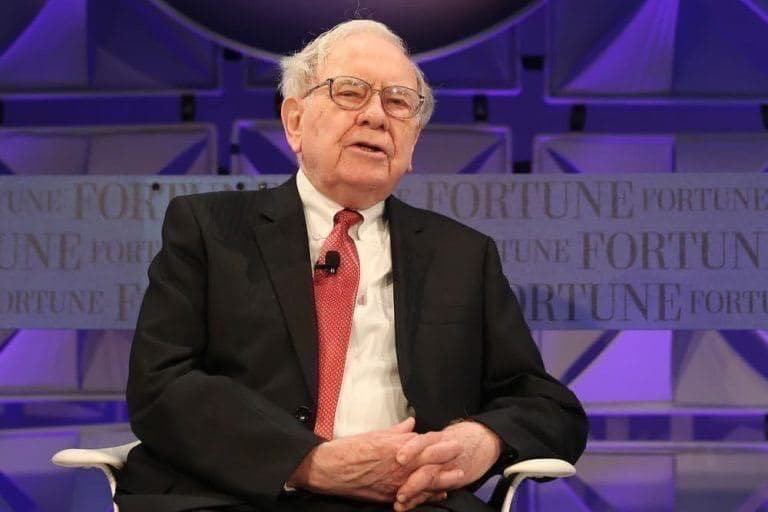

While it is no secret that many stock investors look up to Warren Buffett as one of the most experienced in the field, the Berkshire Hathaway (NYSE: BRK.A) CEO is on the road toward making a massive profit – counting almost $2 billion – based on returns from just three dividend stocks in 2024.

Indeed, the combined dividend yields of these three super stocks to Buffett’s conglomerate will get close to $2 billion this year (about $1,978,000,000), thanks to belonging to strong brands and paying regular returns, adding up to the renowned businessman’s $318 billion stock portfolio.

#1 Coca-Cola (NYSE: KO)

Specifically, Buffett’s longest-held position – that in the Coca-Cola Co (NYSE: KO) – is currently worth $24 billion and provides Berkshire Hathaway with annual dividend income of $736 million, which equates to 56% of its original cost basis, having paid $3.25 per split-adjusted share for that stake.

At the moment, the Coca-Cola stock is trading at the price of $59.57, indicating a daily loss of 0.43% and a 1.36% drop on its weekly chart but nonetheless recording an increase of 3.4% across the previous month, as per the latest data on January 23.

#2 American Express (NYSE: AXP)

Furthermore, the stake in American Express (NYSE: AXP), which Buffett has held for nearly as long as the one in Coca-Cola, will this year provide his company with a dividend profit of $364 million, from a position worth $1.3 billion, or $8.49 per share.

Meanwhile, the price of the AXP stock at press time stood at $185.01, up 1% in the last 24 hours, increasing by 1.63% across the previous seven days, and advancing 2.41% over the past month, according to the most recent information retrieved by Finbold.

#3 Apple (NASDAQ: AAPL)

Finally, Berkshire’s position in Apple (NASDAQ: AAPL) will grant $878 million in dividend income for the next 12 months thanks to the company’s holdings of 915 million Apple shares worth about $177 billion and the technology behemoth’s stock price increase of 378% over the last five years.

Currently, the AAPL stock is changing hands at the price of $193.89, recording an increase of 1.22% on its daily chart and gaining 4.29% over the past week despite declining 0.48% in the last 30 days, as per the most recent chart information.

Conclusion

Overall, the above dividend stocks will probably contribute to another successful year for Warren Buffett. However, things in this sector can make a surprising twist, so it is important to carefully study any asset in the stock market before devoting a significant part of one’s portfolio to it.

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.