With XRP seemingly establishing itself solidly above the $2 support zone, the asset’s technical setup suggests a push toward a record high of $7 may be in the offing.

This outlook comes just days after the token suffered one of its most notable sell-offs of the year, briefly crashing below $2 before bulls regained control in line with broader market sentiment.

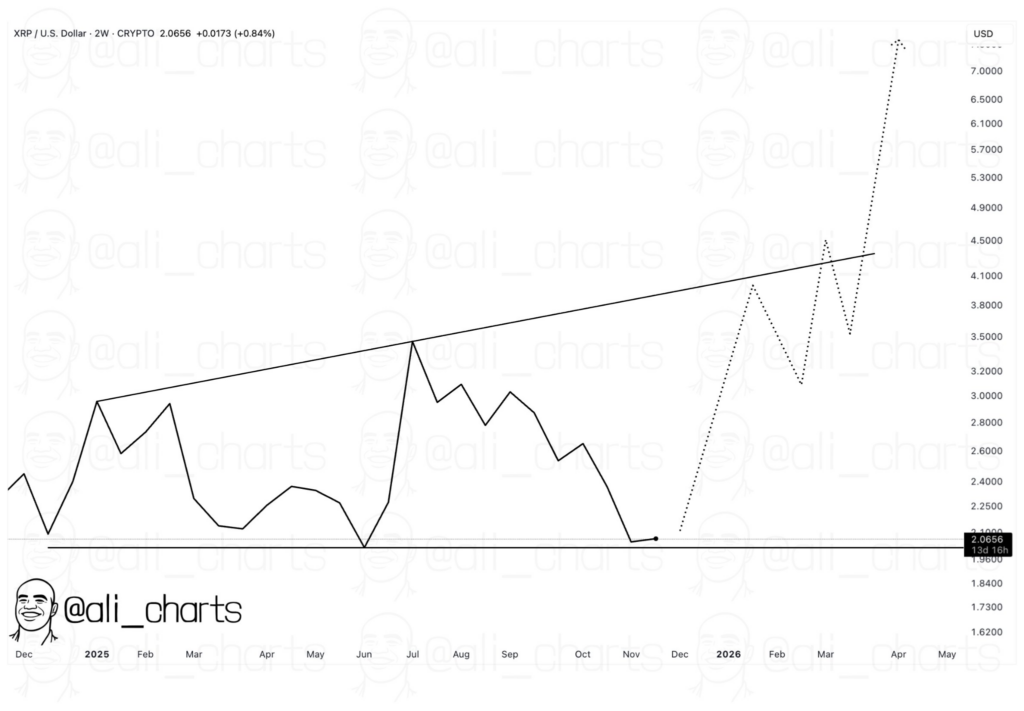

The bullish outlook toward the next record high was highlighted by analyst Ali Martinez, who noted that XRP is forming a right-angled ascending broadening wedge, a pattern that often precedes large breakout moves when the lower boundary holds.

In an X post on November 25, the analyst indicated that XRP is hovering just above the crucial $2 support zone, a level that has repeatedly served as the base of its multi-year structure.

In the projection for early 2026, XRP is expected to rebound from this area and begin a steady climb toward the upper boundary of the wedge near $4.50. This range has acted as long-term resistance and represents the first major hurdle ahead.

If XRP manages to break through that ceiling, the pattern’s full upside extension points toward a move beyond $7. Notably, the token’s current formation shows increasing volatility within a widening structure, typically signaling mounting pressure before a decisive move.

For now, the market’s focus is on the sustainability of the $2 floor. The entire bullish roadmap depends on whether XRP can defend this level and trigger the reversal implied in the pattern.

A price target of $7 would imply a market cap of roughly $440 billion, placing XRP just behind Bitcoin (BTC).

XRP’s increased buying pressure

Indeed, XRP has found renewed bullish momentum, with the asset witnessing increased buying pressure over the past 24 hours. As of press time, its market cap stood at about $135 billion, representing an inflow of $11 billion within a day.

Besides renewed broader cryptocurrency market momentum, XRP also received a boost as newly launched spot exchange-traded funds for the asset saw significant buying pressure.

Franklin Templeton’s XRPZ and Grayscale’s GXRP debuted on NYSE Arca, opening fresh regulated access for U.S. institutions.

The launches triggered a sharp rotation into the asset at a time when the broader crypto market was experiencing heavy outflows.

Franklin Templeton further intensified momentum by waiving fees on the first $5 billion of XRPZ assets until May 2026, a move that boosted early liquidity and attracted strong participation from professional trading desks.

XRP price analysis

By press time, XRP was trading at $2.23, having rallied almost 8% in the past 24 hours, and is up 3% on the weekly chart.

At the current price, XRP’s simple moving averages (SMAs) paint a clearly bearish picture: the 50-day SMA at $2.42 and the 200-day SMA at $2.65 both sit above the spot price, signaling sustained downward pressure as XRP trades well below these longer-term averages, a sign of weakness without near-term support.

The 14-day RSI of 48.97, on the other hand, reinforces this neutral-to-bearish stance, hovering near oversold territory but not yet at levels extreme enough to trigger a strong rebound, suggesting momentum remains subdued, and traders may await a catalyst for reversal.

Featured image from Shutterstock