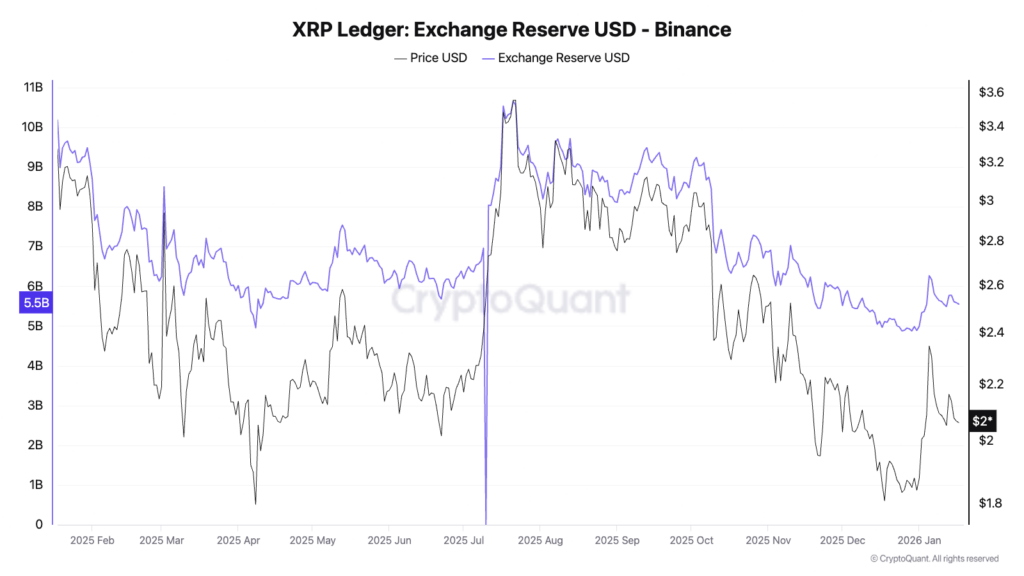

XRP reserves held on Binance have fallen sharply over the past year, pointing to a major shift in market dynamics that could set the stage for a price rebound.

Specifically, on January 18, 2025, the total value of XRP reserves on Binance stood at approximately $10.16 billion.

By January 17, 2026, that figure had dropped to about $5.55 billion, representing a decline of roughly 45% in exchange-held XRP over 12 months, according to data retrieved from CryptoQuant.

This signals a substantial reduction in readily available supply on the world’s largest crypto exchange.

Temporary rebounds were repeatedly followed by fresh outflows, indicating that users continued moving XRP off exchanges rather than redepositing it. By early 2026, reserves had fallen to near yearly lows, confirming a sustained contraction in exchange balances.

At the same time, XRP’s price action shows a volatile but revealing pattern. In this case, sharp declines in reserves often coincided with price stabilization or strong upward moves, most notably in mid-2025 when a steep drop in exchange balances aligned with a rally.

This reflects a classic crypto supply dynamic, as fewer tokens on exchanges typically reduce selling pressure.

The continued decline in Binance’s XRP reserves suggests investors are moving holdings into self-custody or long-term storage, behavior typically associated with accumulation rather than near-term selling. With less XRP available on exchanges, any pickup in demand can exert a disproportionate influence on price.

If the trend continues, reduced exchange supply could become a catalyst for a rally. Historically, sustained reserve declines have preceded bullish phases, particularly when prices remain stable or recover.

While broader market conditions still matter, the 45% drop in Binance’s XRP reserves reinforces the case for tightening supply that favors upside price movement in the months ahead.

XRP price analysis

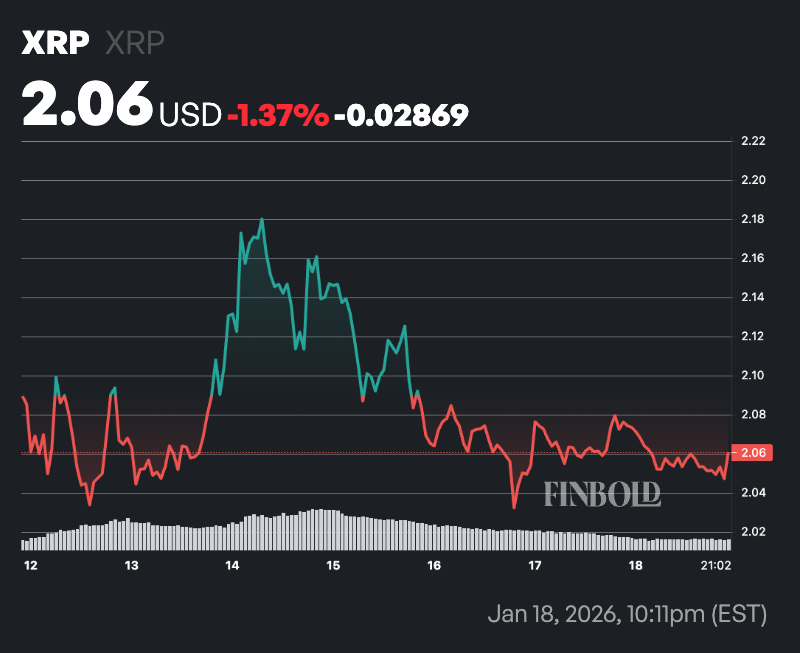

By press time, XRP was trading at $2.06, down 0.65% on the day, while the token has declined 1.3% on the weekly timeframe.

At the current level, XRP is hovering just above its 50-day simple moving average (SMA) near $2.02. This positioning suggests short-term price support is holding, with buyers defending the recent range rather than allowing a decisive breakdown.

However, the much higher 200-day SMA at roughly $2.53 highlights a broader bearish structure, indicating that XRP remains well below its longer-term trend and would need a sustained move higher to signal a meaningful trend reversal.

Momentum indicators reinforce this cautious outlook, with the 14-day RSI sitting at about 50.7, firmly in neutral territory and showing neither overbought nor oversold conditions.

Featured image via Shutterstock