MicroStrategy’s (NASDAQ: MSTR) decision to incorporate Bitcoin (BTC) into its balance sheet was considered a bold move by Wall Street companies.

Now, this strategy is turning out to be a strategic move that has proven profitable for the firm and its investors, prompting questions about whether S&P 500 companies should follow suit.

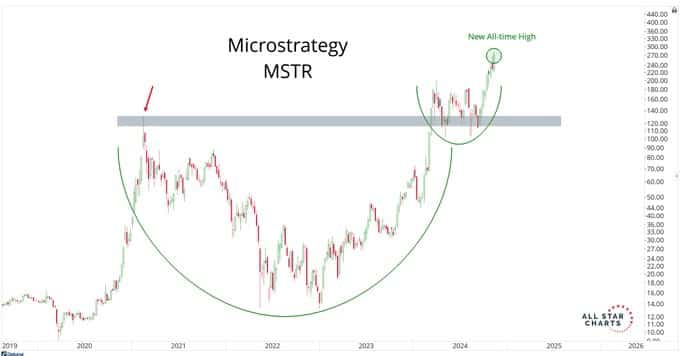

As things stand, MicroStrategy’s stock has surged past every S&P 500 equity since incorporating Bitcoin into its corporate strategy in 2020, according to an analysis shared by technical analyst J.C. Parets.

This approach transformed MicroStrategy’s market position and increased its market cap to a staggering $55 billion.

As of the last trading session, MSTR was valued at $270.42, with a year-to-date return of 294%. This outperformed chipmaker Nvidia (NASDAQ: NVDA), which has returns of 206% in 2024.

These gains coincided with when Bitcoin hit a new high above $77,000, driven by optimism around Donald Trump’s election win, which is considered bullish for digital assets.

According to Michael Saylor, the Bitcoin strategy is expected to evolve into a Bitcoin bank, focusing on creating capital market instruments across various financial products.

Should S&P 500 companies adopt Bitcoin strategy?

Based on MicroStrategy’s performance, the question of whether S&P 500 companies should follow suit and incorporate Bitcoin into their portfolios arises. Microsoft’s (NASDAQ: MSFT) shareholders, for example, will vote on implementing a Bitcoin strategy in December, as Finbold reported.

From the MicroStrategy case, adding Bitcoin to company balance sheets can boost returns, especially in bullish cycles.

Additionally, companies can potentially improve shareholder value with Bitcoin, offering an unconventional yet rewarding avenue. It also provides an opportunity for diversification, reducing reliance on traditional currencies and assets.

At the same time, considering Bitcoin proponents are positioning the asset as potential digital gold, upon maturity, the asset could act as a hedge against inflation and protect assets from cash’s declining value.

Indeed, it’s worth bearing in mind that companies seeking to emulate MicroStrategy’s Bitcoin investment might face resistance due to concerns in the crypto space, such as the lack of clear regulations. To this end, the rollout of spot Bitcoin ETFs offers an avenue for S&P 500 companies to be involved in Bitcoin.

Bitcoin ETFs as an investment strategy for S&P 500 companies

ETFs provide a regulated exposure to Bitcoin without the complexity of direct ownership. They eliminate custody risks, provide liquidity through traditional stock exchanges, and offer a simple way to hedge against inflation.

A spot Bitcoin ETF also diversifies portfolios, reduces reliance on traditional assets, and simplifies compliance and reporting, making it a convenient option for companies seeking to enter the digital asset space.

Some analysts believe that introducing Bitcoin ETFs is meant to spur more institutional interest in the asset. For instance, Matt Hougan, CIO of Bitwise Asset Management, emphasized that the product could fuel long-term growth similar to gold ETFs, contributing significantly to gold’s value expansion.

He anticipated billions flowing into Bitcoin ETFs as institutions gain exposure, potentially elevating Bitcoin’s market position.

Opposition to Bitcoin strategy

Not all industry players are fans of companies buying Bitcoin. For example, economist and Bitcoin critic Peter Schiff has criticized Saylor’s approach, arguing that companies investing in the maiden crypto are gambling with shareholders’ funds.

Considering all factors, a Bitcoin strategy may not suit every company. Therefore, risk tolerance, industry-specific needs, and shareholder requirements may influence the decision to venture into Bitcoin.

Looking at the MicroStrategy case, the strategy might be suitable for companies that are flexible enough to take on more risk and view Bitcoin as a compelling opportunity.

Featured image via Shutterstock