Nvidia’s (NASDAQ: NVDA) share price continues to show strength, with a stock market analyst noting that the equity might be primed for new highs after clearing a few barriers.

The outlook comes after NVDA ended the October 7 trading session up 2.2%, valued at $127. The equity has overcome recent volatility that saw NVDA struggle to break past the $120 resistance. To this end, over the past month, the Nvidia stock has rallied almost 20%, with shareholders being rewarded from the equity’s year-to-date rally of 165%.

At the same time, heading into the October 8 session, Nvidia shares are looking to extend the gains, up 2% in the pre-market.

Picks for you

Nvidia stock upside potential

Now, stock trading analyst Peter DiCarlo has noted that the current Nvidia momentum might be just the beginning, and the $150 target remains the next ideal stop, he said in an X post on October 8.

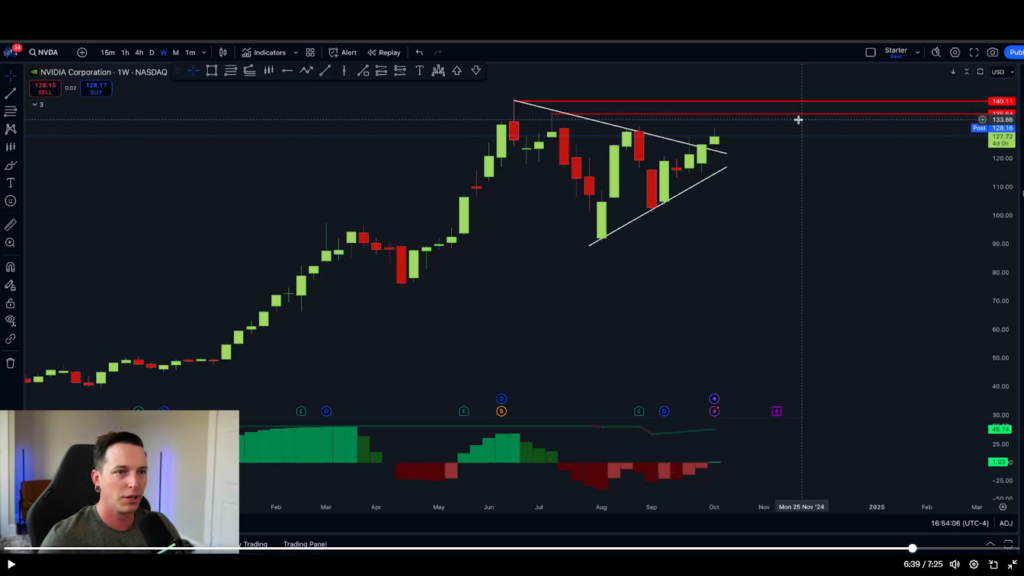

DiCarlo emphasized that $130 is a pivotal level for Nvidia, serving as a crucial resistance point. As the stock moves past this level, it would break a series of lower highs, compressing price action into a bullish wedge. The analyst believes this breakout would signify a shift in the market structure, moving from a series of higher lows and lower highs to higher highs and higher lows.

Additionally, DiCarlo stated that Nvidia’s daily chart indicates a bullish trend, with the stock forming a series of higher lows. He described the behavior as “compression,” where prices have been tightening, a phenomenon often preceding a breakout.

“Looking like $NVDA is ready for $150 price target. Once $130 is taken out, there is NOTHING stopping the bulls from pushing us to all-time highs. <…> I do think that Nvidia is going to end up at around $140 to $150 by the end of December, and I think the $140 could potentially happen by the end of this month,” he said.

