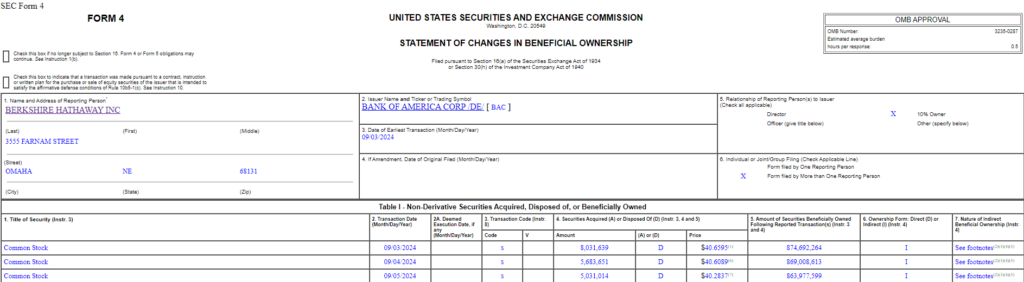

Although abstaining from selling Bank of America (NYSE: BAC) stock during the second quarter, as revealed in his updated portfolio, Warren Buffett, CEO of Berkshire Hathaway (NYSE: BRK.A), has sold almost $7 billion worth of this stock since the end of Q2.

The trend continued with Buffett’s latest sale on September 5, where he offloaded 18,746,304 BAC shares at an average price of $40.51 per share for a total profit of $759.5 million.

Looking at the previous filings with the Securities and Exchange Commission (SEC), the trend of selling Bank of America stock started just after the second quarter ended on June 30, with the first recorded sale on July 2.

How much BAC stock does Buffett own?

Although offloading billions in just over two months, Bank of America remains “Oracle of Omaha’s” second-largest holding, with 863,977,599 shares remaining, or 11% of his portfolio’s weight, worth around $34.7 billion, according to the latest closing price of $40.14.

However, the current holding of BAC shares represents a notable decrease from the previous size of 1,032,852,006 on June 30, which occupied 14.67% of Buffett’s portfolio and was worth $41 billion.

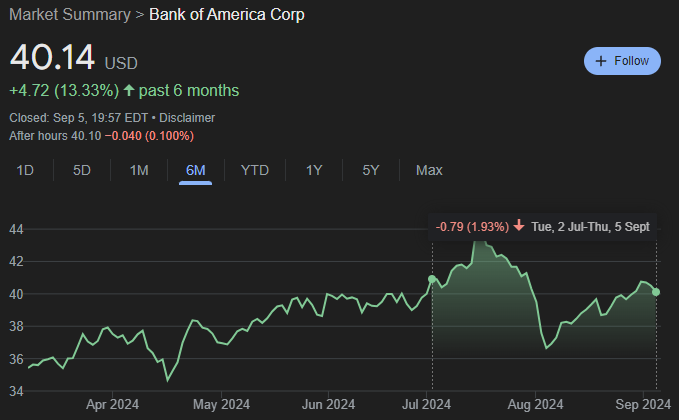

BAC stock performance since Buffett’s initial sale

Since July 2, BAC stock has been on a volatile ride, experiencing a peak at $44, which coincides with its highest closing price in 2024, and losing almost 17% until August 5, trading at $36.65.

However, the gains and losses since the initial Buffett sale have seemingly evened out, with BAC shares recording a 1.93% decrease over this period and closing at a $40.14 valuation on September 5.

These sales could further contribute to Berkshire Hathaway’s growing cash pile, which has recorded a substantial increase in 2024, increasing from $160 billion to almost $300 billion at the time of writing, if Buffett hasn’t decided to use some of this money to acquire new stocks or expand other holdings.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.