The outsized U.S. national debt has ballooned to $36.2 trillion, and a staggering $9.2 trillion of it is set to mature in 2025. This accounts for 25.4% of the country’s total debt, raising concerns over its implications for financial markets, interest rates, and economic stability.

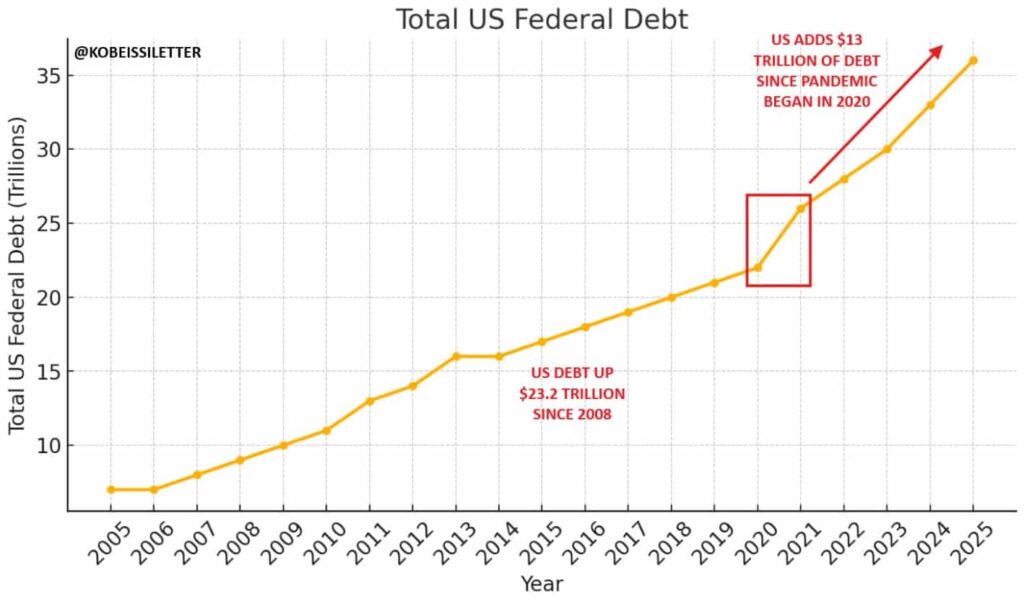

The rapid accumulation of debt has been fueled by historic levels of deficit spending. More recently, since 2020, debt has grown by $13 trillion, averaging $2.6 trillion per year for five consecutive years.

Meanwhile, the federal deficit for 2024 stands at $1.8 trillion, or 6.4% of GDP, and interest payments on the debt have ballooned to over $1 trillion per year, according to data shared by the finance commentary platform The Kobeissi Letter on February 4.

A mounting debt burden: Putting it in perspective

The $9.2 trillion maturing debt is nearly 31.05% of the annual U.S. GDP, projected to be around $29.63 trillion in 2025. This figure is alarming when compared to other key financial benchmarks.

The maturing debt is almost double the total federal revenue of $5.03 trillion. 70% of this debt—about $6.5 trillion—will mature between January and June 2025, creating immense pressure on bond markets.

Much of this maturing debt was borrowed at significantly lower interest rates. With the average interest rate on U.S. Treasury debt now at 3.2%—the highest since 2010—rolling over this debt at current yields will be expensive.

The government will be forced to issue massive amounts of new bonds to meet this, increasing Treasury supply and potentially driving yields even higher.

Market reaction and rising yields

The bond market has already shown signs of stress, with real yields steadily climbing since 2022. The 10-year Treasury yield has surged 115 basis points since the start of rate cuts, showing investor concerns over ballooning government debt.

Longer-term Treasury yields have also jumped by nearly a full percentage point since September, fueled by growing worries over fiscal deficits and inflation in light of Trump’s plans for more tax cuts and tariff hikes.

That being said, the U.S. debt problem is not new, but the scale of the 2025 refinancing challenge makes it an issue investors cannot ignore. While the Fed may attempt to navigate this challenge with gradual rate cuts, the sheer size of the maturing debt suggests significant financial strain ahead.

Featured image via Shutterstock