Successful rebranding is significant in the fashion and retail industries, as it can be a ‘make it or break it’ event. And it seems that Abercrombie & Fitch (NYSE: ANF) has hit the jackpot recently.

This casual wear company has seen its stock increase by 287.18% in the previous year, trumping gains made by Nvidia (NASDAQ: NVDA), which is touted as the best performer in the last 12 months.

So what exactly led to this surge, which has made ANF the best performer in S&P 1500 in the previous year? The answer is quite apparent.

Rebranding as key to success

Since its peak notoriety in the early 2000s, Abercrombie & Fitch has implemented diverse strategies to alter the public’s perception of its brand. Gone are the days when shirts and clothing items prominently displayed the company’s logo or brand name.

Instead, the brand has shifted its focus towards enhancing the quality of its products. Additionally, it has abandoned its previous limited sizing options in favor of more inclusive styles and sizes.

As the full-year and fourth-quarter reports are expected on March 6, the most recent quarterly report illustrates robust performance. Net sales reached $1.1 billion, marking a 20% increase compared to the previous year on a reported basis.

Total company comparable sales surged by 16%. Additionally, the gross profit rate substantially improved, reaching 64.9%, up by approximately 570 basis points from the previous year.

Operating income soared to $138 million on a reported basis, a notable increase from $18 million and $21 million recorded in the same period last year.

What do analysts think of ANF stock?

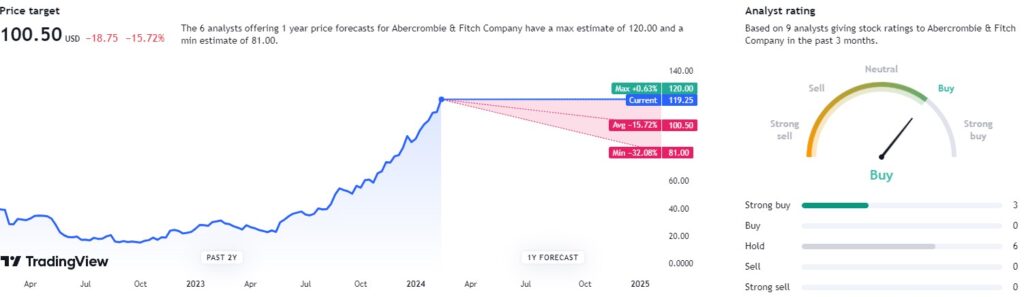

Surprisingly, analysts from TradingView don’t see much of an upside for ANF stock in the 12-month time; they are pretty bearish, even when awarding this stock with a ‘buy’ rating based on 9 reviews. With 3 ‘strong buy’ recommendations and 6 ‘hold’ opinions, the experts seem pretty divided.

Furthermore, their price target is $100.50, a decrease of -15.72% from the current levels.

Analysts may be waiting for the full-year report to give their final verdict, which, considering the performance from 2023, should nudge them to favor this stock more.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.