Amidst a flurry of well-performing semiconductor stocks in the current 2-year bull run, Intel (NASDAQ: INTC) has been struggling. The chipmaker failed to respond quickly enough to the AI boom, while revenue decreases, a shrinking market share, and cost-cutting measures have shaken investor confidence.

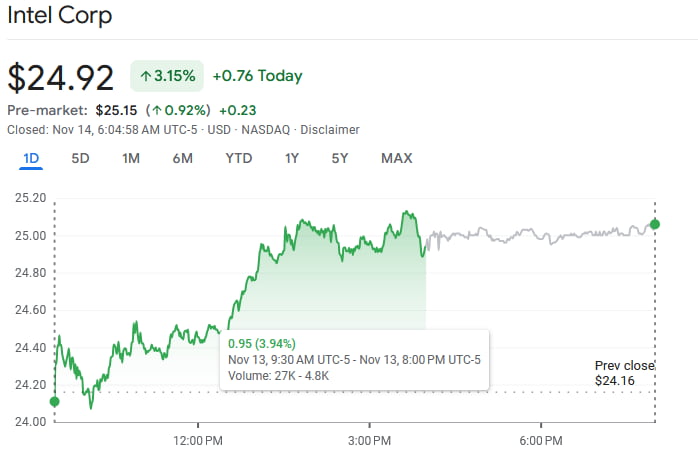

At press time, Intel shares were trading at $24.92 — year-to-date (YTD) losses stood at 47.87%. On November 13, INTC shares unexpectedly rallied by 3.90% — signaling that the processor giant’s fortunes could be starting to change.

INTC stock rises on calls for CHIPS Act funding

Being able to manufacture high-end chips has become a matter of both national security and maintaining a competitive edge in rapidly-evolving and increasingly important fields such as AI. To that end, tensions are high between the United States and China — and bootstrapping domestic production was a priority for the Biden administration.

The CHIPS and Science Act saw $8.5 billion earmarked for Intel to build advanced semiconductor fabrication plants in Arizona, Ohio, Oregon, and New Mexico. Ever-concerned with government spending, President-elect Donald Trump and the Republican party ran a campaign that was highly critical of the act. Most recently, Speaker of the House Mike Johnson claimed that the GOP may try to repeal it entirely — before backtracking and saying that it will more likely be ‘streamlined’.

As a response, 18 business groups from Ohio, Oregon, New Mexico, and New York sent a letter to President Biden, calling for the immediate release of capital. The letter stated:

“We are grateful for your efforts to ensure these laws are enacted with clarity and expediency but are growing concerned that federal funds associated with these laws are not being distributed in a timely manner that allows the American people to fully capitalize on the opportunity to reshore and expand this critical industry.”

Among others, the letter was also signed by the Ohio Chamber of Commerce, Oregon Business & Industry, the New Mexico Chamber of Commerce, and the Business Council of New York State.

Will the upcoming Trump administration sink Intel stock?

Although Trump’s rhetoric appears unfavorable to Intel, as the President-elect favors tariffs in lieu of subsidies, the real estate mogul’s words are seldom followed by equivalent actions. If anything, speaker Johnson’s attempt to backtrack his comments indicates that the Republican party has not yet reached a consensus on the CHIPS act.

Intel is still in a tough spot — with the company reportedly outsourcing more orders to TSMC (NYSE: TSM), efforts to increase domestic production have not yet paid off. The company does not expect its new fabs to provide meaningful revenue before 2027.

However, there is a widely accepted consensus that Intel, as one of the few U.S.-based companies that has the know-how necessary to make advanced chips, is simply too important to be let to fail — a position that lends itself naturally to Trump’s economic populism.

Should President Biden authorize an early release of funds, INTC shares will likely see a move to the upside — albeit a limited one. For now, the future of one of America’s premier semiconductor companies still remains uncertain.

Featured image via Shutterstock