Over 30% of Bitcoin’s (BTC) circulating supply is now concentrated in the hands of just 216 centralized entities, according to the latest blockchain data from a Gemini and Glassnode report.

The trend reflects both expanding institutional adoption and growing custodial centralization in the world’s largest cryptocurrency.

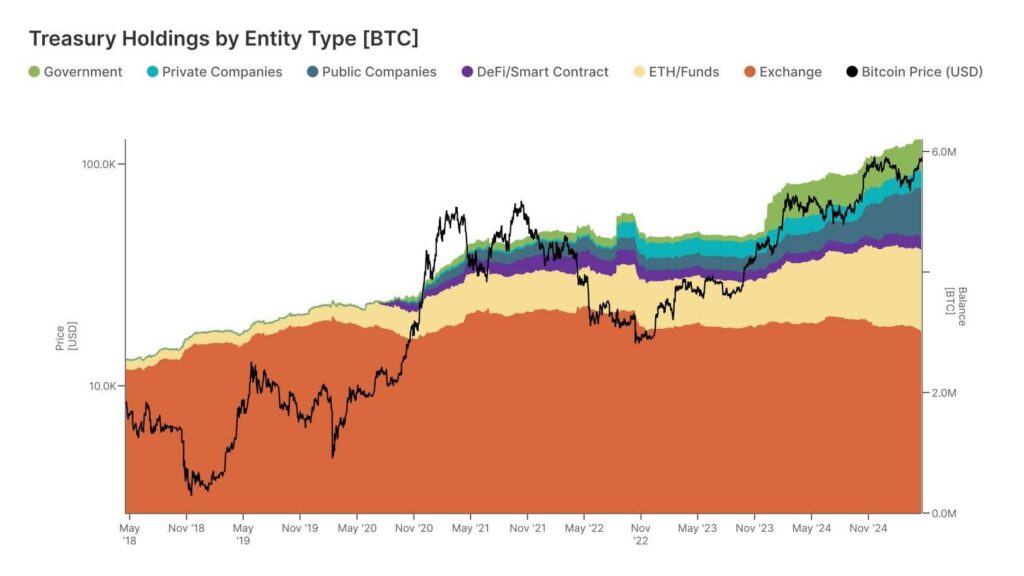

The scale of this shift is striking. A decade ago, centralized exchanges collectively held just under 600,000 BTC for their users. Today the total amount of Bitcoin held across major institutional and custodial entities has surged to an estimated 6,145,207 BTC, a 924% increase over the past ten years.

With this centralization comes as Bitcoin’s spot price continues to climb. Since early 2015, Bitcoin has risen from below $1,000 to now trading above $107,000, reinforcing its growing appeal as a strategic asset among large institutional players.

The data spans 216 entities across six key categories: centralized exchanges, ETFs and funds, public companies, private companies, DeFi contracts, and governments. While the dataset is not exhaustive, it captures the most influential actors now collectively controlling nearly one-third of Bitcoin’s supply.

The chart below shows this evolution visually. Exchanges (shown in orange) remain the dominant custodians of Bitcoin holdings, followed by ETFs and funds (yellow), with noticeable growth in holdings by private companies (blue) and governments (green) over the past two years. Public companies and DeFi contracts represent smaller but steadily growing segments of institutional Bitcoin ownership.

What is driving this trend in centralized Bitcoin adoption?

Several factors appear to be at play. First, the rise of regulated Bitcoin ETFs and funds in major markets like the US and Europe has enabled a broader class of institutional investors to gain exposure to BTC without managing private keys directly, which has contributed to the significant growth in custodial balances.

Second, as Bitcoin matures as an asset class, public and private companies are increasingly adding BTC to their treasuries, both as a hedge against fiat debasement and as a long-term strategic reserve. Notable examples include MicroStrategy, Tesla, and a growing number of smaller firms.

Third, government holdings, once negligible, have begun to climb. While still small in absolute terms, several governments now report seized BTC balances or have quietly added Bitcoin to their reserves.

But this deepening institutional embrace comes with trade-offs. On one hand, greater participation by regulated entities enhances Bitcoin’s legitimacy and liquidity. On the other, it also increases custodial risk and undermines one of Bitcoin’s core principles: decentralized ownership.

As exchanges and custodians aggregate ever larger portions of the total supply, systemic risks emerge. A significant security breach or regulatory action targeting a handful of these entities could trigger outsized impacts on the broader Bitcoin market.

For now, the trajectory is clear. Institutions continue to accumulate Bitcoin, and the network’s original ideal of wide, sovereign individual ownership is giving way, at least in part, to a more centralized custody model.