Although the price of Palantir Technologies (NYSE: PLTR) shares soared sharply in February following a record-breaking quarterly profit report, and the big data analytics and software company is currently expecting another one, experts remain bearish on its price for the next 12 months.

As it happens, Palantir stock price has had a relatively positive year, thanks to not just closing out Q4 2023 with $93 million in profit, triple from the year-prior period, but also the growth of its customer base propelled by successfully showcasing its Artificial Intelligence Platform (AIP) capabilities.

On top of that, two months ago, Palantir won another contract from the United States Army, which employed the data analytics firm to work on phase 3 of the Tactical Intelligence Targeting Access Node (TITAN), a tactical ground station project that has a total value of $1.5 billion, as Finbold reported in March.

Palantir stock price forecast 2025

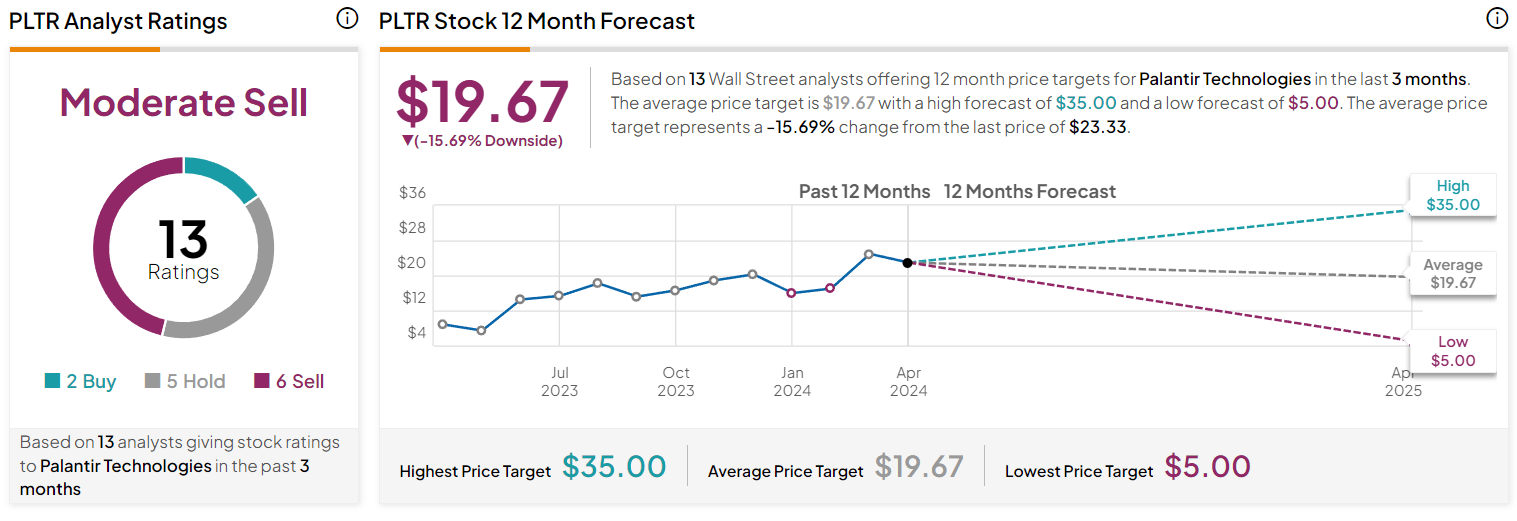

However, 13 Wall Street experts who shared their expectations regarding the future of PLTR shares have rated them as a ‘moderate sell,’ with six votes recommending a ‘sell,’ five voting for a ‘hold,’ and only two of these analysts suggesting to ‘buy’ Palantir stocks, as per data on May 6.

Meanwhile, over the course of the past three months, the experts have also provided their price targets for PLTR stock’s performance in the following year, forecasting that Palantir shares will decrease by around 16% toward the average price of $19.67, with the lowest PLTR price target at $5 (-79%), and the highest expecting to see PLTR at $35 (+49%) in the next 12 months.

Palantir stock price history

At press time, Palantir shares were changing hands at the price of $23.48, which suggests an increase of 3.56% on the day, in addition to gaining 2.98% across the past week and adding up to the advance of 5.09% on its monthly chart, according to the most recent data on May 6.

Despite bearish prognoses, investor Noah’s Arc Capital Management expects a similar scenario from February, arguing that the upcoming report will “show continued growth for Palantir, driven by the increasing demand for AIP and their Foundry software” and adding that:

“The company’s approach of showcasing AIP’s capabilities through workshops and customer conferences has been highly effective in acquiring new customers and expanding their client base. (…) In fact, the effects from these workshops can already be seen, helping boost the company’s commercial revenue streams to over $1 billion over the last twelve months.”

All things considered, the previous PLTR earnings report has had a strong impact on the price of Palantir shares, so it could have the power to move the needle again, depending on how (or even if) positive it is. That said, doing one’s own research is essential before investing in any asset.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.