As Bitcoin (BTC) seeks to reclaim the $120,000 resistance zone, insights from the artificial intelligence (AI) platform ChatGPT indicate that the largest cryptocurrency has the right conditions to climb to $135,000 by October 1, 2025.

A push toward $135,000 would represent an increase of nearly 17% from the asset’s press-time value of $115,511.

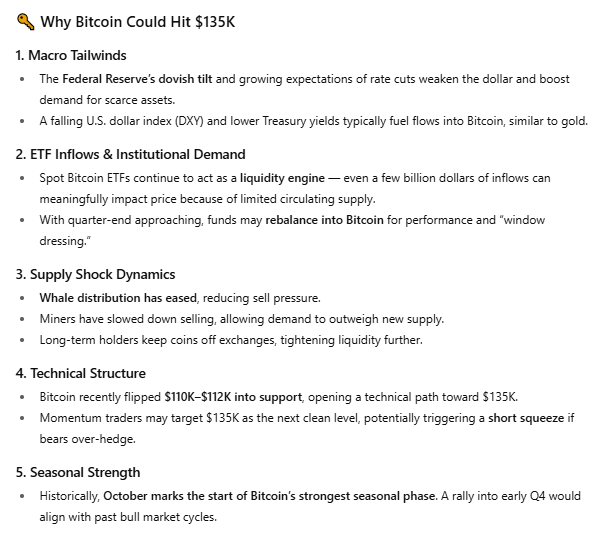

Bitcoin’s path to $135,000

According to ChatGPT’s projection, the path to $135,000 is supported by a mix of macroeconomic tailwinds, institutional demand, and favorable market structures, though risks remain.

ChatGPT highlighted that the Federal Reserve’s dovish stance and expectations of rate cuts are weakening the U.S. dollar, boosting demand for scarce assets like Bitcoin. Historically, a softer dollar and lower Treasury yields have funneled capital into alternative stores of value, giving Bitcoin a gold-like tailwind.

It also pointed to spot Bitcoin ETFs as key liquidity drivers. The model noted that even modest inflows can move prices given Bitcoin’s limited supply, and upcoming quarter-end rebalancing could add further institutional demand.

On the supply side, Bitcoin is showing signs of a tightening market. ChatGPT observed that whale distribution has slowed, miners have reduced selling, and long-term holders continue to keep coins off exchanges. Therefore, this lowers available liquidity and magnifies the impact of any incremental demand.

From a technical perspective, Bitcoin has, in the short term, turned the $110,000 to $112,000 zone into support, which ChatGPT described as opening a path toward $135,000.

To this end, momentum traders could accelerate the move, particularly if short sellers become overextended. Seasonality may also play a role, as October has historically been one of Bitcoin’s strongest months.

Bitcoin’s risks heading into October

However, ChatGPT cautioned that risks remain, including potential ETF outflows, hawkish Fed signals, or geopolitical shocks that could drive investors toward safer assets. Heavy selling from whales or miners, excessive leverage leading to liquidations, and regulatory setbacks could also cap Bitcoin’s rally.

In conclusion, ChatGPT highlighted that Bitcoin’s mix of macro tailwinds, supply dynamics, and seasonal strength could drive it to $135,000 within weeks, but warns that negative ETF flows, central bank shifts, or on-chain selling could stall the rally below $130,000 or trigger a pullback to $110,000 support.

Featured image via Shutterstock