on ADBE.

As of March 2, data reveals that 38 analysts have assigned a buy rating to Adobe. Over the next 12 months, the analysts project that Adobe’s stock will reach a high of $754.87, indicating a 32% increase from the current ADBE price. Conversely, analysts have set a low forecast of $465 with an average target of $646.07.

This rating aligns with the one provided by the investment research firm Zacks, which recently upgraded Adobe’s stock to buy, citing an upward trend in earnings estimates. Accordingly, for the fiscal year ending November 2024, Adobe is anticipated to earn $17.89 per share, reflecting an 11.3% change from the year-ago reported figure.

Adobe integrates AI

Adobe’s recent gains align with the company’s venture into the generative AI space. Specifically, Adobe introduced Project Music GenAI Control, a prototype designed to empower individuals of all skill levels with the ability to create music. According to Adobe, this project significantly improves accessibility, empowerment, and democratization in music creation.

While Adobe has previously excelled in generating visual content, exemplified by projects like Adobe Firefly and features such as generative expand and generative fill in Photoshop, the current focus is on making music creation accessible to everyone.

Furthermore, the stock price experienced a brief decline following the introduction of Sora, a new text-to-video generator by OpenAI, the entity behind ChatGPT. Sora can generate lifelike videos from simple text descriptions.

Given the financial success experienced by companies such as Nvidia (NASDAQ: NVDA) and Microsoft (NASDAQ: MSFT) in their forays into AI, there is a keen interest in monitoring whether this technology will have a similar impact on Adobe.

However, it is essential to note that while AI has contributed significant profits for many companies in the stock market, there is no guarantee that Adobe will follow the same trajectory, as it remains susceptible to other market forces, such as competition and interest rates.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.