Warren Buffett’s investment philosophy has turned Berkshire Hathaway (NYSE: BRK.A, BRK.B) from a struggling textile business into a $1 trillion conglomerate built on a foundation of value investing.

His portfolio is filled with what many consider ‘forever’ stocks—companies with strong fundamentals, attractive valuations, competitive advantages, and the ability to withstand market downturns while delivering steady long-term returns.

With Berkshire’s track record of outperforming the broader market, following Buffett’s picks can offer investors a strong foundation.

Among his holdings, two stocks—Sirius XM (NASDAQ: SIRI) and VeriSign (NASDAQ: VRSN)—stand out as no-brainer buys, backed by solid fundamentals and steady growth prospects.

Sirius XM (NASDAQ: SIRI) stock

Sirius XM has taken a sharp hit over the past year, with shares down more than 48% to trade at $25.95 at press time. Yet, the satellite radio giant remains a major holding for Warren Buffett’s Berkshire Hathaway.

Buffett has steadily increased his stake, now owning 35% of the company’s outstanding shares, valued at $3.1 billion, according to data retrieved from StockCircle.

SEC filings reveal that Berkshire added another 2.3 million shares between January 30 and February 3, pouring an additional $54 million into the stock.

The stock is deeply undervalued, with a forward price-to-earnings (P/E) ratio of 8.5, a free cash flow (FCF) yield of 11%, and a 2.3% dividend yield, according to Stock Analysis. Its status as the only licensed satellite radio operator in the U.S. further strengthens its long-term investment appeal.

The company exceeded Wall Street expectations in Q4 2024, reporting $2.19 billion in revenue and $8.7 billion for the full year, fueled by subscriber growth and key partnerships with EV makers Tesla (NASDAQ: TSLA) and Rivian (NASDAQ: RIVN).

The adoption of its 360L technology and streaming-only platform has also expanded its market reach, and it is now integrated into more than 2 million vehicles on the road.

Looking ahead, Sirius XM is focused on streamlining operations, targeting $200 million in annualized savings by the end of 2025.

While economic headwinds, including rising tariffs and inflation, pose risks to new car sales, the return-to-office trend could boost commuting hours, strengthening retention and ad revenue.

VeriSign (NASDAQ: VRSN) stock

Currently trading at $222.24, with a 7% year-to-date gain, VeriSign remains a key holding of Berkshire Hathaway.

First invested during Q4 2012 at an average price of $41.62, Berkshire steadily increased its stake through mid-2014, including a 1.13 million-share addition in Q2 2014.

After a slight trim in early 2020, Berkshire remained inactive until December 20, 2024, when it purchased 145,000 additional shares at an average price of $198.82, bringing its total stake to $2.95 billion at the press time.

As a prominent name in domain registry services, VeriSign manages the .com and .net domains under long-term contracts extending through 2030 and 2029, respectively, ensuring uninterrupted operations and a stable revenue stream.

Despite facing its first earnings decline since Q2 2021, VeriSign’s Q4 2024 revenue rose 3.9% to $395 million. The company processed 9.5 million new domain registrations, up from 9 million a year ago, though total domain registrations declined 2% to 169 million.

Buffett’s continued confidence in VeriSign likely stems from its predictable revenue stream and strong cash flow generation—key traits of his value-investing philosophy. With minimal competition and long-term contracts in place, the company enjoys pricing power and stable profitability, making it a compelling pick for investors seeking stability.

That being said, for investors looking to mirror Buffett’s time-tested strategy, these stocks offer a compelling mix of fundamentals and growth potential, making them no-brainer buys for a well-diversified portfolio.

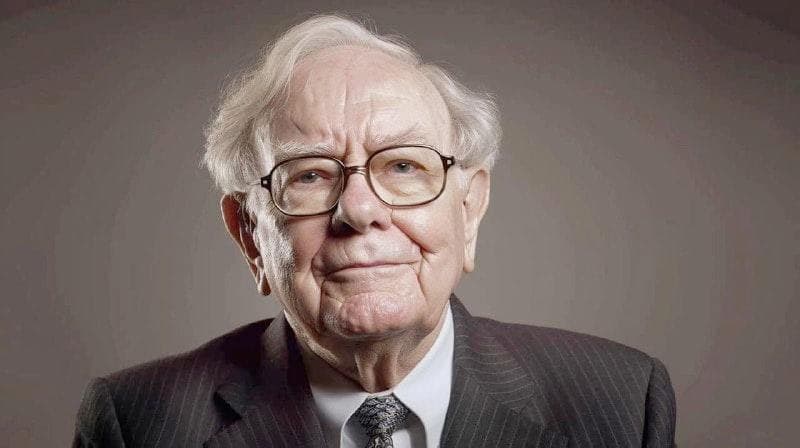

Featured image via Shutterstock