MicroStrategy (NASDAQ: MSTR), currently trading at approximately $1,495.54, has experienced a remarkable year-to-date increase of 118.28%. This surge is fueled by the company’s aggressive Bitcoin (BTC) acquisition strategy, transforming it into the largest publicly traded corporate holder of Bitcoin.

With holdings accounting for 1.1% of the world’s Bitcoin supply, valued at around $14.5 billion, MicroStrategy’s bold moves continue to capture the attention of investors and analysts alike.

This is driven by the company’s strategic initiatives, including an upsized $700 million debt offering to fund further Bitcoin acquisitions, demonstrating MicroStrategy’s commitment to leveraging market opportunities and solidifying its position in the Bitcoin space.

Recently, Canaccord Genuity reaffirmed its “buy” rating on MicroStrategy stock and raised its price target from $1,590 to $2,047, based on its strategic approach to leveraging digital assets and the positive outlook for Bitcoin.

Overall, attention remains on how MSTR will fare in the coming months. Wall Street analysts and OpenAI’s most advanced artificial intelligence (AI) tool, ChatGPT-4o, have offered insights into where the stock might be headed in the next 12 months.

Wall Street predictions on MSTR stock

Recently, analysts at Bernstein initiated coverage on MicroStrategy with an Outperform rating, setting an ambitious price target of $2,890. This target suggests a potential 95% upside from the current trading price of $1,495.54.

Bernstein’s bullish outlook is driven by MicroStrategy’s aggressive Bitcoin acquisition strategy and its market positioning as a leading corporate holder of Bitcoin.

In addition to Bernstein’s analysis, a broader consensus among Wall Street analysts provides a comprehensive view of MicroStrategy’s potential stock performance.

Over the past three months, five Wall Street analysts have offered 12-month price targets for MSTR where the average price target is $2,012.40, with a high forecast of $2,890 and a low forecast of $1,450.

The average price target represents a 34.56% change from the last price of $1,495.54.

ChatGPT-4o prediction for MSTR

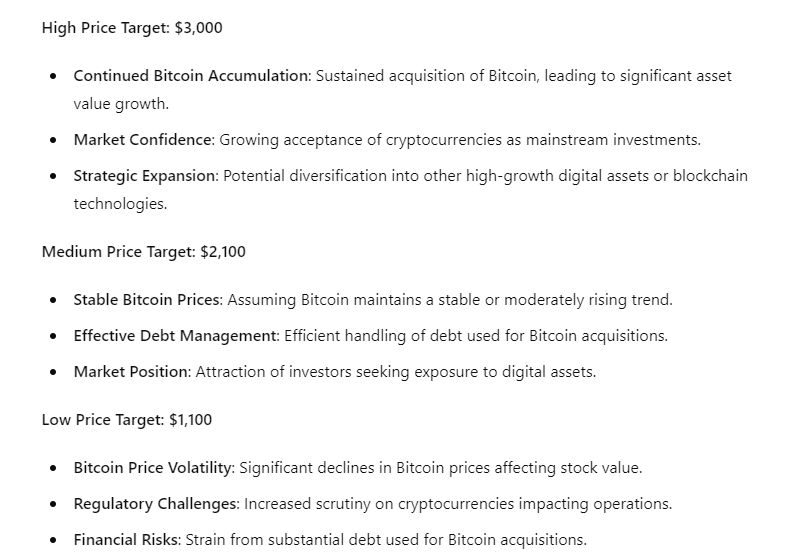

ChatGPT-4 predicts a range of potential outcomes for MicroStrategy’s stock. In the optimistic scenario, the stock could reach as high as $3,000. This high target is based on continued aggressive Bitcoin accumulation, sustained market confidence, and potential strategic expansions into other high-growth digital assets or blockchain technologies.

Conversely, in a bearish scenario, the stock could drop to $1,100, considering risks such as Bitcoin price volatility, regulatory challenges, and financial strain from substantial debt used for Bitcoin acquisitions.

A balanced medium-case scenario sets the price target at around $2,100, assuming stable or moderately rising Bitcoin prices and effective debt management.

Both sets of predictions underscore the significant impact of Bitcoin prices on MicroStrategy’s stock. While there is considerable upside potential for MicroStrategy, investors must also be prepared for the inherent risks associated with its Bitcoin-centric strategy.

The company’s unique position as a major Bitcoin holder makes it an attractive option for those seeking exposure to digital assets, but this comes with substantial volatility and regulatory risks.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.