For years, the technology sector has been a cornerstone of substantial returns, consistently outperforming other industries through sustained growth and innovation.

The emergence of artificial intelligence (AI) has further accelerated this momentum, reshaping market dynamics and elevating companies at the forefront of this revolution to unprecedented levels.

Among these companies, Meta Platforms (NASDAQ: META) and Amazon (NASDAQ: AMZN) stand out by effectively harnessing AI, digital advertising, and e-commerce to strengthen their positions in an increasingly digital global economy.

Supported by robust financial performance and robust strategies, these tech giants present compelling opportunities for long-term investors aiming to benefit from the next wave of tech innovation.

Meta Platforms (NASDAQ: META) stock

Meta Platforms presents a compelling case as a strong buy for investors looking to capitalize on both immediate growth opportunities and long-term potential in the tech and AI sectors.

With its robust social media ecosystem, boasting over 3.2 billion daily active users across Facebook, Instagram, and WhatsApp, Meta has maintained its dominance in digital advertising, as evidenced by an 18.5% increase to $39.8 billion in Q3 ad revenue.

The company’s AI initiatives, including the Llama models and GenAI tools, are driving higher user engagement and ad conversions, while its Reality Labs division positions Meta as a leader in VR and the metaverse, reporting a 28.5% increase in revenue.

Currently trading at $554.08, Meta has experienced a 4% decline over the past month but boasts an impressive 60% year-to-date gain.

Despite facing short-term margin pressures and regulatory scrutiny, Meta’s robust financial position, with $15.5 billion in free cash flow and $70.9 billion in cash reserves, positions it to weather challenges effectively.

Trading at 22 times forward earnings for 2025, the stock offers an attractive valuation in a high-growth industry.

While uncertainties remain around regulatory and political shifts, including the implications of Trump’s potential return to office, Meta’s adaptability and leadership in AI, digital advertising, and social media solidify its position as a compelling long-term investment for growth-oriented portfolios.

Amazon (NASDAQ: AMZN) stock

Amazon stands out as a strategic investment for those aiming to tap into immediate advancements and sustained growth across the AI, e-commerce, and digital advertising landscapes.

Through Amazon Web Services (AWS), the company has developed proprietary AI chips like Trainium and Inferentia, which have significantly reduced AI training costs by up to 50%.

Meanwhile, AWS’s Bedrock platform enhances accessibility, providing businesses with affordable access to advanced large language models, including Claude 3.5 and Llama 3.2.

By offering cost-effective AI infrastructure, Amazon positions itself as a challenger to Nvidia’s (NASDAQ: NVDA) dominance in the AI hardware market while reinforcing AWS’s leadership in AI service.

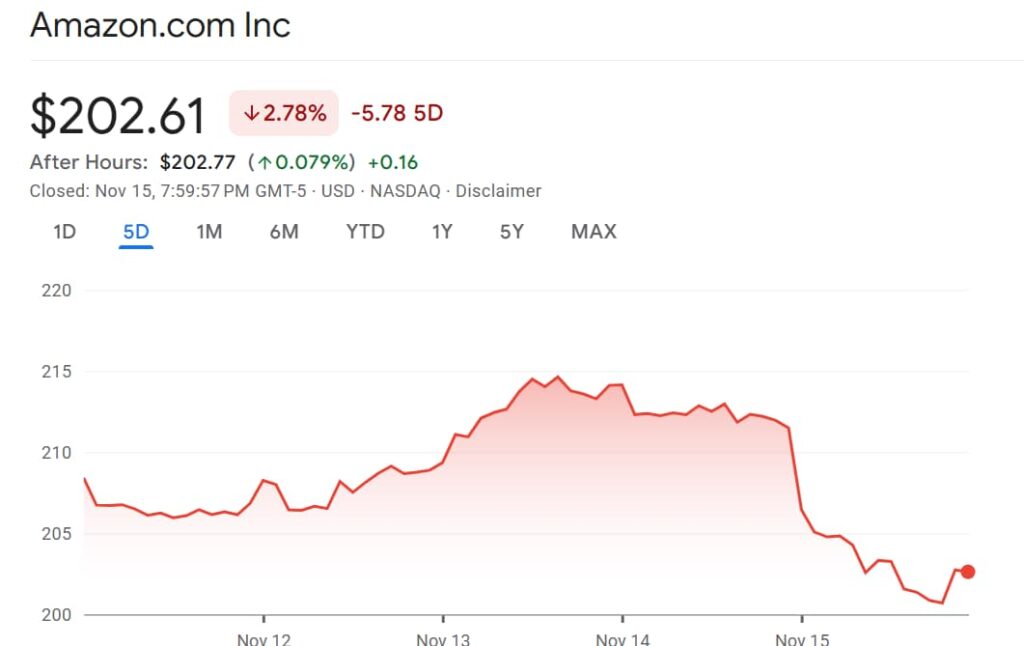

Currently trading at $202, Amazon has posted an impressive one-month gain of 8% and a year-to-date rise of 35%, reflecting its ability to deliver consistent growth.

Beyond AI, its e-commerce segment is evolving with initiatives like the low-cost storefront “Haul,” designed to compete with platforms like Temu by offering products under $20.

Furthermore, its advertising business, which generated $14.3 billion in Q3 2024, is leveraging AI to attract advertisers to platforms like Prime Video and Twitch, unlocking a high-margin growth channel.

This multi-faceted approach makes Amazon a strong buy-and-hold for long-term investors, offering diversified and sustained revenue growth potential.

As the digital economy continues to expand, these companies remain at the forefront, offering investors a promising pathway to long-term returns.

Featured image via Shutterstock