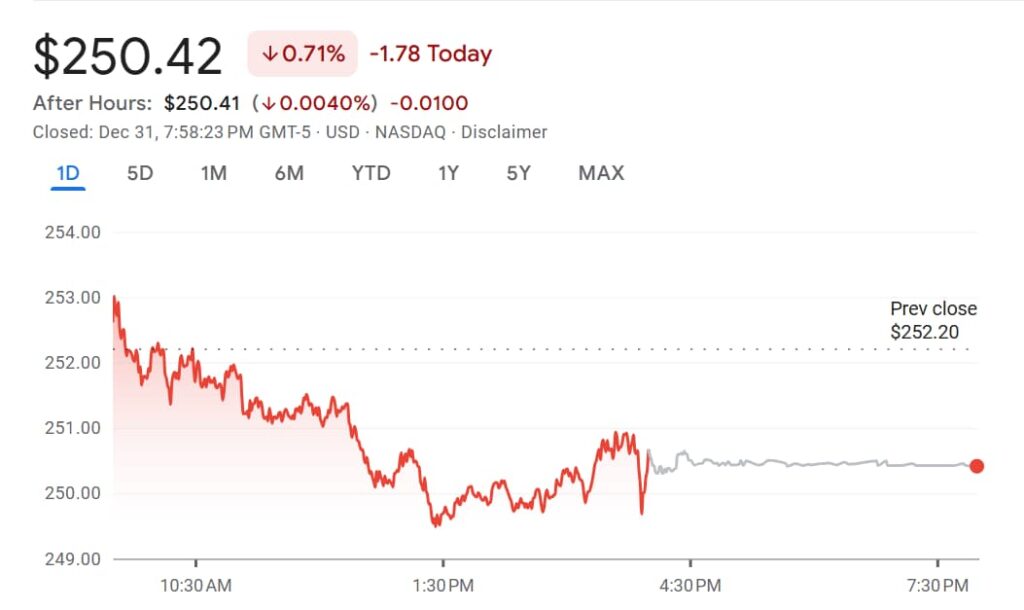

Apple Inc. (NASDAQ: AAPL) wrapped up 2024 on a strong note, with its stock continuing to trend higher despite a slight dip in the final trading session. The stock closed at $250.42 on December 31, reflecting a minor decline of $0.71 from the previous session.

However, the tech giant posted an impressive 34% annual gain, significantly outperforming the S&P 500 Index’s (SPX) 25% return during the same period.

AI-driven growth fuels investor optimism

Apple’s remarkable performance in 2024 was primarily fueled by its aggressive push into artificial intelligence (AI).

Picks for you

The launch of the iPhone 16 series in September, followed by Apple Intelligence features like ChatGPT integration and advanced visual intelligence tools, marked a significant pivot toward AI-driven user experiences.

These advancements are projected to drive a multi-year iPhone upgrade cycle, with analysts predicting sales of over 240 million iPhones in Fiscal Year 2025.

Wedbush Securities analyst Dan Ives labeled this a “golden era of growth” for Apple, raising his 12-month price target for the company’s stock from $300 to $325 — the highest on Wall Street.

Ives anticipates that Apple’s AI strategy and pent-up demand for device upgrades will propel the company’s market capitalization to $4 trillion by 2025, with a potential path to $5 trillion as AI adoption accelerates.

How much would $1,000 invested in AAPL be worth now?

If an investor had allocated $1,000 to purchase AAPL stock on January 2, 2024, when the stock price was $185.64, they would have acquired approximately 5.39 shares (assuming fractional shares were allowed).

By December 31, 2024, with Apple’s stock closing at $250.42, those 5.39 shares would have grown to approximately $1,349, reflecting the stock’s impressive 34% annual gain.

Looking ahead, Apple is poised to enhance its AI capabilities with new features and expanded language support in Apple Intelligence, aiming to boost user engagement, drive device upgrades, and further strengthen its growing services segment.

However, rising production costs, inflation, and broader macroeconomic uncertainties could pose challenges, especially with much of the optimism already priced into its stock. Apple’s strong 2024 performance sets a high bar, making 2025 crucial in solidifying its leadership in the AI-driven era.

Featured image via Shutterstock