The first-ever leveraged XRP ETF in the United States, Teucrium’s 2x Long Daily XRP ETF (NYSE Arca: XXRP), made a strong market debut on April 8, 2025.

The fund recorded $5 million in trading volume on day one, placing it in the top 5% of all new ETF launches, according to Bloomberg Senior ETF Analyst Eric Balchunas.

XRP institutional appetite grows amid volatility

The debut comes during a period of intense volatility in crypto markets, a sign of growing institutional interest in products tied to digital assets like XRP.

The fund aims to deliver twice the daily return of XRP and uses swap agreements referencing European exchange-traded products, given the absence of a U.S.-listed spot XRP ETF.

Balchunas noted that XXRP’s opening-day volume was roughly four times higher than that of Volatility Shares’ 2x Solana ETF (SOLT), which launched in March. While XXRP’s performance still trails the $1 billion trading volume seen during the debut of BlackRock’s iShares Bitcoin Trust (IBIT), the Senior ETF Analyst deemed the performance ‘respectable’ given the current climate for digital assets.

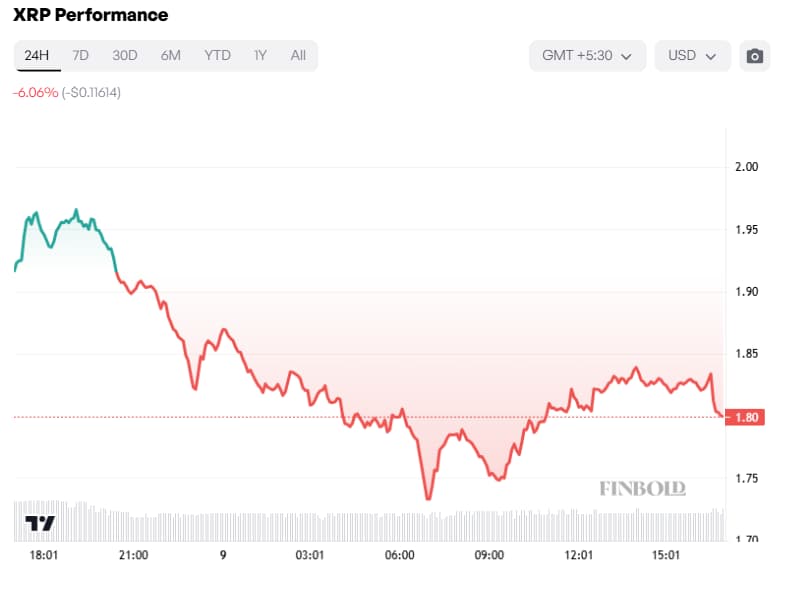

Following the ETF’s release, XRP briefly surged nearly 6%, climbing to $1.96 before retreating. Within 24 hours, the token had slipped 3.4%, trading at $1.80 at press time, as macroeconomic uncertainty continued to weigh on sentiment across the market.

Despite the pullback, the ETF’s launch has reignited conversations around XRP’s community strength. John Deaton a lawyer, who played a key role in the Ripple v. SEC case commenting on Balchunas’s post, pushed back against widespread skepticism, noting that XRP has far more appeal than many in the industry are willing to acknowledge.

He pointed to the 75,000 XRP holders who came together to petition the court during the Ripple case, an effort he described as extraordinary.

While the fund’s debut was strong, it may face early headwinds, with Teucrium warning that XRP’s high volatility and declining network usage could present challenges post-launch.

The ETF also carries a relatively high management fee of 1.85%.

Featured image via Shutterstock