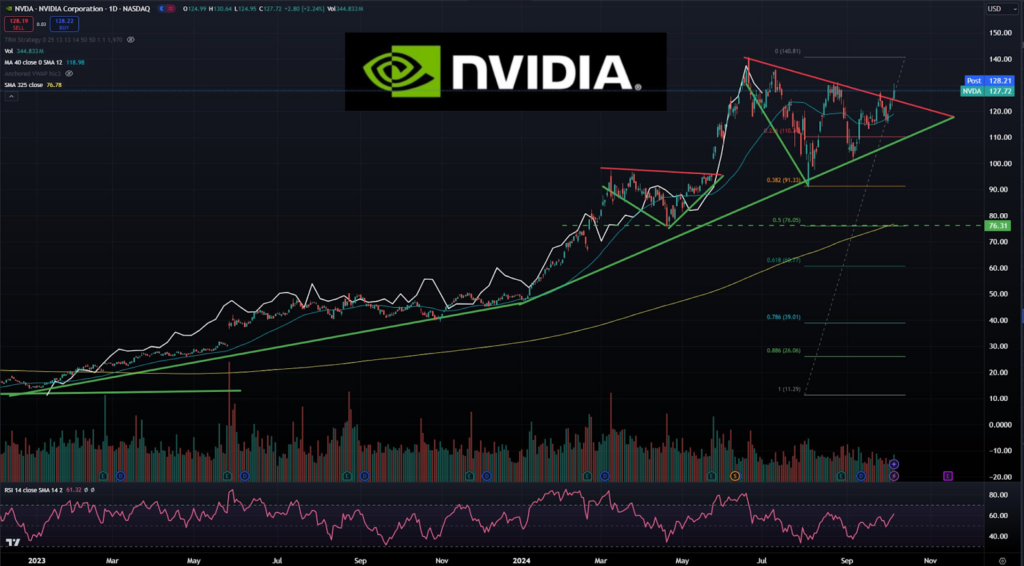

Elsewhere, a separate analysis by a stock trading expert who goes by the pseudonym TommyJR in an X post on October 8 highlighted a bullish outlook for Nvidia, noting its ascending triangle pattern—a sign of potential upward movement.

According to the expert, Nvidia has followed an ascending trendline since early 2023, approaching the $140 resistance level—the pattern’s upper boundary—hinting at a possible breakout.

The 40-day simple moving average (SMA) at $118.98 provides dynamic support, while the 325-day SMA at $76.78 underpins the long-term uptrend. As per the analysis, key support levels include $91 (38.2% Fibonacci) and $76 (50%). A breach above $140 could drive new highs, though a drop below $110 might signal a deeper correction.

Meanwhile, as reported by Finbold, an analysis by Harmonic Patterns indicated that the tech giant was forming a butterfly pattern, hinting at the possibility of Nvidia touching the $150 mark.

Nvidia stock’s key fundamentals

The bullish sentiment around Nvidia is backed by the company’s inroads in the artificial intelligence scene through its chips, which continue to attract significant demand. Although primarily trading in line with the overall market, the current gains have coincided with Nvidia’s 2024 AI Summit that began on October 7.

The summit will offer a sneak peek at AI’s future and Nvidia’s role in revolutionizing the sector. Interestingly, prior to the summit, CEO Jensen Huang unveiled Nvidia’s AI roadmap, a move likely to help the stock target $200.

Regarding Nvidia’s role in the AI space, the company’s Blackwell GPU is among the most anticipated products, with the technology giant confirming it has already received high demand. To this end, an analyst from Morgan Stanley (NYSE: MS) noted on October 8 that Blackwell chip production will likely outpace Hopper in the first quarter of 2025.

On the same front, Phil Panaro, a former senior advisor at the Boston Consulting Group, noted that revenue generated from the chip could push Nvidia’s share price to $800 by 2030, with revenue reaching $600 billion by the same year.

This strong optimism is also backed by Ben Reitzes from Melius Research, who maintained that Nvidia’s long-term trajectory is intact, urging investors to keep faith in the company despite skepticism around elements such as competition from entities like Advanced Micro Devices (NASDAQ: AMD) and the delay of the Blackwell chip rollout.