The still-ongoing controversy surrounding Super Micro Computer (NASDAQ: SMCI) is one of the most notable events to happen in the booming semiconductor industry in 2024.

Not so long ago, SMCI stock was up as much as 316% on a year-to-date (YTD) basis. Almost all of those gains have been erased — at the tail end of October, SMCI shares even went into the red.

Allegations of fraud from short-selling activist group Hindenburg Research made in August caused an initial selloff. This was soon followed by Super Micro delaying the filing of its annual report. Finally, on October 30, it became public that the company’s auditor, Ernst & Young, had resigned six days prior — bringing about a 30% loss in share price within a single day amid risks of delisting from the NASDAQ.

It might not be out of the woods yet — but for the first time in a long time, the server-maker has some good news to share — and the markets reacted quite favorably.

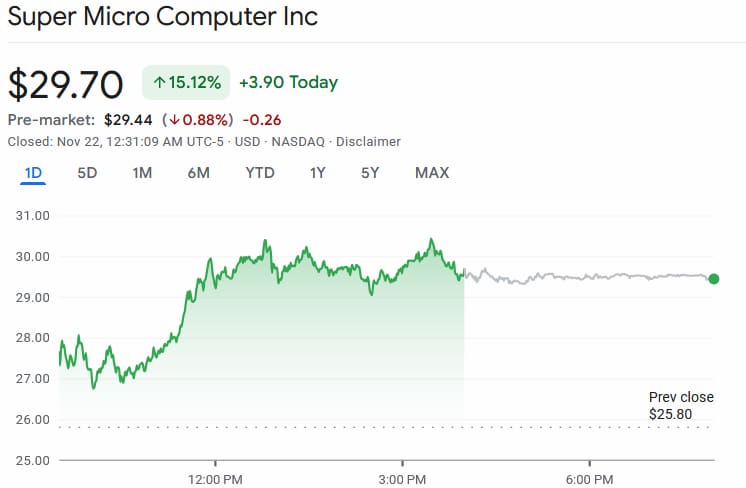

At press time, Supermicro stock was trading at $29.70. Shares rallied by 15.12% over the course of the day, bringing YTD returns up to 4.03%.

Nvidia earnings and auditor replacement buoy SMCI stock

The initial report made by Hindenburg Research alleged widespread accounting and reporting fraud. However, there is little doubt that Super Micro Computer’s core business is on a growth trajectory. Even with the complications seen in the past couple of months, other major players in the space have continued to collaborate with the business.

On November 20, industry leader and stock market favorite Nvidia (NASDAQ: NVDA) released its Q3 FY2025 earnings call. Although NVDA stock dropped by as much as 5.4% in the immediate aftermath due to fairly aggressive profit-taking, the report was a beat in terms of both earnings and revenue. This was seen as a bullish signal for the wider semiconductor industry and AI businesses in particular.

That is one part of the equation — the other is that on November 18, Supermicro announced that it had engaged the services of a replacement auditor, BDO, and submitted a compliance plan with its exchange.

One of the key fears surrounding the potential delisting is that none of the big four accounting companies were likely to take on the task of setting the books straight after E&Y’s resignation. For a business of SMCI’s scale, a suitably large auditor is needed — and BDU is the fifth-largest accounting firm in the world.

Put together, these two factors caused a 48.20% surge in SMCI share price from November 18 up to the time of publication.

Is SMCI now in the clear?

While the latest developments are certainly positive, the issues surrounding the business are far from a done deal. Submitting a plan to return to compliance does not, in fact, guarantee a return to compliance — and since one auditor already resigned when faced with allegations of misconduct on SMCI’s part, investors would be wise not to make hasty conclusions.

There’s also the question of reputation and trust — going forward, both businesses and investors are likely going to be more wary of collaborating with Super Micro Computer.

Once all is said and done, although it might be tempting to bet that SMCI share price will recover as things settle back into normalcy, without properly vetted and audited financial statements, investors are essentially operating in the dark. There is an additional, entirely different dimension of risk at play with SMCI — and ultimately little in the way of potential reward to compensate.

Featured image via Shutterstock