Heico Corp (NYSE: HEI), a leading aerospace and electronics company, recently achieved a significant milestone by reaching an all-time high, with shares peaking at $257.19.

This milestone coincides with Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A) making notable adjustments to its stock portfolio in the June quarter, including a new investment in Heico.

Over the past year, Heico’s stock value has surged by an impressive 42%, showcasing the company’s robust performance and market presence.

Heico has further solidified its position by rewarding shareholders with an increased semiannual cash dividend of $0.11 per share, reflecting the company’s strong performance and positive future outlook.

The company’s outstanding shares total 138.50 million, reflecting a 0.88% increase over the past year. According to sources, Insider ownership stands at 13.98%, while institutions own 82.05% of the stock, indicating strong institutional support.

Financial foundation and analyst upgrades

Heico’s impressive growth is supported by a market capitalization of $33.32 billion and an enterprise value of $31.46 billion, highlighting its solid financial foundation.

In the backdrop of this positive performance, several prominent financial analysts have revised their price targets for Heico, reflecting heightened optimism about its future performance.

Jefferies, for instance, raised its price target to $275 while maintaining a “Buy rating,” forecasting earnings per share (EPS) of $0.88 for the fiscal third quarter, slightly below the consensus estimate of $0.92.

Additionally, Stifel and Bank of America (NYSE: BAC) securities increased their targets to $250, citing strong demand for Heico’s products and its expanding market presence.

These upgrades are driven by Heico’s robust earnings performance, which included a 39% year-over-year increase in sales during the fiscal second quarter, reaching $955 million.

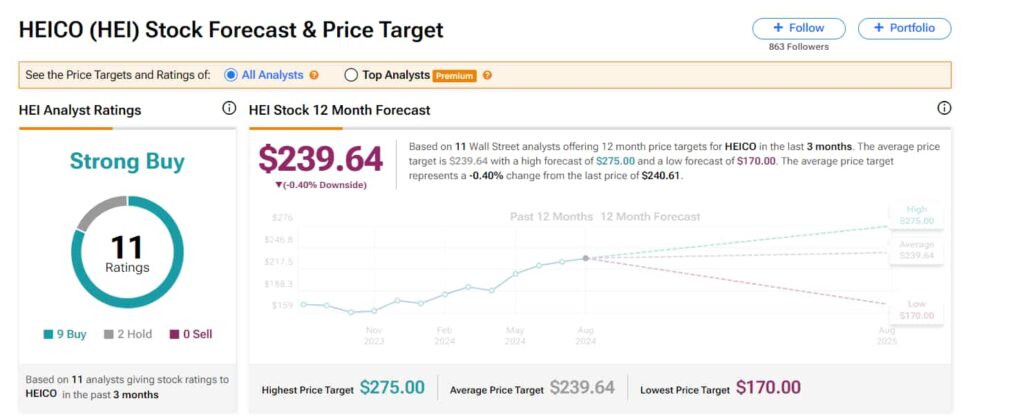

Despite its recent peak, Heico’s stock last traded at $240.61, close to the average 12-month price target of $239.64 based on projections from 11 Wall Street analysts.

These projections range from a high forecast of $275 to a low of $170, reflecting diverse views on the stock’s future performance. The average price target suggests a slight potential downside of 0.40% from the last traded price, indicating a mix of cautious and optimistic outlooks among analysts.

Looking ahead: Fiscal Q3 earnings and market outlook

As Heico prepares to report its fiscal third-quarter earnings on August 26, 2024, both investors and analysts will closely monitor any updates that could impact these projections.

With a trailing price-to-earnings (PE) ratio of 75.65 and a forward PE of 61.91, the company faces high expectations for continued earnings growth. The PEG ratio of 3.49 suggests that while the stock is priced for growth, it may also carry some premium, reflecting strong investor confidence in its long-term prospects.

In summary, Heico’s recent stock performance and the wave of analyst upgrades show the company’s strong standing in the aerospace and electronics sectors.

With substantial support from major investors like Berkshire Hathaway and positive analyst sentiment, Heico appears well-positioned to maintain its upward trajectory in the coming months, offering potential gains for shareholders.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.