As the stocks of Amazon (NASDAQ: AMZN) continue to grow in a year that has marked a new all-time high (ATH) for their price, both stock market experts and artificial intelligence (AI) platforms agree on one thing – the price of AMZN shares will continue to advance in the next 12 months.

In this context, Finbold has consulted the most recent and advanced model of the OpenAI invention ChatGPT, called ChatGPT-4o, as well as retrieving the updated price predictions shared by renowned Wall Street analysts to compare their respective Amazon stock price one-year targets.

Wall Street AMZN stock price prediction 2025

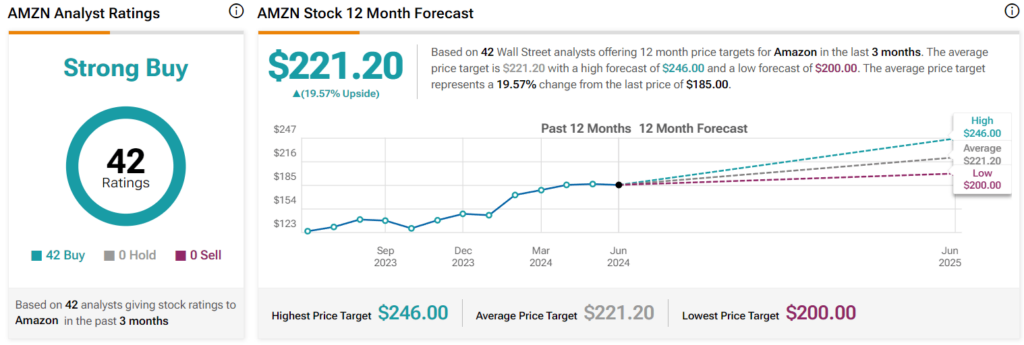

As it happens, a group of 42 Wall Street analysts have set the average price of Amazon stock at $221.20, unanimously agreeing that AMZN is a ‘strong buy’ with no recommendations to either ‘hold’ or ‘sell,’ and with both the low-end and high-end targets higher than its price at press time.

Indeed, the average stock price target for AMZN represents an increase of 19.63% from its current state, with the low-end target still 8.17% higher than the present Amazon stock price and the high-end suggesting a 33.05% gain from its current price.

According to one of these experts, Loop Capital analyst Rob Sanderson, who raised the price target on AMZN shares from $215 to $225 following the recent better-than-anticipated earnings report, Amazon will continue to report profits beyond Wall Street’s expectations.

ChatGPT-4o Amazon stock price prediction 2025

At the same time, ChatGPT-4o has predicted that AMZN stocks will trade “within a price range of $140 to $230 over the next 12 months, taking into account both the bullish and bearish market sentiments and assuming continued execution of its strategic initiatives.”

Specifically, to explain its reasoning behind such a forecast, the advanced generative AI chatbot has cited “widespread confidence in Amazon’s growth potential, driven by its diversified business model and continued investments in AI initiatives,” adding that:

“Furthermore, Amazon’s financial metrics support an attractive valuation. The stock’s EV/EBITDA ratio is currently at around 14.3x on a forward basis, compared to its five-year historical average of 20.6x, indicative of a significant discount and potential value.”

Conclusion

At press time, the price of NVDA shares stood at $184.90, which represents an increase of 1.34% on the day, a 4.06% advance across the past week, declining 1.63% over the month, and growing 23.35% year-to-date (YTD), as per the most recent chart data retrieved by Finbold on June 7.

All things considered, it seems that both finance experts and generative AI agree that Amazon stocks will probably continue to grow in price in the next 12 months, although ChatGPT’s predicted price range includes a potential downside, but nonetheless, a high of $230, if indicators and developments play along.

That said, blindly following the recommendations and predictions by either side would be unwise as things in the stock market can sometimes change on a whim, so doing one’s own research, weighing all the risks, and individual risk tolerance is critical when investing in any asset.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.