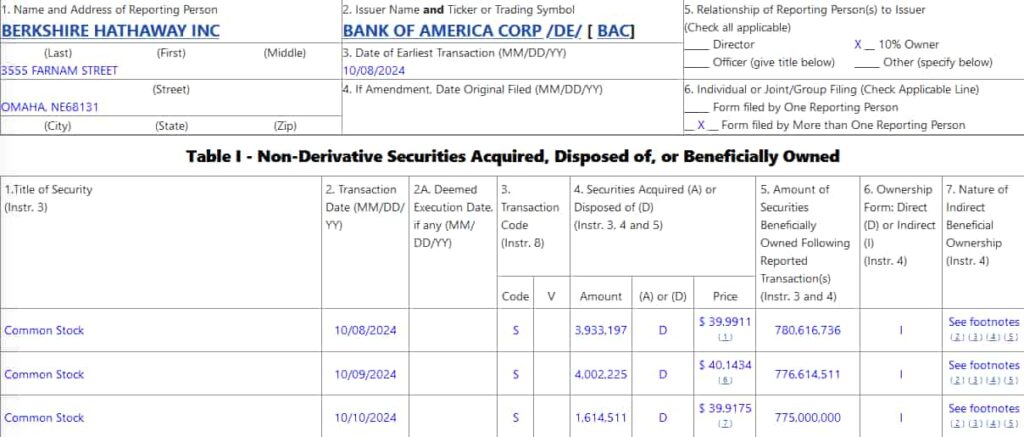

An SEC filing released on October 10 revealed that Warren Buffett sold an additional $382.4 million in Bank of America (NYSE: BAC) stock.

The disclosure included three transactions that took place from October 8 to October 10, which saw Buffett sell a total of 9.54 million shares.

This latest sell-off follows Buffett’s previous October 3 transaction, which saw the ‘Oracle of Omaha’ dump $337.9 million in BAC stock.

At press time, Berkshire Hathaway (NYSE: BRK.A) owns less than 10% of Bank of America — meaning that the holding company will no longer have to disclose its trades via Form 4 submissions, which have to be filed within 2 business days. This gives Buffett some leeway to approach his BAC holdings more flexibly, although the mogul will still have to disclose his holdings via regular 13-F filings.

Buffett reduces BAC holdings amid broader bank exit

While investors and traders have been quite intrigued by Buffett continuously reducing his exposure to BAC, speculating that the famed investor anticipates a sharp drop, a closer look at the subject does not necessarily lend credence to such theories.

Since 2020, Buffett has been steadily reducing or even completely exiting his stakes in banks — the same thing that has occurred with BAC has already happened with Goldman Sachs, JPMorgan, Wells Fargo, U.S. Bancorp, and BNY Mellon.

The investor’s caution regarding the sector isn’t particularly difficult to understand — major stock market indices are near or at all-time highs, uncertainty abounds regarding the Fed and interest rates, and banking is experiencing heightened competition from fintech companies.

The worries surrounding Bank of America have not materialized — at least not yet.

At press time, the BAC stock price is $41.93 — having rallied by 7.50% over the last 30 days to bring year-to-date (YTD) returns up to 23.70%.

BAC stock analyst outlook and future prospects

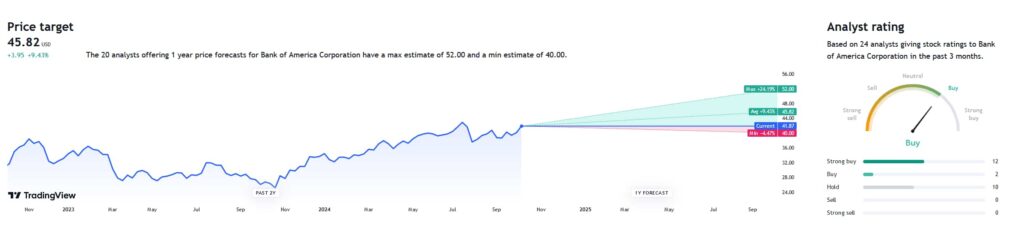

In spite of Buffett’s recent transactions, Wall Street analysts remain bullish on the stock — albeit cautiously. Of the 20 equity researchers who issue ratings for the stock, 12 rate it a ‘Strong Buy’, 2 rate it a ‘Buy’, and 10 issue ‘Hold’ ratings — there are currently no experts who rate the stock a ‘Sell’.

Price targets are generally optimistic — the average forecast sees the stock’s price in a year’s time at $45.82, which would represent a 9.45% increase. The most optimistic price target is $52, a mark that corresponds to a 24.16% rally in share price.

Although BAC is in a challenging environment, the worries surrounding the stock appear to be overblown. Investors and traders should keep an eye out for the company’s next earnings call, which is scheduled for October 15, as it will provide a much more material basis for further analysis.