In a string of major banks offering exposure to Bitcoin (BTC) through its spot exchange-traded funds (ETFs), one of the latest to hop on the Bitcoin bandwagon is Goldman Sachs (NYSE: GS), which has just unveiled it holds millions in spot Bitcoin ETFs.

Specifically, Goldman Sachs reported in its new quarterly filing with the United States Securities and Exchange Commission (SEC) that it was holding more than $400 million in spot Bitcoin ETFs, according to the 13F document for the quarter ending June 30, released on August 13.

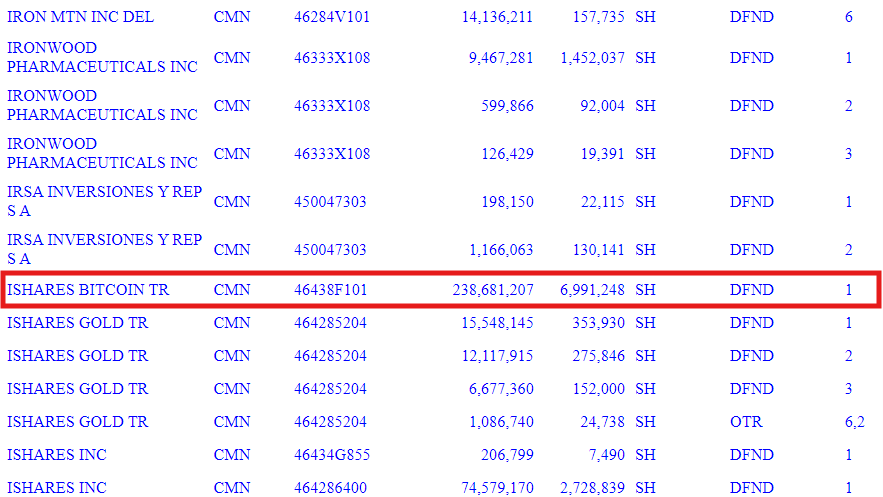

Among others, the major bank has filed new holdings in BlackRock (NYSE: BLK) iShares Bitcoin Trust, valued at $238.6 million, or nearly 7 million shares, with additional positions in Fidelity Bitcoin ETF at $79.5 million, Grayscale Bitcoin Trust at $35.1 million, and Invesco Galaxy Bitcoin ETF at $56.1 million.

Picks for you

Meanwhile, in terms of other smaller yet still notable Goldman Sachs’ positions in Bitcoin ETFs, they include Bitwise Bitcoin ETF at $8.3 million, ARK 21Shares Bitcoin ETF at $299,900, and WisdomTree Bitcoin ETF at $749,469, according to the financial services giant’s SEC filing.

Others hop on Bitcoin train

Notably, the move arrives as other major names in the banking sector revealed their own pushes toward spot Bitcoin ETFs, including Morgan Stanley (NYSE: MS) and Wells Fargo (NYSE: WFC) earlier, and hedge funds are not staying on the sidelines either, as evident in the example of Europe’s Capula.

As a reminder, the first spot Bitcoin ETF arrived earlier this year, when the SEC approved 11 Bitcoin spot ETFs in the U.S. on January 10, with the top launches appearing in the form of iShares Bitcoin ETF, Fidelity Bitcoin ETF, ARK 21Shares Bitcoin ETF, and Bitwise Bitcoin ETF.

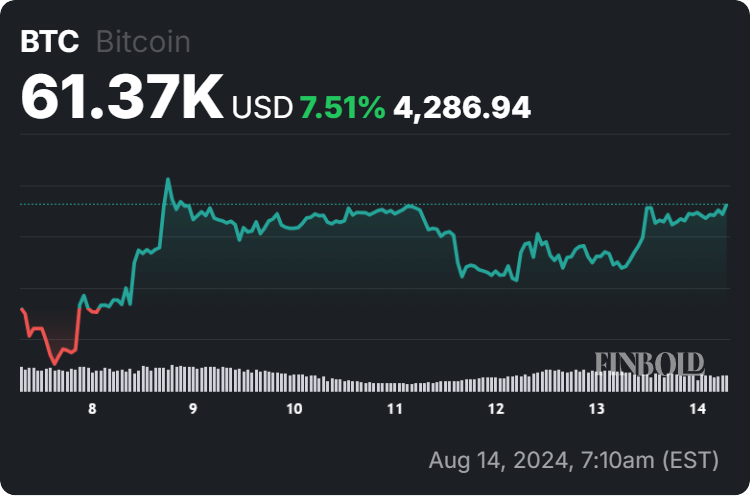

At press time, the flagship decentralized finance (DeFi) asset was changing hands at the price of $61,370, indicating a 3.70% increase on the day and gaining 7.51% across the past week, as it moves to reverse the 2.27% loss accumulated on its monthly chart, as per data on August 14.

All things considered, the approval of spot Bitcoin ETFs and Goldman Sachs’ heavy Bitcoin exposure demonstrates growing institutional interest in the maiden cryptocurrency and the largest asset in the crypto sector by market capitalization, as well as the crypto industry as a whole.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.