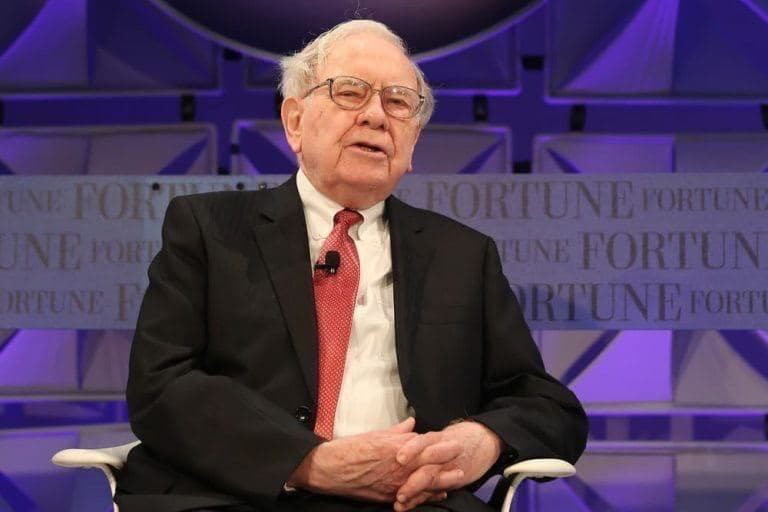

Berkshire Hathaway, led by Warren Buffett, acquired approximately 10.5 million shares of Occidental Petroleum (NYSE: OXY) this week at nearly $590 million. This move followed Occidental Petroleum’s announcement of a $12 billion deal to acquire CrownRock, a Permian producer.

In a filing with the exchange on December 13, Occidental revealed that the stock acquisitions were executed through five distinct transactions at prices ranging from $56.31 to $57.08 per share.

Berkshire, the largest shareholder of Occidental, currently possesses slightly more than 27% ownership. Additionally, it holds preferred shares and warrants, allowing the purchase of approximately 83.9 million OXY shares at $56.62 per share, totaling around $4.7 billion.

Occidental Premium acquires CrownRock

On December 11, 2023, Occidental announced that it had engaged in a purchase agreement to acquire CrownRock L.P., an oil and gas producer based in Midland. CrownRock L.P. is a joint venture involving CrownQuest Operating LLC and Lime Rock Partners. The transaction consists of a combination of cash and stock, with an overall valuation of approximately $12 billion, encompassing the assumption of CrownRock’s debt.

The total value of the transaction is around $12 billion. Occidental plans to fund this acquisition through the incurrence of $9.1 billion in new debt, the issuance of approximately $1.7 billion in common equity, and the assumption of CrownRock’s existing debt of $1.2 billion. The anticipated closing date for the transaction is the first quarter of 2024, contingent upon meeting customary closing conditions and obtaining regulatory approvals.

OXY stock analysis

As of the latest market data, OXY’s stock price was recorded at $57.22, showing a rise of 3.01% over the past 24 hours.

This change is part of a broader pattern observed over the past week, with the stock gaining 0.93% across five trading sessions.

This recent acquisition of OXY shares by Berkshire Hathaway aligns with the announcement that Occidental plans to increase its dividend yield from $0.04 to $0.22, starting from the February 2024 declaration. This represents a 450% increase, which will spell profits for Buffett.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.