After multiple malfunctions on its Boeing 737 Max aircraft and mysterious whistleblower deaths attracted worldwide attention, Boeing (NYSE: BA) has faced some tough times, including the BA stock dropping nearly 30% this year, but experts remain optimistic in terms of its price for the following 12 months.

Specifically, BA took several hits recently, including the outrage over its poor safety practices, the CEO’s salary, two Boeing whistleblowers found dead and 10 more informants coming out, as well as the United States Federal Aviation Administration (FAA) opening a probe into the company’s inspections.

As it happens, all of this has contributed to the steady decline in price of the BA stock, with passengers increasingly looking at which Boeing planes to avoid before booking their flights as more videos, images, and reports surface of various parts of its aircraft falling off.

Boeing stock price prediction 2025

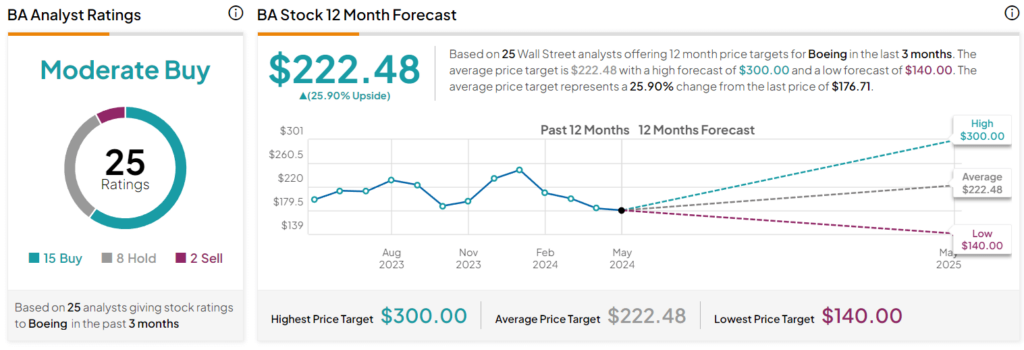

That said, 25 Wall Street experts who shared their analyses of the future performance of BA stocks during the last three months, have largely rated them as a ‘moredate buy,’ based on 15 of these analysts recommending a ‘buy,’ eight suggesting refrainment from any action (‘hold’), and only two advising a ‘sell.’

At the same time, these experts have also offered their Boeing price targets for the following year, forecasting an average of $222.48, or an increase of 25.90% from its current price, with the lowest Boeing stock price target at $140 (-20%), and the highest at $300 (+70%).

On the other hand, it is also worth pointing out that analysts at Melius Research have downgraded the BA stock from a ‘buy’ to hold while maintaining a $209 price target in early April, arguing there were “too many overhangs” and explaining that:

“Although there is strong demand for Boeing’s commercial aircraft, execution issues, a slower-than-expected 737 production ramp, and continued losses at Boeing Defense mean that the $10B of FCF that Boeing and consensus are looking for in 2026 is optimistic. (…) Overall, we believe Boeing is headed for, and in need of, a multi-year restructuring.”

Boeing stock price history

Meanwhile, the BA shares price at press time stood at $176.57, recording a 0.92% drop on the day, an increase of 1.64% across the previous week, and a decline of 2.75% in the last month, according to the most recent charts retrieved on May 8.

All things considered, Wall Street experts seem to remain bullish on the BA stock despite Boeing’s current issues and the price lagging since early this year. However, it is crucial to do one’s own research when investing instead of blindly adhering to analysts’ opinions, as things in this sector can suddenly change.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.