With the hype surrounding artificial intelligence (AI) still very much alive, it is no surprise that companies across sectors are trying to implement this technology and its related advances into their products and services, including some of the least expected yet very well-known names in their respective industries.

As it happens, the automobile and semiconductor industries, in particular, have taken note of the trend, and it has given rise to the rapid evolution of autonomous driving systems that rely heavily on data science, as well as related software and/or hardware to aid drivers on the road.

In this context, Finbold has singled out the five best autonomous driving-related stocks that could be a smart buy at this time, particularly given the public’s interest in these systems and the advantages they offer, as well as their hard work in developing them for the future.

#1 Tesla (NASDAQ: TSLA)

An obvious first choice is Tesla (NASDAQ: TSLA), the largest autonomous driving provider in the world with very few competitors. And although it has been suffering under the effects of raging inflation, it remains one of Ark Invest CEO Cathie Wood’s favorites, who has called it the ‘biggest AI play’ on the market.

As things stand, the stock of one of the successful electric vehicle (EV) companies is currently trading at $184.02, down 2.18% on the day, dropping 0.58% over the week, and losing 16.32% in the last month, making this an ideal time to ‘buy the dip,’ like Cathie Wood is doing.

#2 Nvidia (NASDAQ: NVDA)

Meanwhile, Nvidia (NASDAQ: NVDA) is not an autonomous driving stock per se, but its powerful graphics processing units (GPUs) have demonstrated the multinational technology and AI computing corporation’s significance in developing autonomous driving systems.

At the moment, Nvidia stock is changing hands at the price of $721.28, recording a 0.17% drop on its daily chart but nonetheless an increase of 5.72% in the last seven days, as well as gaining 27.03% in the past month, according to the latest data retrieved on February 14.

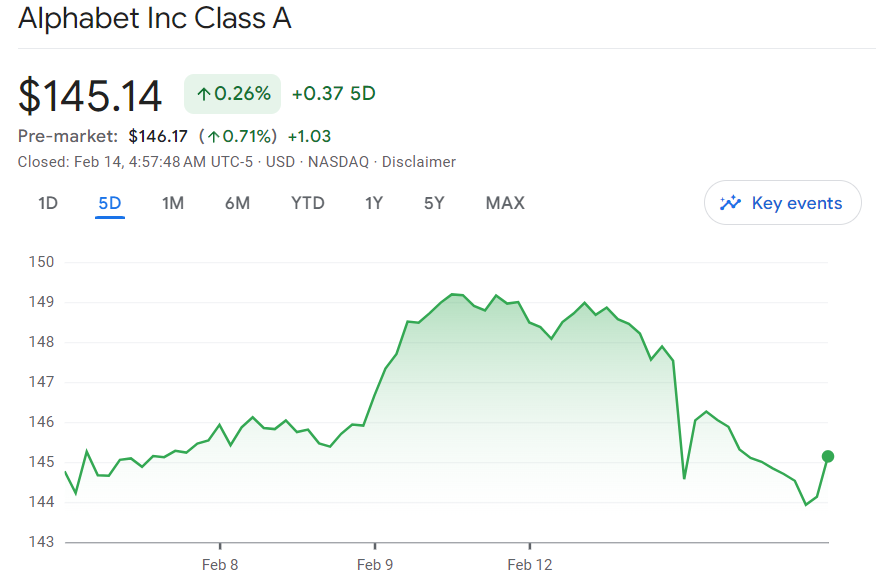

#3 Alphabet (NASDAQ: GOOGL)

Another technology mammoth priding itself on an expansion into the autonomous driving territory is Alphabet (NASDAQ: GOOGL) or, more specifically, its subsidiary Waymo, formerly known as the ‘Google self-driving car project,’ which has great potential despite its recent software issues.

Presently, this stock’s price stands at $145.14, representing a decline of 1.62% on the day but a slight improvement of 0.26% over the week and an accumulated advance of 1.86% across the previous month, as the most recent charts demonstrate.

#4 Apple (NASDAQ: AAPL)

Meanwhile, the autonomous test vehicles produced by tech giant Apple (NASDAQ: AAPL) have already delivered significant results after traveling almost half a million miles in 2023, and the launch of its ‘spatial computing’ product, the Vision Pro, has exited consumers all over the world.

