Palantir (NYSE: PLTR) has been on a roll since the beginning of the year — but institutions remain skeptical about the company’s long-term prospects.

One of the key catalysts Palantir stock’s positive price action over the course of the last months was the September 6 announcement that the company would be joining the S&P 500 index.

Looking back even further, PLTR has spent the vast majority of 2024 in the green — and is currently up 120.87% YTD (year-to-date).

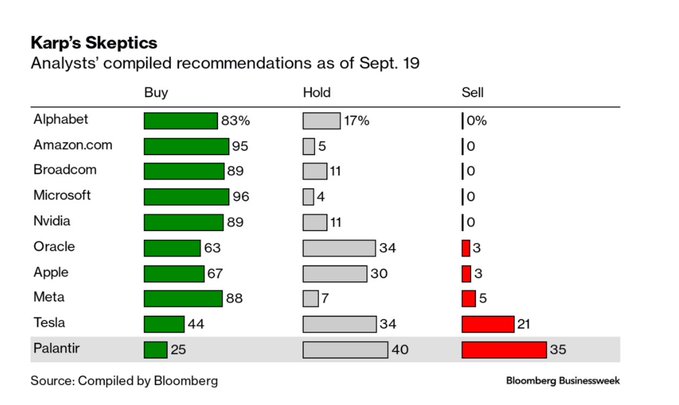

However, it seems that Wall Street isn’t quite convinced — and Palantir’s high valuation remains a sore spot for analysts.

Even short-term traders have cause for concern, as a key technical indicator, the relative strength index (RSI) has recently dipped into overbought territory, reaching historically high levels. In tandem with this, the PLTR’s share price has gone 54% above its 200-day SMA (simple moving average).

In addition, the big data business’s surveillance dealings tend to attract negative press, while its attempts to diversify income streams away from governments and toward commercial clients have been a mixed bag at best.

While the most bullish of analysts have set 12-month price targets at $50, which would represent a 36.53% upside, their ratings are quite far from the general consensus.

The average 12-month price target is at $27.08 — and if things pan out this way, we’ll be looking at a 26.05% dip in share price as per the latest data from Finbold at the time of publication.

Some experts even see the price going as low as $9 — although this, which would entail a -75.4% drop in price, is a relatively fringe view.

Insider selling of PLTR shares

Although institutional investors are bearish at the moment, it’s also worth noting what insiders are doing. Specifically, we’re referring to the recent stock sales of Palantir’s CEO, Alexander Karp.

On September 16 and 17, Karp sold 4.5 million and 4.25 million shares, respectively, for a grand total of $316 million.

While insider sales are by no means uncommon, these transactions are roughly 20 times larger than Karp’s previous sell orders.

This isn’t necessarily a cause for concern — the selloff might reflect Karp’s personal financial strategy, or hint that this is, at least per Karp, a reasonable time to take profits. However, on the whole, the move does lend some credence to the case that PLTR’s recent upswing could be limited in scope.

Finally, it’s important to remember that institutions have historically been wary of PLTR — and while those concerns are backed up by real factors, in contrast, contrarians have had plenty of opportunity to cash in significant profits since the beginning of 2023.

One should also note that bearish outlooks are not wholly universal on Wall Street — that $50 price target comes from Bank of America, whose analysts likened most Wall Street forecasts to the way that institutional investors missed the mark on cell phone adoption way back in the 1980s. Still, it’s hard to make a case for PLTR — even with such a long timeframe, at the current valuation.

Palantir’s long-term future remains up in the air — but the current situation does not provide enough cause for short-term or medium-term investments in the tech company.