As the cryptocurrency market moves deeper into 2026, volatility has increased across digital assets. This environment has brought renewed focus to tokens that offer the potential for significant long-term returns.

While the largest cryptocurrencies already command massive valuations, investor attention is shifting elsewhere.

In this line, established but still expanding networks are drawing interest, particularly those seeing accelerating adoption, growing institutional involvement, and strengthening structural demand.

Together, these factors could position such assets for outsized gains in the next market cycle.

Solana (SOL)

Solana (SOL) has become one of the most active blockchain ecosystems, with network usage surging and transaction volumes hitting multi-month highs, signaling rising demand from both users and developers.

This momentum is reinforced by the rapid growth of real-world asset tokenization on the network, with tokenized assets surpassing $1 billion in value, bringing traditional finance use cases on-chain and grounding activity in real economic demand.

Institutional involvement is further strengthening Solana’s outlook, as major asset managers and crypto firms roll out Solana-linked funds, lifting assets tied to the network beyond $1 billion.

Alongside improving infrastructure and expanding cross-chain interoperability, these trends are positioning Solana as an emerging core settlement layer rather than a high-beta altcoin, with substantial upside potential still ahead.

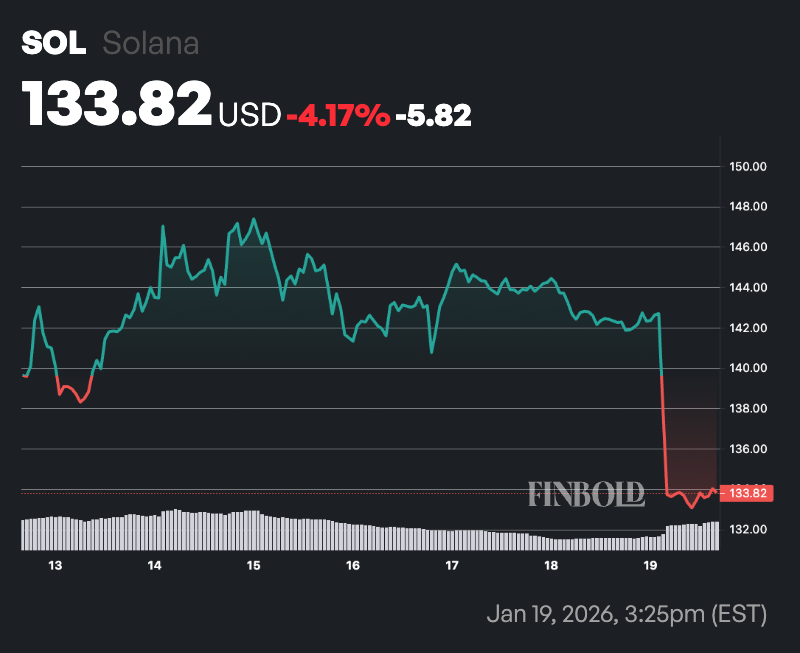

By press time, SOL was trading at $133, having plunged nearly 6% over the past 24 hours. On a weekly basis, the asset was down about 4%.

Chainlink (LINK)

Chainlink (LINK) is increasingly viewed as a long-term growth asset due to its critical role in the blockchain ecosystem. In price terms, LINK was down more than 7% over the past 24 hours, trading at $12 as of press time.

As the leading decentralized oracle network, Chainlink supplies secure real-world data to smart contracts, underpinning much of decentralized finance and becoming essential for real-world asset tokenization.

With more institutions exploring blockchain-based financial products, demand for reliable and tamper-resistant data feeds continues to rise, reinforcing Chainlink’s core relevance.

On-chain trends suggest this growing importance is translating into market positioning. Activity among large holders has increased, a pattern that has historically preceded stronger price performance, while tightening supply dynamics could amplify future moves if demand accelerates.

At the same time, institutional adoption of Chainlink’s infrastructure for compliance, settlement, and cross-chain connectivity is expanding, cementing its role as a key bridge between traditional finance and blockchain networks.

Featured image via Shutterstock