Following a deal on a massive injection of funds its Chinese subsidiary will receive from strategic investors, the NIO Inc. (NYSE: NIO) stock is already soaring in pre-market trading, signaling further advances as the partners fulfill the obligations set up in this funding.

Specifically, NIO has entered into definitive agreements for its Chinese subsidiary, in which it holds 92.1% controlling equity interest, with Hefei Jianheng New Energy Automobile Investment Fund Partnership, Anhui Provincial Emerging Industry Investments, and CS Capital, the company said on September 29.

$1.9 billion in NIO China

Under these agreements, the strategic investors will inject a total of 3.3 billion in renminbi (RMB, the official currency of China), which equals $470.5 million, to subscribe for newly issued shares of NIO China. In turn, NIO will invest 10 billion RMB or $1.43 billion in cash to subscribe for these shares.

Once the investment transaction—carried out in two installments—is complete by the end of 2024, NIO will reduce its controlling equity interest in NIO China to 88.3%, whereas the strategic investors, alongside other existing shareholders, will collectively hold the remaining 11.7% of equity interest in NIO China.

As it happens, the electric vehicle (EV) manufacturer also said it had the right to invest an additional 20 billion RMB ($2.86 billion) to subscribe for more shares in NIO China by the end of 2025, based on the same pricing and terms of the investment transaction, which is subject to regulatory and internal approvals.

NIO stock price analysis

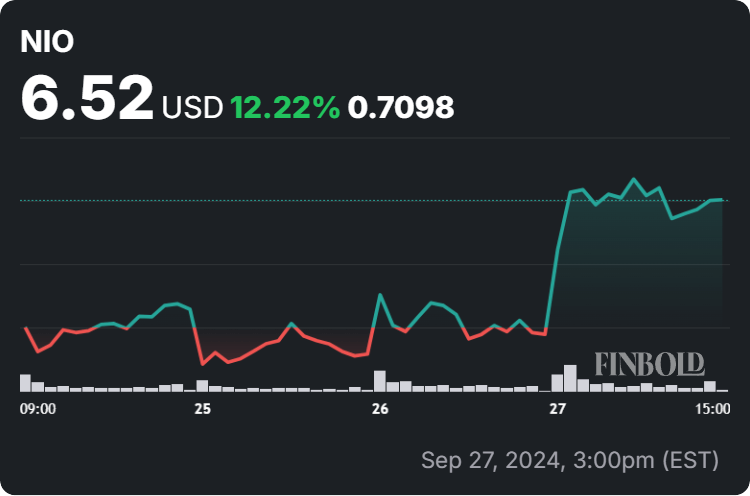

Meanwhile, the market has already started to react to the positive developments for NIO, with NIO stock charging 12.12% in pre-market, adding up to the 12.22% gain across the past week, gaining as much as 76.02% over the month, and reducing its year-to-date (YTD) loss to 13.24%, currently standing at $6.52, as per data on September 30.

Notably, in terms of its technical analysis, NIO stock has formed a bullish double bottom at $3.65, surpassing the critical neckline at $6 and moving to the 0.236 Fibonacci retracement point, while its current price is above both the 50-day and 200-day exponential moving averages (EMAs) of $6.10 and $5.85, respectively.

Indeed, the strategic investment deal is certainly one of the largest triggers for the price of NIO stocks, others including a positive financial report, as well as the undervalued stock (with a price-to-sales ratio of 1.37 and forward EV to sales at 1.39), making it relatively more affordable than other EV companies.

On top of that, the Chinese government has recently announced a $150 billion-plus stimulus to the economy in the upcoming price, and China’s EV industry has started to witness increasing demand, with NIO’s success likely to continue with its Onvo brand and representative L60 vehicle.

That said, making any definitive NIO stock prediction is impossible as trends in the stock market can easily change, so keeping up with any relevant developments, like when is NIO earnings report, experts’ NIO price prediction, analysts’ NIO stock price target and ratings, and the like, is critical.