Ripple has around 39.9 billion XRP, currently locked in escrows and not part of the token’s circulating supply. On February 1, Ripple unlocked 1 billion XRP, valued at $500 million, keeping 20% of the total.

Each month, Ripple unlocks another 1 billion tokens. The company often retains only a fraction of it for its treasury, frequently selling the rest on the market. Finbold has tracked these unlocks, identifying patterns that affect the asset’s long-term value.

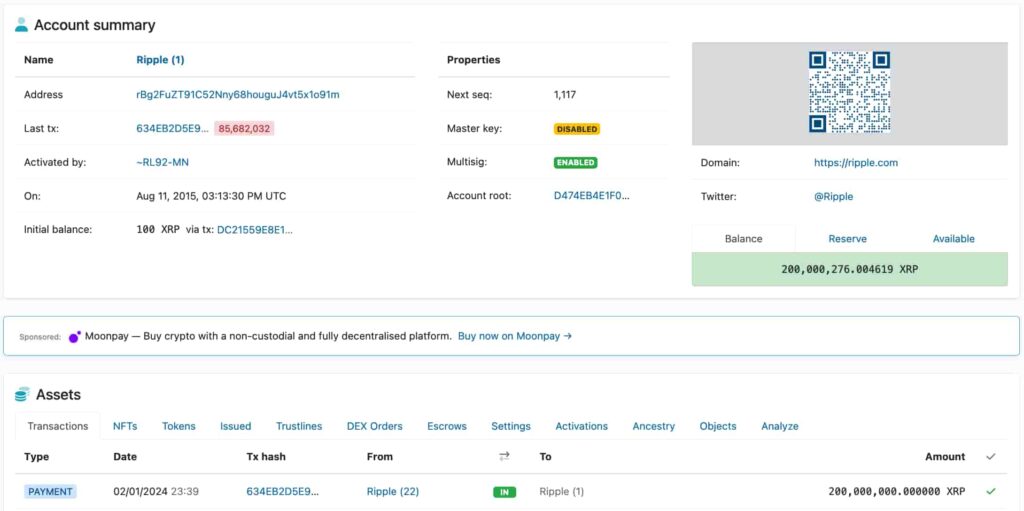

In February, Ripple held back 200 million XRP, consistent with prior months. This amount is now worth roughly $100 million, with each token priced at $0.50 by press time.

In particular, the company prepared this month’s selling activity by sending the 200 million XRP from ‘Ripple (22)’ to ‘Ripple (1)’. The institution controls both accounts, with the former being the unlocked escrow address and the latter used as its liquid treasury.

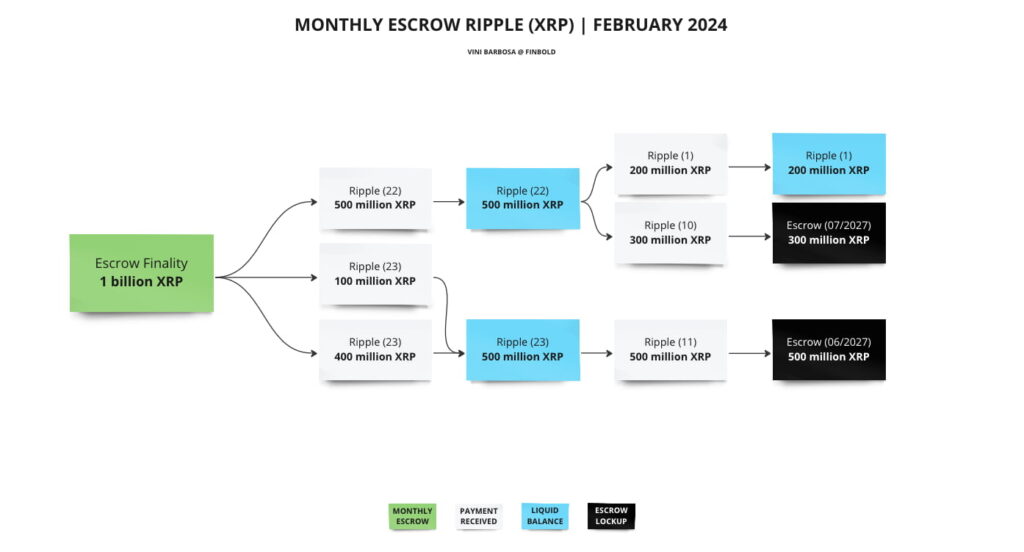

Ripple’s XRP escrow activity for February’s sell-off

Similarly to what happened in previous months, escrows have reached finality within the ‘Ripple (22)’ and ‘Ripple (23)’ accounts.

The former unlocked 500 million XRP on February 1, sent 200 million to ‘Ripple (1)’, and 300 million to ‘Ripple (10)’. Interestingly, this account is currently used to re-lock XRP in new escrows. As for this recent transaction, the 300 million will be released on July 1, 2027.

Later, ‘Ripple (23)’ sent the unlocked 500 million to ‘Ripple (11)’, also fully locked in an escrow to June 1, 2027.

Nevertheless, both ‘Ripple (22)’ and ‘Ripple (23)’ still hold 1 billion XRP tokens for escrows that will end next month – March 1, 2024. After these unlocks, the market should start looking at ‘Ripple (10)’ and ‘Ripple (11)’ in preparation for the controller’s dumps.

It is important to understand that Ripple usually liquidates their holdings in strategic moments. Essentially, the sell-offs represent a relevant weight of the token’s 24-hour trading volume, capable of influencing short-term price action.

Recently, the institution’s Co-founder and Executive Chairman, Chris Larsen, lost $112 million worth of XRP due to a hack. The token’s price reacted negatively to the expectation of a sell-off, which had a similar nominal value to this month’s reserves.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.