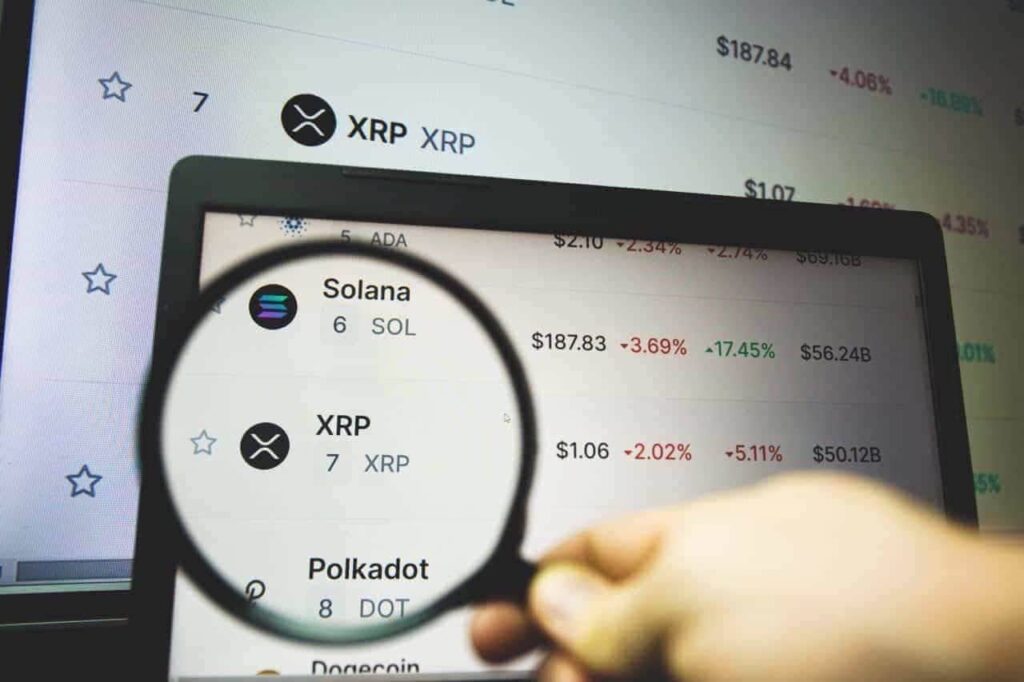

As of writing, XRP sits in the 6th position among all cryptocurrencies ranked by market cap. In a highly dynamic ecosystem, capital comes and goes, flowing between the projects, in and out of the crypto market.

Currently, XRP is valued at $28.028 billion in a $1.516 trillion market, holding 1.85% of this total. The token’s unitary price is $0.517, with a 54.339 billion XRP circulating supply.

In the meantime, supply and demand constantly move the asset’s price up and down, flowing from one cryptocurrency to another. Bitcoin (BTC), for example, dominates the total crypto market cap by around 51%, with nearly $785 billion in capitalization.

If only 1% of the total valuation moved to Ripple’s token, its market cap would increase by $15.16 billion to $43.188 billion. Therefore, XRP could go as high as $0.794 while its circulating supply remains unchanged.

Interestingly, this would reward XRP investors with over 54% gains, only considering internal flows within the crypto ecosystem.

XRP market cap vs. the total crypto index

However, XRP suffers from constant increases in its circulating supply, resulting in higher market caps for lower or similar prices. Ripple, the largest XRP holder, unlocks and sells new tokens monthly, increasing its overall valuation while suppressing the price.

The supply effects are visible on XRP’s market cap chart. Notably, XRP had a value peak in 2017-2018 following a massive token release at a given price. Just to retrace back under sell-off pressures as the price sought its fair value.

Since then, the total crypto market cap has mostly outperformed the token’s capitalization. Thus, XRP tends to have less dominance against the whole cryptocurrency ecosystem instead of more.

Nevertheless, this observed trend could shift in the future, facing an expected increased demand for Ripple’s digital assets. XRP use cases for remittances and payments could fuel adoption and compensate for the sell-offs.

All things considered, its ability to absorb 1% of the total crypto market cap is uncertain and fully dependent on XRP, which is proving to have real competitive advantages in this industry.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.