Among all of his other holdings, which include major names like Amazon (NASDAQ: AMZN) and Visa (NYSE: V), Warren Buffett, the legendary investor and CEO of Berkshire Hathaway (NYSE: BRK.A), now owns more United States Treasury Bills than the country’s central bank.

Specifically, Warren Buffett and his company currently own 4% of all T-Bills issued to the public, which is substantially more than what the Federal Reserve holds – $195 billion, according to the data shared by X user Michael Burry Stock Tracker in an X post on August 5.

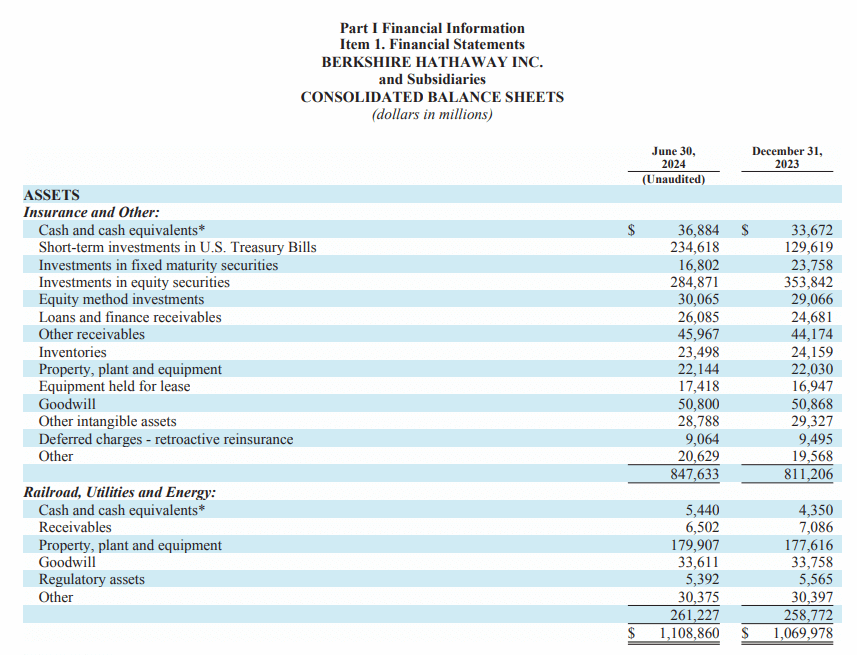

Buffett’s $235 billion in T-bills

As it happens, as Berkshire Hathaway’s second-quarter earnings report published on August 3 demonstrates, the renowned investor had $235 billion worth of short-term investments in US Treasury Bills as of June 30, 2024, almost twice as much as in the previous quarter when he held $130 billion.

Indeed, as the 93-year-old investor’s company specified:

“At June 30, 2024, our insurance and other businesses held cash, cash equivalents, and U.S. Treasury Bills of $271.5 billion, which included $237.6 billion in U.S. Treasury Bills.”

On the other hand, the Federal Reserve recently reported its holdings statistics that included about $195.3 billion in US T-bills as of July 31, 2024, a significantly lower amount than what the ‘Oracle of Omaha’ now holds.

How profitable Treasury Bills are?

As a reminder, Buffett has been a long supporter of stocking up on T-bills, arguing that they are the “safest investment there is,” during the annual Berkshire conference in May this year, although they might not offer returns as large as those from riskier investments like stocks.

That said, with the Federal Reserve holding its benchmark interest rates in the 5.25% to 5.5% zone for the moment, these returns have increased, featuring a 5.21% return rate on three-month T-bills, 4.91% on six-month bills, and 4.43% on 12-month Treasury notes, as per latest data on August 6.

Interestingly, Representative Marjorie Taylor Greene has also jumped on the T-bill bandwagon, recently purchasing another $250,000-worth batch of them after already having bought $500,000 in late July, even though she opposes Congressional stock trading, as Finbold reported earlier.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.