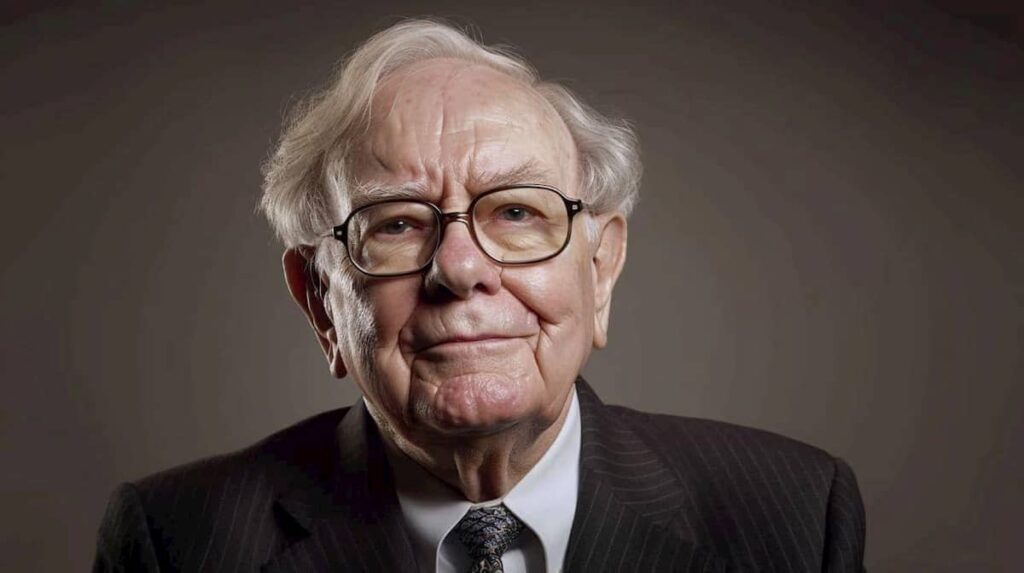

Renowned value investor Warren Buffett has made significant changes to his portfolio in 2024. Notably, the Oracle of Omaha has slashed his holdings in Apple (NASDAQ: AAPL) and Bank of America (NYSE: BAC).

At present, Buffett also holds a record amount of cash — at least $277 billion, a move which has caused widespread worries among investors that a stock market correction is due soon.

However, the Berkshire Hathaway (NYSE: BRK.A) CEO does have a bullish view on some equities — one notable instance is his recent $6.7 billion position in Chubb Limited (NYSE: CB), which was initially kept secret by requesting confidential treatment for the SEC.

Picks for you

That is not the biggest novelty in Buffett’s portfolio — starting with an $82 million investment made on January 4, he has significantly increased his exposure to Sirius XM (NASDAQ: SIRI).

Per Finbold’s latest coverage on October 22, the legendary investor owned 32.5% of the company or roughly $129 million in SIRI stock. Recent SEC filings reveal that the billionaire investor has bolstered his ownership share by purchasing an additional $60 million in SIRI shares.

At the time of publication, Sirius stock price sits at $27.19, and a 15.02% rally over the course of the last 30 days has brought losses on a year-to-date (YTD) basis to 50.47%.

Buffett purchased SIRI stock amid crucial restructuring

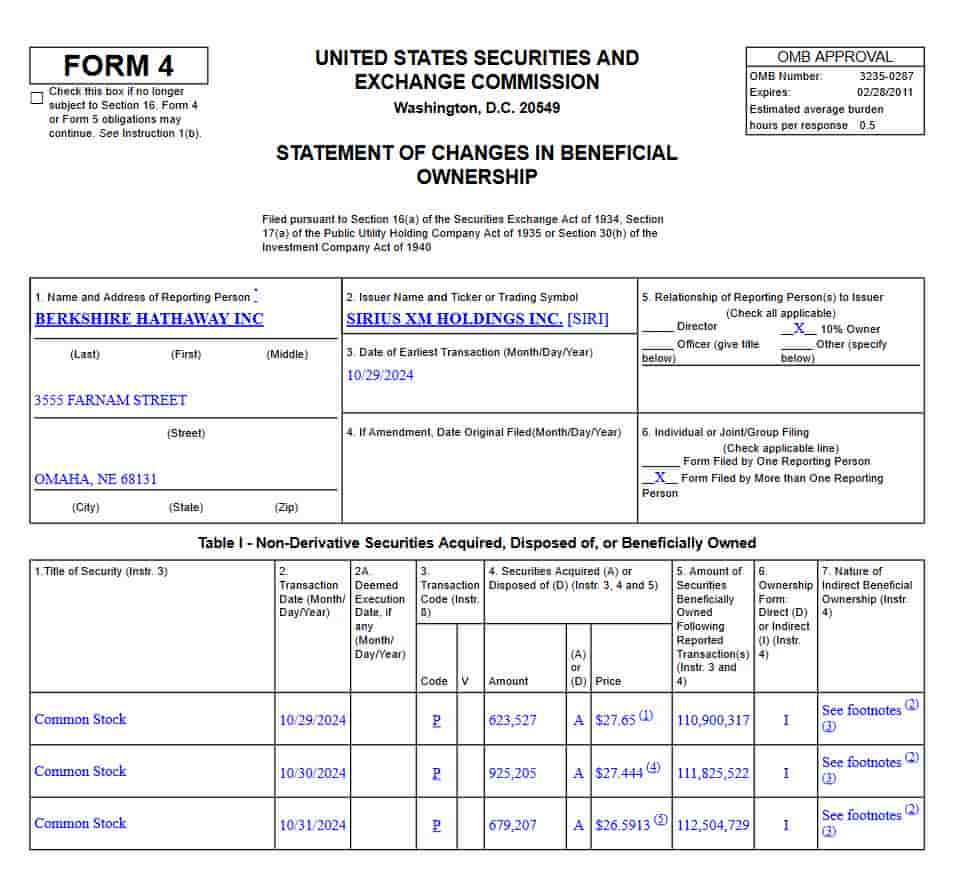

According to an October 31 SEC filing, the ‘Oracle of Omaha’ executed three transactions — on October 29, October 30, and October 31.

Buffett’s recent purchases unfolded over three consecutive days. The first transaction brought in 623,527 SIRI shares at $27.65 each.

Building on that, a second, larger buy added 925,505 Sirius stocks at $27.44 apiece. Finally, his third order scooped up an additional 679,207 shares at an average price of $26.59.

In total, the transactions encompassed 2,227,939 SIRI shares — worth a grand total of $60,696,492 — which means Buffett has increased his SIRI position by 50% in the span of just three days.

Buffett bought the dip on Sirius XM

The most obvious question to pose is — why would the billionaire invest in a stock that is nosediving?

Remember — Buffett, much like his mentor, Benjamin Graham, is a value investor. He has a pronounced preference for stocks with low relative valuations — having once stated he only invests in companies whose price is attractive when compared to the low end of estimated earnings.

That certainly applies to Sirius XM. At present, the radio business has a trailing price-to-earnings (P/E) ratio of 8.07 — and a forward PE of 8.17, both of which are far below market averages.

There’s also another factor — a key tenet of value investing is finding ventures that have an economic moat. In simple terms, this is a competitive advantage that translates to stock price.

Sirius’ latest earnings call might have been a disappointment, but it is, arguably, one of the few legal monopolies in the United States, as the only licensed satellite radio operator in the country.

While short-term prospects might be looking a tad gloomy, for investors with a long time horizon, following Buffett’s cues has generally been a winning strategy.