As many economists continue to warn about the strong possibility of a recession in 2024, a $3 trillion asset manager, Bank of America (NYSE: BAC), has joined the warnings, suggesting that recession could arrive in the next three months and listing the indicators that support its views.

Specifically, as one of the most critical indicators, Bank of America (BofA) has singled out the Personal Savings Rate, which traditionally fell below 5% before an economic recession, including from April 1999 – May 2001, just before the Dot-com bubble, and from January 2005 – December 2007, as per a report.

Personal Savings Rate below 5%

Most recently, this indicator fell in January 2022 and has stayed below this level for 32 months now, giving away strong signals that a recession might, indeed, happen in the next three months, taking into account its behavior ahead of previous crises.

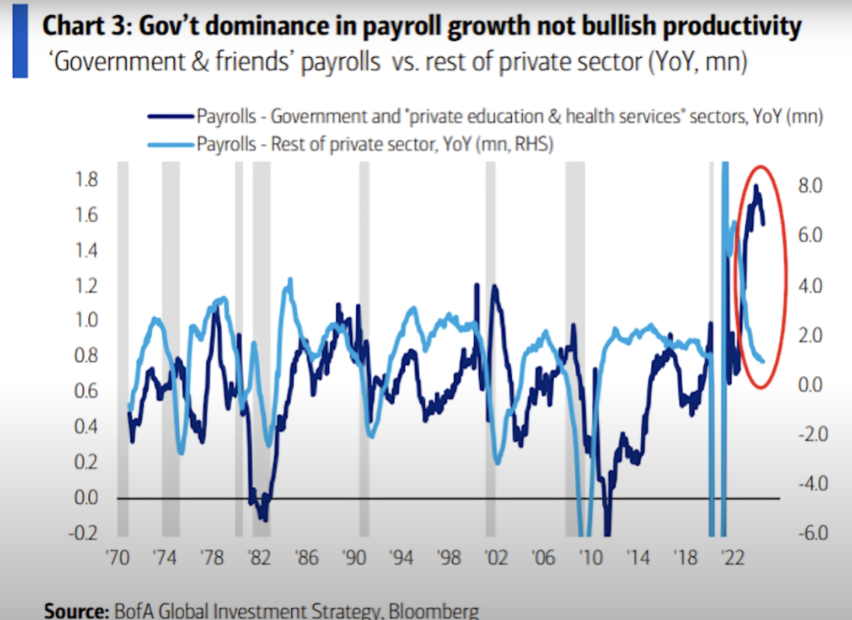

Payrolls gap indicates recession 2024

Furthermore, the banking institution observed that payrolls were peaking in the public and specific private sectors (private education and health) versus the rest of the private sector on a downward trend, with both these indicators having their opposite peaks, usually signaling a looming recession in 2024.

World trends in equities

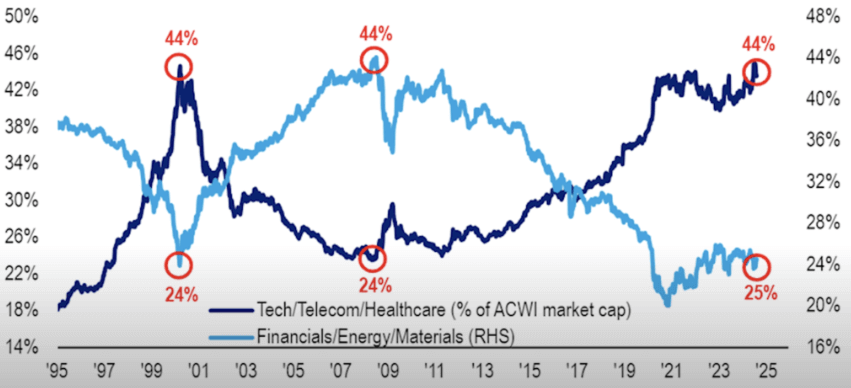

Finally, BofA’s chart comparing the financial, energy, and commodities versus technology, telecom, and healthcare sectors eerily echoes the Dot-com bubble times and the 2008 crisis, where tech and other sectors hit 44% of MSCI All Country World Index (ACWI) market cap, while financial and other sectors (RHS) dropped to 24%.

Whales selling off stocks

It is also worth noting that Warren Buffett, CEO and founder of Berkshire Hathaway (NYSE: BRK.A), recently sold $981 million worth of BofA stock, possibly due to recession fears, high valuation, and weakening consumer financial health as the banking giant faces downsides like increasing credit losses, leverage risks, and poor loan growth.

All things considered, one of the major banks in the world and the so-called ‘Oracle of Omaha’ seem to agree on one thing – a recession may, indeed, be at our doorstep. However, trends in the world markets can easily change, so doing one’s own research is critical.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.