Almost everyone in the cryptocurrency community knows that Michael Saylor is a massive Bitcoin (BTC) enthusiast, but he has not bought any of the maiden crypto asset lately, leading one trading expert to try and discern the logic behind this and whether his confidence is going down.

Indeed, trading expert Alan Santana has pointed out that the MicroStrategy (NASDAQ: MSTR) executive chair “hasn’t been buying any Bitcoins,” as well as that BlackRock (NYSE: BLK), “is nowhere to be found,” wondering what this indicates, in a TradingView post on September 4.

Why is Saylor not buying Bitcoin?

According to Santana, “one way to look at the Bitcoin market from a rookie bullish perspective is through the story that Bitcoin is strong and cannot move lower because (1) the Spot ETFs (aka. BlackRock) will buy everything and (2) Micheal Saylor “bought Bitcoin.”

Hence, he asked his followers, who might be “one of those Spot ETFs and MS Bought Bitcoin kind of person,” how they were feeling now that these people are not in the spotlight for buying Bitcoin. “Does this lower your confidence in Bitcoin’s ability to maintain its current price, or are we still aiming for 100K next?”

“The correction is on! and has been ongoing for almost six months now. We are about to experience what traders call the final ‘leg down.’ It is very intriguing, I can feel the suspense in the air… But we have bearish action, lower lows, and normally, when you are about to experience a very strong rise, everything is green, day after day. Right now, I am only seeing red.”

Expert’s Bitcoin vs. altcoins prediction

Highlighting Bitcoin’s movements in the recent period, Santana explained that, since 2017, Bitcoin has closed almost every September in the red, with the exception of 2023, and that “September 2024 can end up being another bearish (very bad) month,” with a possible “4 months of straight up bearish action.”

Furthermore, as the trading analyst clarified, Bitcoin might be heading for a crash toward $42,000, during which “everything can experience a very strong negative reaction, but everything soon stabilizes,” and the smaller altcoins “will recover sooner, some will not even flinch,” while “others will grow.”

On the other hand, he stressed that big altcoins, “the giants, are going to crash together with Bitcoin,” adding that the “altcoins trading against Bitcoin, some are safe but prepare to hold strong for a few days.” However, Santana concludes with a glimmer of hope that:

“Once the correction is over, we will be sharing bullish charts, LONG, until late 2025. It will be awesome.”

Bitcoin price history

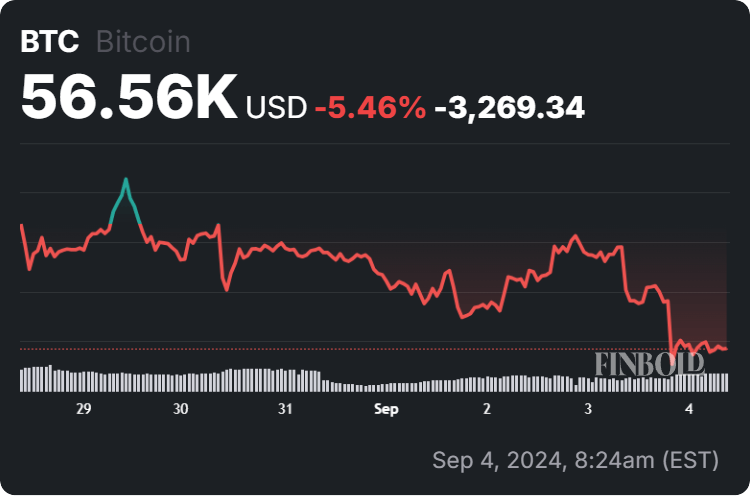

Meanwhile, the flagship decentralized finance (DeFi) asset was at press time changing hands at the price of $56,560, which demonstrates a 4.40% drop in the last 24 hours, adding up to the 5.46% decline across the previous seven days, while recording an increase of 13.64% on its monthly chart, as per the most recent data on September 4.

Ultimately, the reason why Michael Saylor is not buying any Bitcoin at the moment could lie in the fact that the largest asset in the crypto sector by market capitalization is looking at a potential dip, which means that the MicroStrategy chairman could be waiting for the price to drop further so he can get it at a bargain.

As a reminder, Saylor led MicroStrategy to adopt the Bitcoin strategy back in August 2020, having hailed BTC as an “economic engine based on a truth machine poised to emerge as a freedom machine,” although some, like Hal Press, the founder of the crypto investment fund North Rock Digital, have criticized his plans as “comically stupid.”

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.