XRP has slid over the past 24 hours, losing its position as the fourth-largest cryptocurrency by market capitalization after being overtaken by BNB amid a broad market sell-off.

Specifically, the token’s market cap fell from $120.3 billion to $113.6 billion, marking a $6.7 billion contraction in a single day.

The decline pushed XRP below BNB in the rankings, with BNB holding the fourth spot despite also posting losses. BNB’s market capitalization slipped from $122.58 billion to $118.35 billion over the same period, a decrease of about $4.23 billion.

However, BNB remained ahead of XRP in total valuation despite its price falling 3.5% to $859.

Why XRP price is plunging

Notably, XRP’s weakness reflected broader risk-off conditions across crypto markets rather than any token-specific trigger. Trading activity was dominated by liquidity concerns and position unwinding, with selling pressure accelerating near well-defined technical support levels.

Although spot XRP ETF inflows into crypto products have remained positive in recent weeks, short-term price action has been driven mainly by technical positioning and reduced risk appetite.

The sell-off coincided with a weaker open in U.S. equity markets, which dragged down risk assets more broadly.

With year-end liquidity thinning, relatively modest sell orders had an outsized impact, turning incremental declines into sharper moves.

Macro uncertainty also resurfaced, limiting the positive impact of the Federal Reserve’s recent 25 basis point rate cut and dampening expectations for a seasonal year-end rally.

Additional pressure emerged from renewed scrutiny of crypto activity in China, including reports of mining shutdowns in Xinjiang. While there is no clear evidence of large-scale bitcoin selling tied to these developments, the headlines added to cautious sentiment, reinforcing defensive positioning across major digital assets and leaving XRP more exposed relative to peers like BNB.

XRP price analysis

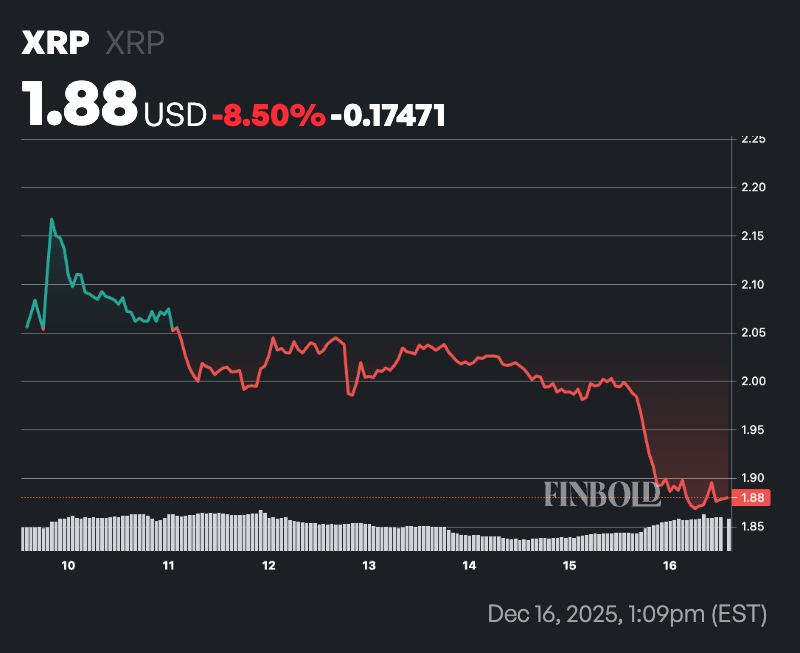

By press time, XRP was trading at $1.88, down more than 6% over the past 24 hours. On a weekly basis, the asset is down nearly 9%.

As things stand, XRP is trading well below its key moving averages (MA), reinforcing a bearish technical structure. The 50-day simple moving average sits at $2.24, while the 200-day SMA is higher at $2.58, both significantly above the current price near $1.88.

This gap indicates that recent price action has weakened relative to both the medium- and long-term trends, with sellers maintaining control and no clear sign of a trend reversal yet.

Meanwhile, the 14-day RSI stands at 35.32, placing XRP near the lower end of neutral territory and close to oversold conditions. While this suggests downside pressure has dominated recent sessions, the RSI has not yet reached levels typically associated with a strong rebound.

Featured image via Shutterstock