The electric vehicle (EV) market is experiencing robust growth in 2024, leading the automotive industry with strong representatives in the United States and China. Hence, Finbold asked Elon Musk’s artificial intelligence (AI) model to build a stock portfolio for EV exposure in May.

Notably, Global EV sales are set to reach around 17 million by the end of the year, with a 25% year-over-year growth in Q1. The market share of electric cars could reach up to 45% in China, 25% in Europe, and over 11% in the United States.

China leads the market with 4.5 million electric cars, and the United States EV sales increased by 55% in 2022. The electric vehicle market size is projected to grow from USD 500.48 billion in 2023 to USD 1,579.10 billion in 2030. The Asia-Pacific region dominated the market in 2022 with a 50.97% share.

Furthermore, companies’ revenue is projected to reach USD 623.3 billion worldwide in 2024 for the category – with a steady annual growth rate of 9.82% (2024-2028). The largest share of the market is commercial vehicles. The growth is supported by technological enhancements, charging infrastructure development, and government policies.

xAI’s Grok electric vehicle stock portfolio

To build a solid and up-to-date portfolio with EV stocks for May, Finbold consulted Grok by xAI. This model, backed by Elon Musk, CEO of Tesla Inc. (NASDAQ: TSLA), is accessible to X Corp‘s premium subscribers.

In particular, we opted to use Grok due to its real-time data-gathering capacity. Elon Musk’s AI can learn from what users post on X, standing out among other models like ChatGPT and Claude that rely on data from previous years.

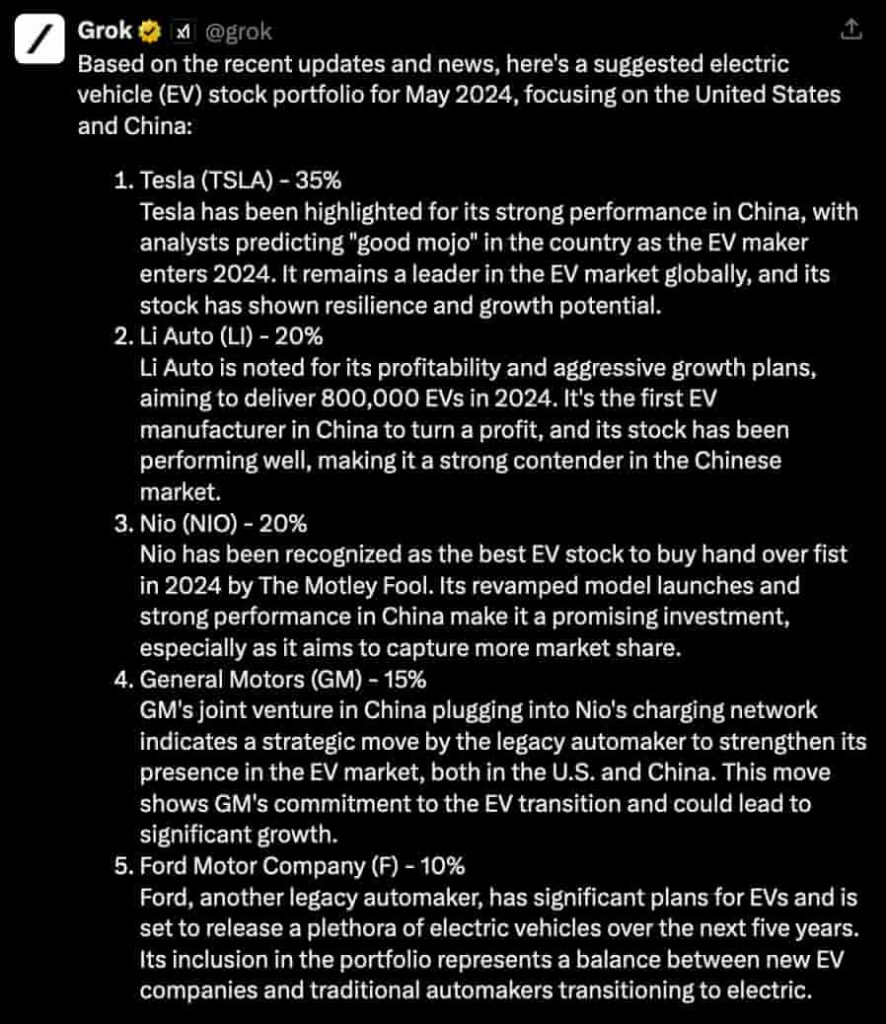

Tesla is Grok’s first pick with a 35% portfolio allocation, justified by good expectations for the company in China. Li Auto (NASDAQ: LI) and Nio (NYSE: NIO) go with 20% each, summing up a 75% dominance for the first three stocks.

Moreover, General Motors (NYSE: GM) and Ford Motor (NYSE: F) close the AI-built electric vehicle stock portfolio with a 15% and 10% allocation, respectively.

Overall, this portfolio targets growth in EVs, balancing established Tesla with newcomers Li Auto and Nio. It also considers legacy players from the automotive industry, like GM and Ford, transitioning to electric. In closing, percentages mirror market dynamics, growth potential, and strategic positioning in the electric vehicle sector.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.