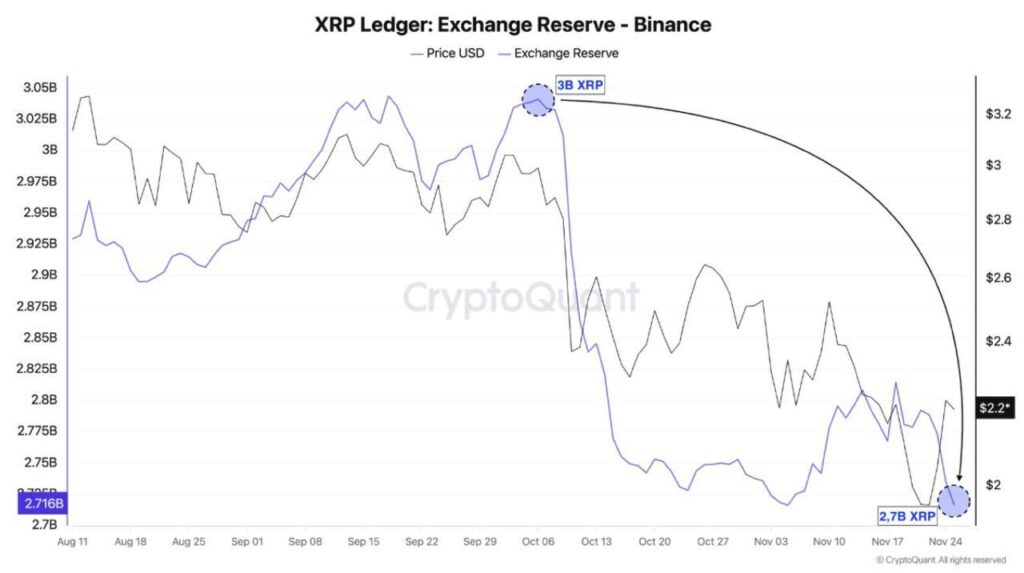

XRP reserves held on Binance have dropped sharply in recent weeks, suggesting growing pressure on liquid exchange supply at a time when the token attempts to stabilize following months of selling fatigue.

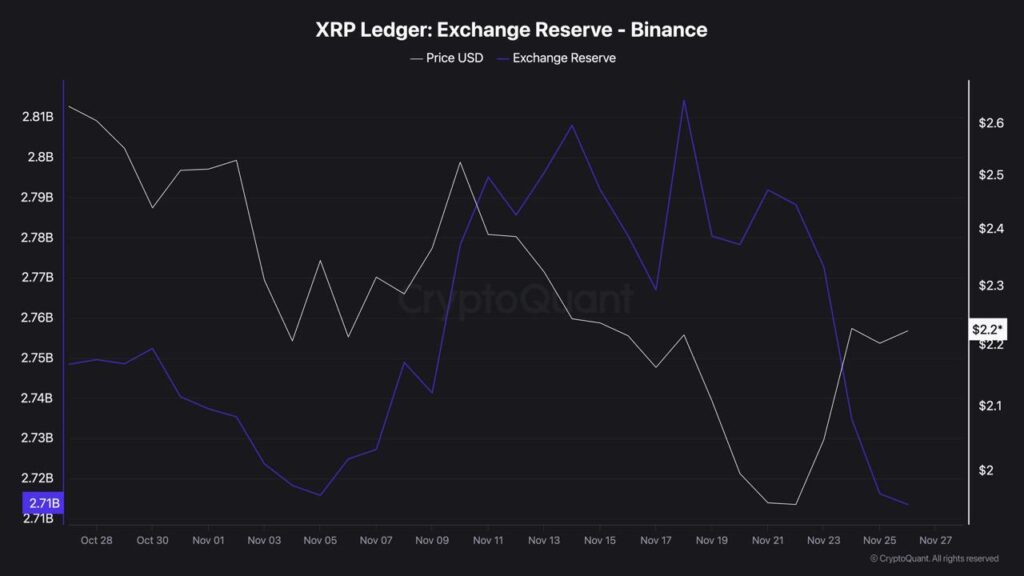

Per data retrieved by Finbold from on-chain analytics platform CryptoQuant, XRP exchange reserves fell from roughly 3 billion tokens in mid-October to just 2.71 billion as of November 27, coinciding with a continued decline in price momentum.

During the period of peak accumulation at around 3 billion XRP, the asset was trading near $3.025, whereas it currently trades at $2.17, recording a mild 1% gain in the past 24 hours. The sharp reserve contraction signals either increased withdrawals toward self-custody or strategic long-term holding behaviour at lower price levels.

XRP price divergence

While XRP price has fallen steadily since early November, exchange-held reserves have simultaneously trended lower, marking a potential inverse correlation between available liquidity and investor confidence. Typically, declining exchange reserves are considered a bullish indicator in the long term, as reduced supply can limit sell-side pressure and amplify price elasticity in the event of renewed demand.

However, the move also reflects fragility in near-term sentiment, with market participants hesitant to deploy capital until XRP breaks above key resistance levels, most notably the $2.40–$2.50 range, which capped multiple upside attempts this month.

XRP institutional interest may rise if supply contraction continues

Historically, supply reductions on major exchanges such as Binance have preceded accumulation from high-net-worth entities and custodial platforms seeking low entry points.

That said, momentum remains weak across broader altcoin markets, coinciding with elevated macro uncertainty ahead of December’s Federal Reserve meeting. XRP currently trades around its two-week moving average, reflecting sideways consolidation rather than definitive trend reversal.

Can XRP hold above $2.15 support as liquidity tightens?

With exchange reserves at their lowest point since August, market dynamics are now increasingly dependent on whether XRP can maintain support above $2.15. A breakdown below this level could trigger derisking and invalidate the supply-driven bullish thesis. Conversely, a sustained hold above current levels, coupled with continued reserve reduction, may set up XRP for a structurally stronger breakout should institutional flows begin to materialize.