In terms of price, Apple stock is presently trading at $185.04, which suggests a decline of 1.13% on the day, in addition to indicating a drop of 2.25% across the week. However, on its monthly chart, AAPL stock has made a modest recovery of 0.77%.

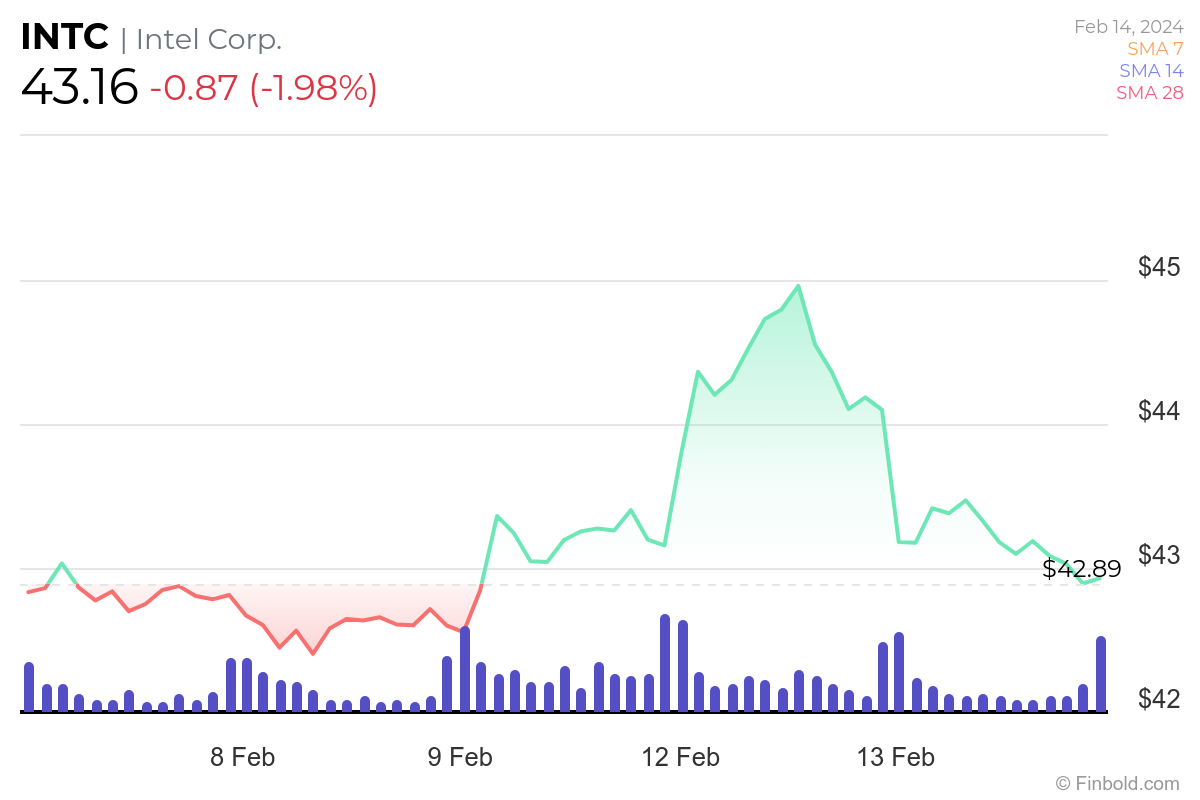

#5 Intel (NASDAQ: INTC)

Finally, Intel (NASDAQ: INTC), a semiconductor behemoth that also boasts a significant role in the self-driving automobile industry through its subsidiary Mobileye, is another worthy investment, although analysts are cautious regarding its capability to retain a technology lead in the industry.

At press time, INTC was changing hands at $43.16, recording a decline of 1.98% in the last 24 hours, gaining 0.98% in the previous seven days, and dropping 8.29% on its monthly chart, according to the most recent chart data accessed on February 14.

Conclusion

All things considered, the above autonomous driving stocks might be a great opportunity to grow one’s portfolio. However, caution is always necessary, and doing one’s own due diligence and carefully researching the market and its particular participants before investing in them is essential.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.