In May, the stock market has traded mainly in the green zone, with technology equities taking center stage once again. While big names are making headlines, other smaller stocks also have the potential to rally, driven by critical fundamentals that are likely to attract investor interest.

Finbold has identified two equities that are likely to see an uptick in capital inflow and potentially hit the $200 billion mark in market capitalization by the end of June 2024.

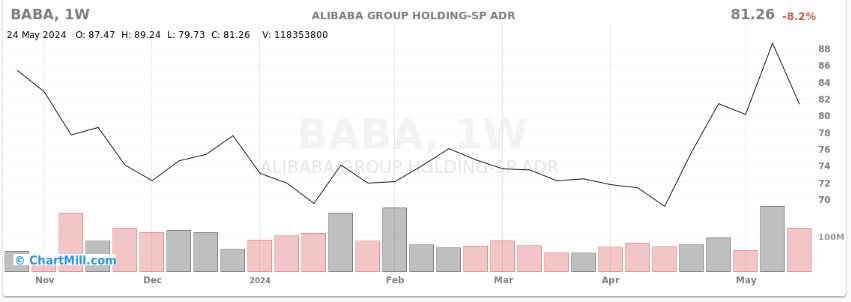

Alibaba

Alibaba (NYSE: BABA), the Chinese e-commerce titan, has demonstrated resilience and growth potential. Despite recent regulatory challenges in China and market volatility, the company’s core businesses in e-commerce and cloud computing have continued to experience growth and expansion.

Overall, Alibaba has been affected by negative sentiment toward Chinese stocks, with the country’s economic indicators suggesting further softening in recent months. Despite the stock taking a hit due to China’s slowdown, Alibaba remains on course to hit the $200 billion market cap.

With regulatory pressures easing and consumer confidence gradually recovering post-pandemic, Alibaba’s stock is seeing a resurgence in 2024. Notably, during a difficult period in 2023, Alibaba’s performance was bleak, with shares briefly falling below the Initial Price Offering (IPO) price.

The stock has been partly boosted by improving financial performance. For instance, Alibaba’s revenue grew by 6.6% in the most recent quarterly earnings. However, its net income fell short of analyst estimates, sliding by 4%.

Recently, Alibaba’s stock has grown, with investors expressing confidence in the company’s long-term outlook. This confidence stems from the strategic investments in various businesses aimed at boosting revenue.

At press time, the stock was valued at $81.26, having gained 0.57% in 24 hours. In 2024, the stock recorded gains of almost 9%, exhibiting resilience.

To reach the $200 billion market cap, Alibaba’s stock will need an upside of about 1.7%, considering its value was $196.50 billion at press time.

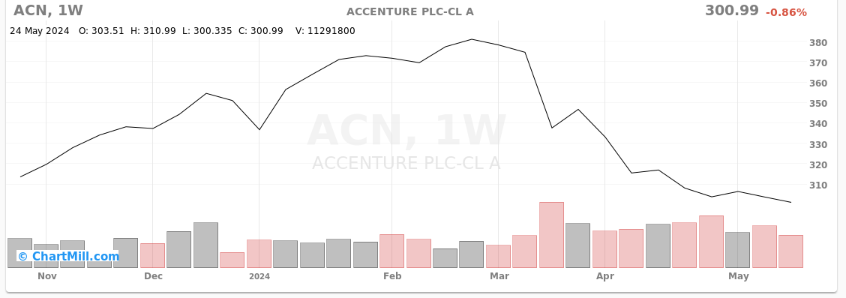

Accenture

Accenture (NYSE: ACN), a global leader in consulting and professional services, has been riding the wave of digital transformation, positioning itself as a key player in helping enterprises navigate the complexities of the digital landscape.

Notably, the stock has underperformed compared to its competitors in recent months. However, it remains well-positioned to reach a $200 billion market capitalization, receiving endorsements from various market players.

For instance, research analysts at Guggenheim recently gave the stock a “buy” rating, noting its potential to hit $395, representing an upside of almost 30% from its current valuation.

The company’s strong financial performance supports the possibility of increased buying pressure. Specifically, Accenture’s quarterly earnings results, released in March, showed the company recording $2.77 earnings per share, beating the consensus estimate of $2.66.

The business reported revenue of $15.80 billion for the quarter, compared to analyst estimates of $15.85 billion. Additionally, analysts forecast Accenture will post $12.09 earnings per share for the current fiscal year.

Furthermore, the company continues to expand its product offering through acquisitions. For instance, Accenture announced the acquisition of Partners in Performance, a consulting firm specializing in business performance improvement in asset-intensive industries by leveraging data and AI capabilities.

As of press time, ACN was trading at $300.99, having dropped 13% in 2024. The company aims to reclaim its March yearly high of $386.

Currently, ACN’s market cap is $189.2 billion, reflecting an upside of about 5.6% to reach $200 billion.

While both highlighted stocks showcase strong fundamentals that could help them hit the $200 billion market cap, the outcome will heavily rely on the general market trajectory. Factors such as Federal Reserve monetary policy currently influence the market movement.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.