Following a scandal involving an Alaska Airlines flight during which one of its planes lost a door midair in early January, Boeing (NYSE: BA) has faced a decline in the price of its stock, which dropped nearly 18% since the incident, but analysts are moderately optimistic about its share price for the next 12 months.

Indeed, the lack of bolts on a door panel of a Boeing 747 MAX caused the door to detach and fall off in the middle of a flight on January 7, 2024, and the United States Federal Aviation Administration (FAA) halted the production expansion of the planemaker’s model, contributing to further stock price drops.

Wall Street weighs in on Boeing stock

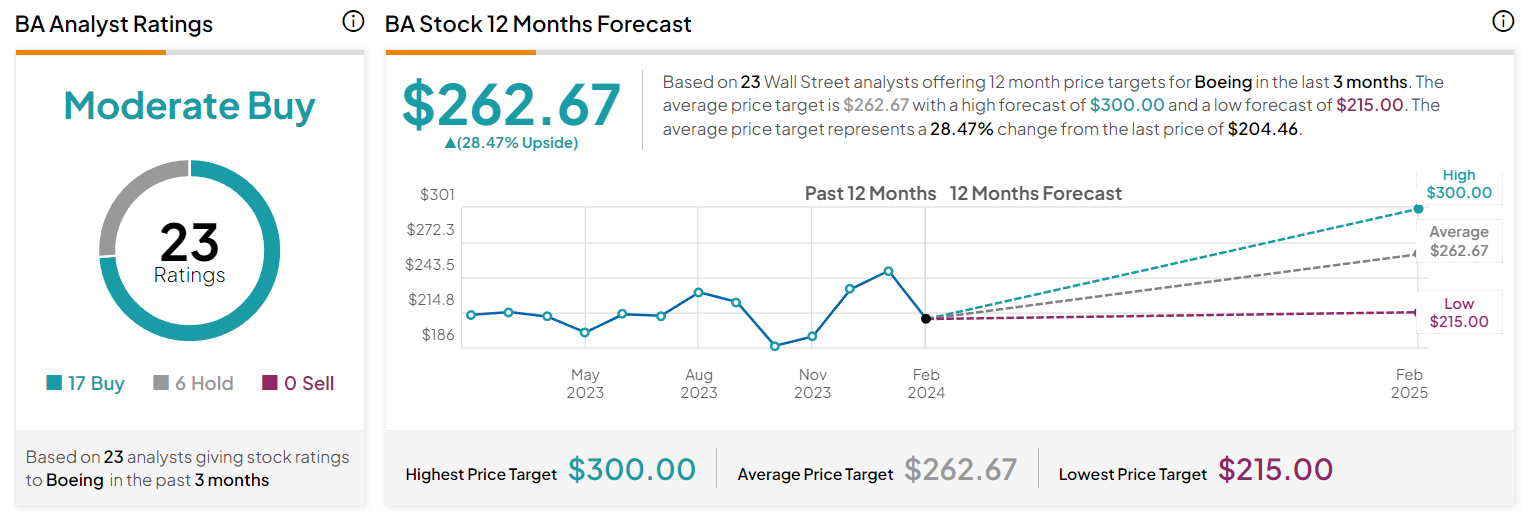

That said, a group of 23 Wall Street analysts has offered their view of Boeing stock for the next 12 months, rating it as a ‘moderate buy’ on the basis of 17 experts declaring it a ‘buy,’ six of them assigning it a ‘hold’ status, while there were no ‘sell’ recommendations.

Picks for you

At the same time, their 12-month price targets over the last three months suggest an average price of Boeing stock at $262.67, which would represent an increase of 28.47% compared to its current price, with the highest target at $300 (+46.73%) and the lowest offered price standing at $215 (+5.16%).

Boeing stock price analysis

Presently, Boeing stock is changing hands at the price of $204.46, indicating a negative movement of 2.33% across the past day, as well as dropping 1.98% over the last week while gaining 1.96% in the previous month and losing 3.4% in the last year, as per data on February 14.

All things considered, the Alaska Airlines incident has caused some reputation and stock price loss for Boeing, but the experts’ confidence in its recovery is possibly justified, particularly considering the recent major order of at least 45 aircraft from the Bangkok-based Thai Airways International.

In the meantime, BA stock shows negative trends in both the short and long term, as it has performed worse than 64% of all other assets in the stock market over the past year and 68% of stocks in the aerospace and defense industry, in addition to showing a bear flag chart pattern.

On the other hand, it is recording an average volume of over 10 million traded shares per day, which indicates healthy liquidity, albeit going through a lower period in the last few days, demonstrating the need for doing one’s own due diligence before investing in any asset.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.