A strong risk management framework is essential for anyone looking to succeed in cryptocurrency trading. This approach safeguards investments amid the highly volatile and rapidly evolving crypto market conditions.

In this context, traders can use different risk management strategies, with one key method being the avoidance of overextended cryptocurrencies. This strategy is particularly effective in protecting traders from sudden trend shifts that could lead to significant losses.

Within the arsenal of tools for managing risk, the Relative Strength Index (RSI) stands out. Cryptocurrency traders frequently use the RSI to detect when an asset is overbought. This might indicate a pending downward trend. On the other hand, oversold tokens could precede a sudden price surge in a downward-trending market.

Picks for you

In particular, Finbold spotted three cryptocurrencies to avoid trading next week, considering CoinGlass’s RSI heatmap on January 13. Ethereum Name Service (ENS), Sui Network (SUI), and ConstitutionDAO (PEOPLE) are showing overbought signals and, thus, extra risks.

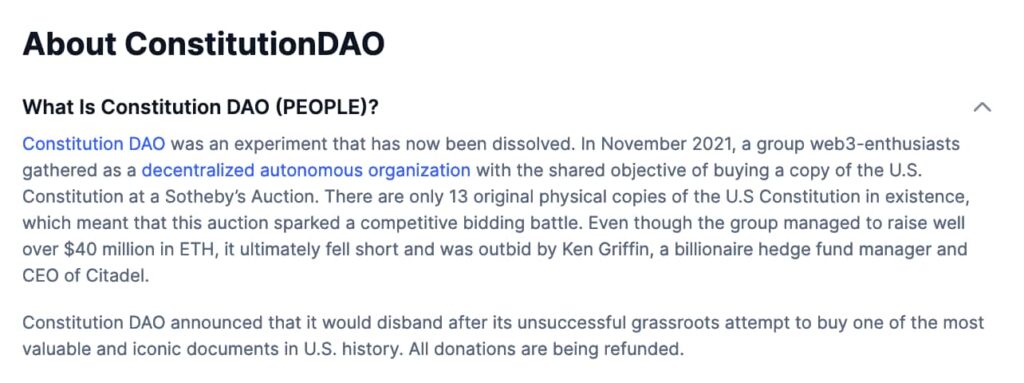

ConstitutionDAO (PEOPLE) is a dissolved experiment

According to CoinMarketCap, ConstitutionDAO is a dissolved experiment due to “its unsuccessful grassroots.” Still, speculators have continued trading its token, PEOPLE, with surprisingly positive short-term results.

Moreover, PEOPLE shows a strong momentum, slightly overbought, in its 24-hour 70.17 RSI. The ConstitutionDAO’s token is trading at $0.0399 by press time, down 4% in the day but with an 85.17 weekly Relative Strength Index. Investors should avoid trading PEOPLE due to a lack of organic value.

Ethereum Name Service (ENS) is currently overbought

In the meantime, ENS should probably be avoided for now despite the Ethereum Name Service having meaningful demand. This is based on overbought RSIs of 77 and nearly 89 points in the daily and weekly charts, respectively. Currently, ENS trades at $22.99 per token, down 8.8% in the last 24 hours.

Avoid trading Sui Network (SUI) next week

Similarly, SUI signals overbought with 75.48 and 84.35 RSI points in the daily and weekly time frames, respectively. The Sui Network has earned Web3 investors’ attention with its high scalability layer-1 solution and an asset-oriented model similar to Radix (XRD) and MultiverX (EGLD).

As opposed to the others, SUI had a recent pump and is now up 5.35% in the last 24 hours, trading at $1.27 by press time.

Despite overbought signals, cryptocurrencies can still experience price surges, defying expectations of poor future performance.

In closing, investors aiming for conservative risk management should avoid trading the highlighted overbought cryptocurrencies to limit exposure. It’s crucial for traders to conduct thorough research and comprehend the potential impacts on their trading activities.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.