Choosing between XRP and Stellar (XLM) as potential investments for 2025 isn’t an easy task.

Both tokens have carved out niches in cross-border payments, but their recent performance and unique characteristics could influence where they might stand in the coming year.

Finbold did a deeper dive into each token, with insights from ChatGPT-4o on which might be the better buy for 2025.

XRP performance and outlook

Currently trading at $0.5113, XRP has faced a turbulent year.

The token is down -18.01% year-to-date in 2024, with a -3.35% decline over the past month and a significant -19.40% drop over the last year.

This decline has positioned XRP as an underperformer among the top 100 crypto assets, lagging behind 86% of them. Furthermore, trading below its 200-day simple moving average (SMA) signals bearish momentum. However, with 16 green days in the last 30-day period—making up 53%—there’s evidence of some stability within the price volatility.

Despite the setbacks, XRP’s outlook holds some promise. Recent filings for spot XRP Exchange-Traded Funds (ETFs) by Bitwise and 21Shares indicate growing institutional interest, and Ripple’s CEO is optimistic, suggesting ETF approval is “inevitable.”

Should this happen, it could trigger broader adoption and renewed investor enthusiasm. With that being said, XRP’s trajectory still hinges on the resolution of its legal battle with the SEC, with regulatory clarity likely to play a major role in its potential for growth in 2025.

Stellar (XLM) performance and outlook

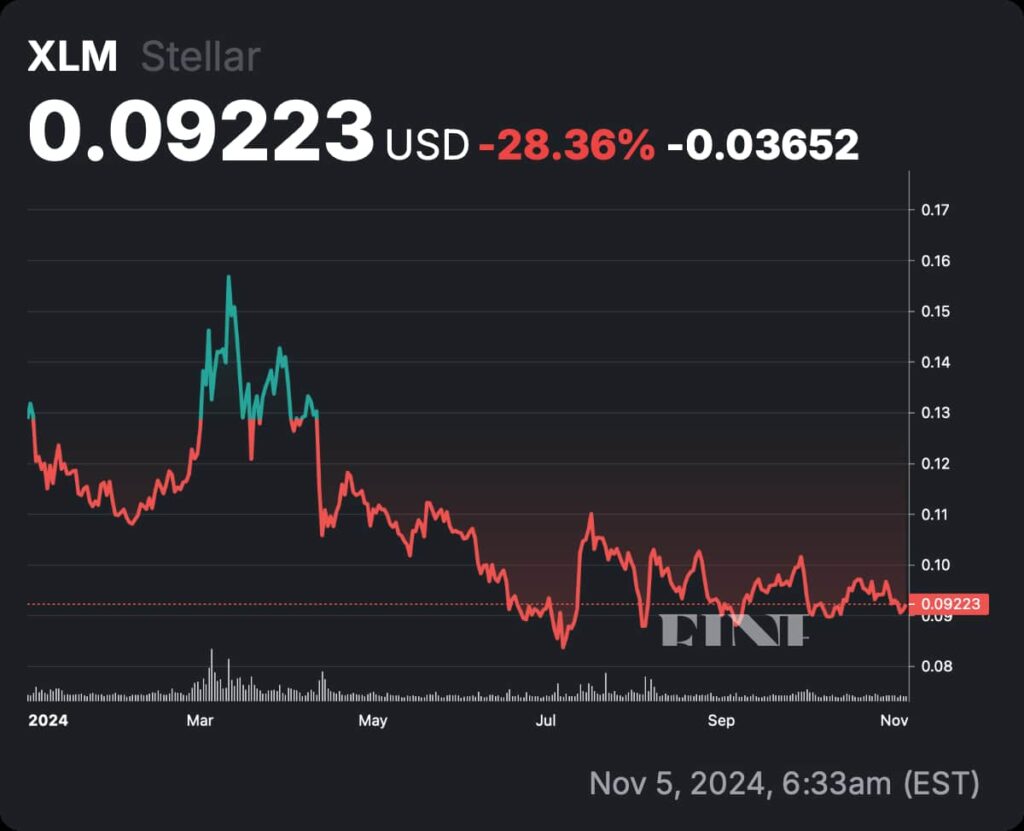

XLM, currently priced at $0.09216, shares a similar story of ups and downs. Over the past year, it’s seen a -27.59% decline, underperforming major assets like Bitcoin and Ethereum, as well as 90% of the top 100 cryptocurrencies.

Like XRP, XLM trades below its 200-day SMA, highlighting a struggle to maintain upward momentum. Additionally, with the price now about -90% below its all-time high, XLM faces significant challenges in reclaiming previous peaks.

Unlike XRP, Stellar’s value proposition centers around financial inclusion, with partnerships aimed at enhancing secure and affordable cross-border payments in emerging markets.

While XLM hasn’t seen the same ETF speculation, its steady development and established use cases provide a more predictable, if modest, growth path. This stability could appeal to investors who favor consistent progress over speculative gains.

XRP vs. XLM: Which is the better buy for 2025?

Both XRP and XLM are solid contenders in the cross-border payment space. However, XRP’s traction with institutional investors could give it an edge if regulatory clarity is achieved. ChatGPT noted:

“XRP presents a high-risk, high-reward scenario. If an ETF gains approval, XRP could experience a significant price surge, attracting a new wave of investors. However, the unresolved SEC case remains a major regulatory risk, and any unfavorable outcomes could cap XRP’s growth potential.”

On the other hand, the AI noted:

“XLM offers a lower-risk, moderate-reward profile. Its emphasis on partnerships and financial inclusion brings credibility and a steady development track, though it lacks the speculative buzz of an ETF.”

For investors with a higher risk tolerance and confidence in XRP’s regulatory outlook, the potential for an ETF and institutional adoption makes XRP an attractive, albeit speculative, option.

For those who prefer a more stable investment with steady growth potential, XLM may be the wiser choice, providing gradual progress without the volatility of high-stakes regulatory battles.