The insurance sector is reeling as related stocks plummeted following the negative impact of the devastating wildfires in Los Angeles.

Notably, insurers with significant exposure to California homeowners are bracing for one of the largest claims events in history, with analysts estimating losses from the inferno could range between $10 billion and $20 billion, further pressuring the sector.

Despite the stock sell-off, this downturn presents a potential opportunity for investors. Market turbulence has created the chance to acquire shares of fundamentally strong insurance companies at discounted prices.

Below are two insurance stocks seemingly offering value amid the ongoing crisis.

Chubb Limited (NYSE: CB)

Chubb Limited (NYSE: CB), an insurance company focusing on high-net-worth individuals, has taken a hit due to its significant exposure to the Los Angeles market, an estimate backed by banking giant JPMorgan (NYSE: JPM).

Amid the sell-off from the fires, Chubb remains well-positioned to see future gains, thanks to its diversified portfolio that extends beyond the U.S., mitigating some of the regional risks.

Specifically, the Zurich-headquartered firm operates in 54 countries, offering commercial and personal property and casualty insurance for entities of all sizes.

Chubb has also been actively expanding, as evidenced by two notable acquisitions during the second quarter of 2024: Healthy Paws, a U.S.-based pet insurance company, and Catalyst Aviation Insurance, a Melbourne-based managing general agent specializing in general aviation insurance.

Chubb’s strong balance sheet and track record of consistent dividend payouts make it attractive for investors seeking growth and income.

For the long term, a JPMorgan analyst raised Chubb’s stock price target to $296 from $294 on January 3, maintaining a ‘Neutral’ rating. The Wall Street firm expressed optimism about Chubb’s property and casualty sector for 2025.

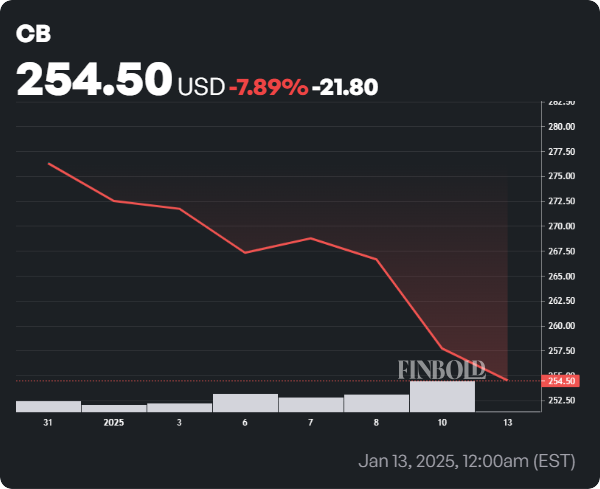

At the close of the most recent trading session, CB was valued at $254.50, ending the day down 3.35%. Year-to-date, the stock has declined over 7%.

Travelers Companies (NYSE: TRV)

Travelers Companies (NYSE: TRV) has also faced a downward spiral triggered by the unfolding disaster in California.

Although the payment from claims related to the Los Angeles fires could potentially eat into its cash reserves, TRV has the potential for a rebound, given the diverse product offerings, which include personal, commercial, and specialty insurance markets.

The rebound can also be backed by the firm’s strong brand reputation and a history of navigating challenging times.

Before the California disaster struck, Travelers was projected to achieve cash flow growth of 7.3% in 2025. This comes on the back of stronger financials reported in its most recent Q3 2024 results.

During the period, Travelers’ underwriting margins improved year-over-year, driving a record underlying underwriting income of $1.5 billion.

Overall, the insurer has growth potential, bolstered by its effective risk management strategies and diversified portfolio, which position it to absorb the shock from the fires without sustaining long-term damage to its financial health.

TRV ended the January 10 trading session valued at $228.48, down over 4%. Year-to-date, the stock has declined 4%.

Chubb and Travelers may face continued stock pressure as the Los Angeles wildfires remain uncontained. However, both are likely to rebound once the crisis settles, especially if federal aid supports recovery efforts while presenting long-term investors an opportunity in the current volatility.

Featured image via Shutterstock