Summary

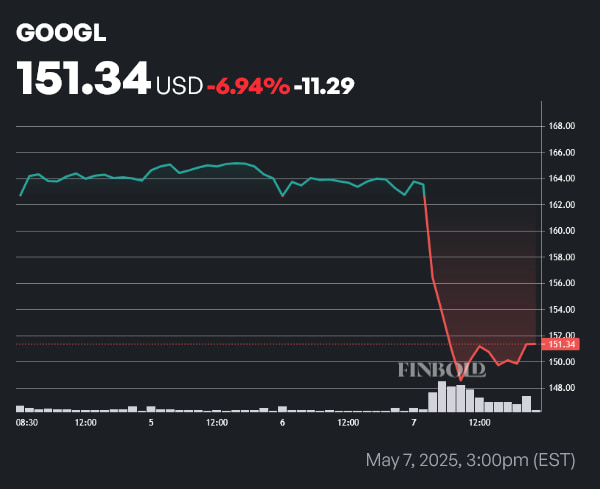

⚈ Google stock fell 6.94% after Apple hinted at exploring AI search alternatives.

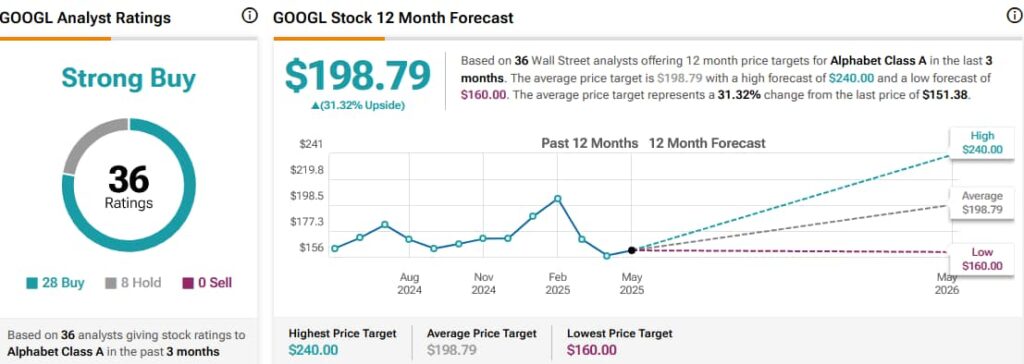

⚈ Analyst sentiment remains largely positive, with Google maintaining a consensus ‘Strong Buy.’

Analysts from major Wall Street firms have adjusted their stock price targets on Google stock (NASDAQ: GOOGL) in the aftermath of the company’s Q1 2025 earnings report.

As of May 8, the 36 equity researchers who cover GOOGL stock have set an average 12-month price forecast of $198.79, equating to a 31.32% upside according to data retrieved by Finbold from TipRanks. The stock remains a consensus ‘Strong Buy’, with 28 ‘Buy’ ratings, 8 ‘Hold’ ratings, and 0 ‘Sell’ ratings.

At press time, Google stock was trading at $151.34, having seen a 6.94% move to the downside within the last week.

The brunt of the move came on May 7, as Apple’s Senior Vice President of Services, Eddy Cue, stated that the iPhone maker is considering adding artificial intelligence (AI) search engines like Perplexity to its Safari browser.

Cue’s statement was made as a part of the ongoing DOJ antitrust case levied against Google — in addition, the executive noted that Safari recently saw its first-ever drop in search activity, an occurrence he believes was caused by users shifting toward AI search.

Analysts stay the course on Google stock

Google, recently dubbed one of the most disrespected stocks of today by investment strategist Shay Boloor, maintains its appeal on account of strong core operational metrics — but that is exactly the strength that a shift toward AI search could undo.

With that being said, with the exception of post-earnings revisions, recent analyst coverage has been remarkably tame. Since the beginning of May, the stock has received new coverage from only two stock researchers — JMP Securities’ Andrew Boone and WestPark Capital’s Curtis Shauger. The former reiterated a ‘Market Perform’ rating without a price target — while the latter maintained a ‘Buy’ rating with an unchanged $210 price target.

While not a revision per se, Jefferies researcher Brent Thill also chimed in, calling the selloff on account of Cue’s comments excessive.

Featured image from Shutterstock