President Donald Trump’s controversial trade tariffs officially took effect today, March 4, 2025, sending panic through the stock market as investors reacted negatively.

The tariffs, aimed at tackling immigration, drug trafficking, and trade imbalances, have introduced extreme uncertainty, as highlighted by the massive capital outflow in major indices.

Notably, the new policy measures include a 25% tariff on all Mexican goods, 25% on Canadian goods (excluding energy), 20% on many Chinese imports, 10% on Canadian energy, and Canada’s retaliatory 25% tariff on up to $155 billion worth of U.S. exports.

The market response was swift when Trump confirmed the tariffs on March 3. For instance, after opening 300 points higher, the Dow Jones Industrial Average plunged as much as 1,100 points, marking a 1,400-point reversal.

By 3:30 PM ET, the S&P 500 had erased $1.5 trillion in market capitalization, as Trump stressed that there would be no last-minute negotiations or delays.

Amid this sell-off, the following two stocks remain fundamentally strong and could thrive in this new tariff-driven environment.

Walmart (NYSE: WMT)

Walmart (NYSE: WMT) is an ideal defensive stock, having built a resilient business model over the years. WMT has potential for growth, despite showing weakness during the initial announcement of the tariffs.

The ability lies in the fact that consumers tend to prioritize value in phases of economic uncertainty, which benefits discount retailers like Walmart.

While tariffs could drive up the cost of imported goods, Walmart’s sophisticated supply chain and strong pricing power help mitigate these impacts. The company can adjust sourcing or pass costs to consumers without significantly losing market share.

Beyond its strong market positioning, Walmart also boasts solid financials. Revenue reached $180.55 billion in the fourth quarter, marking a 4% year-over-year increase.

Meanwhile, the retail giant continues to expand its market share, fueled by its growing e-commerce presence. Online sales now account for 18% of total revenue, with global e-commerce surging 16% last quarter.

Adding to its appeal, Walmart has a strong track record of dividend payments. The company recently announced a 13% dividend hike to $3.76 per share, marking 52 consecutive years of increases.

As of press time, WMT was trading at $97.59, down 1% in the last session but up more than 8% year to date.

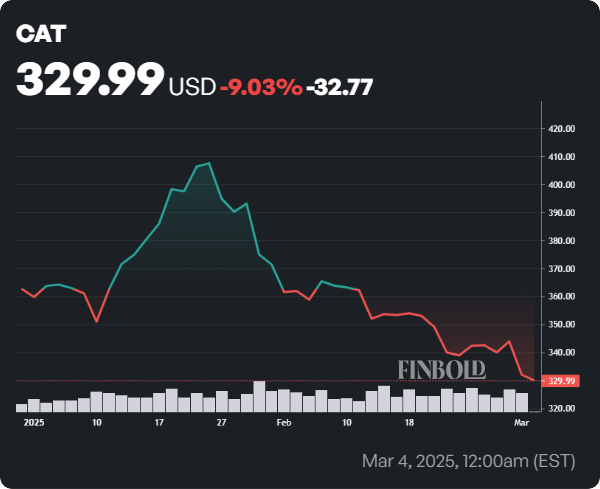

Caterpillar (NYSE: CAT)

Caterpillar (NYSE: CAT) plays a key role in the industrial equipment sector and could be an ideal pick in an environment dominated by tariffs.

It’s worth acknowledging that tariffs might hurt its international sales, and historically, industrial stocks often underperform during trade wars.

However, there is room for CAT to grow if Trump’s policies push infrastructure spending or domestic manufacturing. In that case, Caterpillar could benefit from increased U.S. demand.

Although the stock might take a hit in the current conditions, it can be viewed as a buying opportunity if the equity rebounds.

At the same time, Caterpillar’s potential lies in its ability to adopt new technologies and innovate with elements such as artificial intelligence (AI), autonomous technology, and electrified powertrains in its machinery.

These advancements and its global presence can help the company offset any slowdown caused by the trade tariffs.

The highlighted fundamentals are key, considering the company has faced some headwinds in its financial performance. Specifically, during the fourth quarter, Caterpillar reported revenue of $16.2 billion, down 5% year-over-year and below analyst expectations. However, earnings per share hit a record high of $5.78.

At the time of reporting, CAT stock was priced at $332.04, down 3.4%. Year to date, the equity is also in the red, down over 7%.

Generally, the impact of tariffs varies across sectors, and while the highlighted equities are not guaranteed to rally, they have a strong chance of showing resilience.

Featured image via Shutterstock